Poll encourages bond supporters

Clark County School District government relations chief Joyce Haldeman can barely say $9.5 billion without stuttering.

She's working on it. During the next year, she'll be repeating "$9.5 billion" over and over.

Haldeman is one of the key people tasked with persuading county residents to support the district's proposed 10-year plan to build 73 new schools and renovate the old ones. To accomplish that, she knows she must sell voters on a 2008 bond measure that would supply $7 billion of the total funding needed.

If the plan passes, it will become the most costly school construction program in Nevada history.

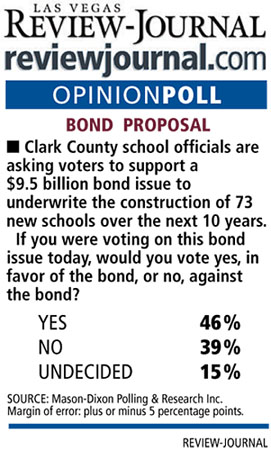

A poll commissioned by the Review-Journal shows Haldeman and her staff might not have far to go to win the necessary public support.

When 400 county voters were interviewed by Mason-Dixon Polling & Research staff last week, 46 percent said they would vote yes on such a bond measure. Thirty-nine percent said no and 15 percent were undecided. The poll's margin of error is plus or minus 5 percentage points.

"I'll take those numbers," Haldeman said. "That's a good place for us to start, especially if you consider we've not done any campaigning or community outreach yet."

The $7 billion cornerstone of the plan rests on maintaining the district's share of property taxes for school construction at 0.5534 cents per $100 of assessed valuation through 2018.

As existing school construction debt is paid off, the tax rate would remain the same, allowing the district to collect revenue for new building projects.

The remaining $2.5 billion is expected to come from the district's share of the real estate transfer tax and the hotel room tax.

The plan borrows its model from the district's 1998 bond program, crafted when the district was the ninth-largest public school system in the United States. Today, Clark County holds the No. 5 spot, with a student enrollment of 308,783.

"We aren't looking to raise the tax rate," Haldeman said. "This basically keeps everything the same."

That means the owner of a $300,000 home would continue to pay $581.07 annually for school construction. That amount would fluctuate as a residential property's assessed valuation increases or decreases during the time the bond is in effect.

Any increases are limited by the 3 percent property tax cap now in place for Nevada homeowners. Jeff Weiler, chief financial officer for the district, said the 2008 proposal takes that cap into account. The plan is built on the assumption that annual property tax increases for existing homeowners will not exceed 3 percent.

State law does allow entities such as the school district to apply for exemptions to the property tax cap, which would allow the rates to grow beyond the 3 percent. Haldeman said the district is aware of the option but has no plan to pursue an exemption.

Mason-Dixon managing partner Brad Coker cautioned against being overly optimistic in interpreting the poll results on the school bond question. In general, people will support concepts, but as the ballot question is developed, as people are confronted with the actual language, and if they become confused, their natural instinct will be to vote no, he said.

"The results usually look different when we have a real ballot question to ask," Coker said. "The general rule of thumb on bond issues is that, once they're proposed, the only place they have to go is down."

Carole Vilardo, president of the Nevada Taxpayer Association, said it's in the district's best interest to keep any proposal simple and easy to understand. The concept of rolling over the current bond and renewing it for another 10 years isn't going to confuse voters. Muddying the waters by taking an action such as seeking an exemption creates uncertainty, Vilardo said. It also blows the district's historic advantage.

"In Clark County, with very few exceptions, voters are generally very supportive of school bond issues," Vilardo said.

The Nevada Taxpayers Association hasn't taken a position on the school bond proposal yet.

Vilardo is waiting to see what the ballot question looks like once School Board members approve the language in January.

The district's first foray into selling a mammoth school construction program to the public was a success. In 1998, 65 percent of voters approved the district's request to maintain the property tax rate for school construction at 0.5534 cents for 10 years. That construction program was proposed at $3.5 billion, but the money generated by property taxes and other growth revenues created a $4.9 billion construction fund. The 1998 program will conclude with the construction of 101 new schools and 11 replacement schools.

If voters approve the 2008 bond measure, the district has earmarked $5.1 billion for new construction: 53 elementary schools, 16 middle schools and four high schools. The model is built on the expectation that the district will experience an annual student enrollment increase of 3 percent to 4 percent.

The remaining $4.4 billion would be devoted to renovation and replacement of older schools, although the projects for that have not yet been formally prioritized.

School Board member Terri Janison said that portion of the bond is crucial. Schools in established communities should be able to provide the same level of service that new schools deliver to students.

"From a personal perspective, it's a true need," Janison said. "We do need to make sure that equity is there. Students need to have the same kind of quality education."

Contact reporter Lisa Kim Bach at lbach @reviewjournal.com or (702) 383-0287.

Review-Journal Polls