Top 10 Gold IRA Companies Secure Your Future: Best IRA Accounts for Gold Investing in 2023

*Attention: This article is not intended to provide financial advice. It is highly recommended to consult with a financial advisor prior to engaging in any investment activities.

You may have heard of gold IRAs, but do you know what it is? Well, it’s a type of individual retirement account that lets you invest in physical gold and other precious metals as a means to protect your retirement savings from economic uncertainty.

That is not to say that investing in gold IRAs is not risky. Like any investment, a gold IRA has its pros and cons. It can help protect your retirement savings in times of crisis, but this is dependent on gold retaining or increasing its value. There are also management fees, storage costs, and tax implications to think about.

As you embark on this journey, you’ll need to choose a reputable and reliable gold IRA company that will help you roll over from your other retirement savings accounts. That’s why this article will thoroughly review the top gold IRA companies in the USA. Read on if you want to find out more about what each company offers, its fees, and its unique benefits.

10 Best Gold IRA Companies of 2023

- Augusta Precious Metals – Best overall gold IRA company

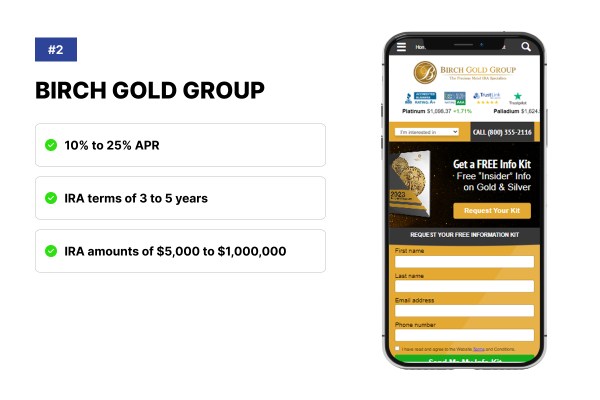

- Birch Gold Group – Best gold IRA company selection of gold, silver, platinum, and palladium for small IRA accounts

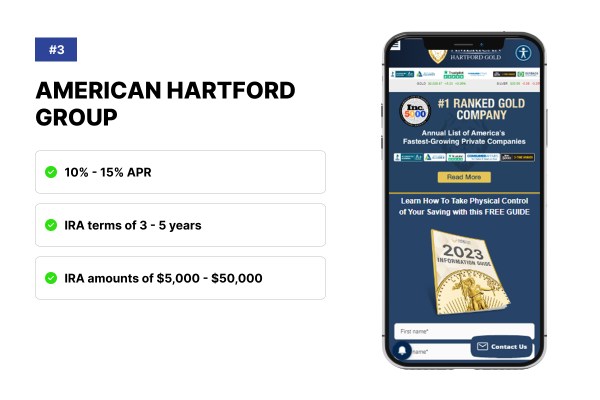

- American Hartford Group – Premier choice for IRA investors

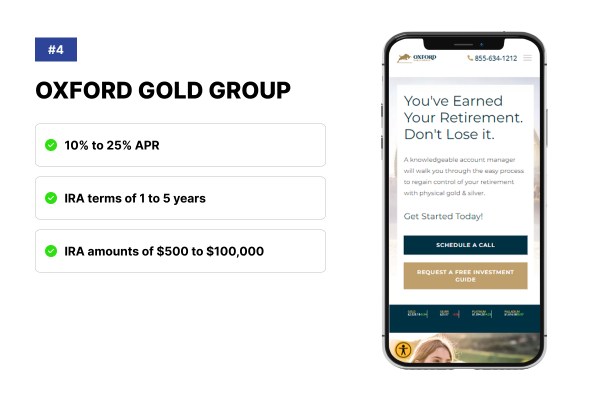

- Oxford Gold Group – Best for anyone looking to diversify their gold IRA portfolio

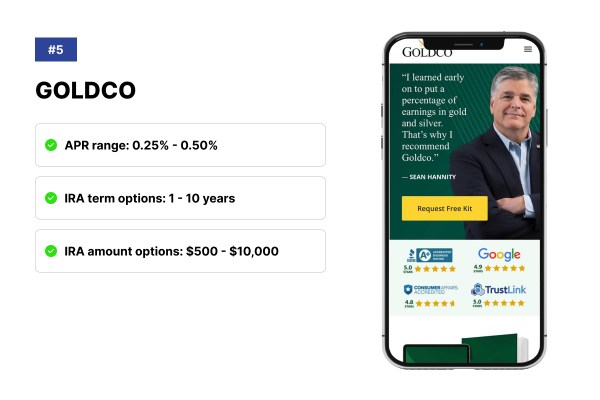

- Goldco – Best for retirement savings planning

- Noble Gold – Noble Gold: Best for gold investment options

- Patriot Gold Group – Best for a variety of metals investing

- Advantage Gold – Best for expedited shipping and low fees

- Lear Capital – Best for mobile use and risk-free guarantee

- Regal Assets – Best for exchanging cryptocurrencies for gold

Why Do You Need Gold IRA Investments?

Well, here is a likely scenario that may not be too far-fetched. You may have a lot of money in a tax-advantaged retirement savings plan. And this may make you happy and confident about your future. You may also think that you have everything under control. But then, one day, something terrible happens.

The economy crashes and the stock market plummets, reducing the value of your retirement plan. You could end up significantly losing a large sum in the blink of an eye. The solution? Well, you can diversify your retirement savings with other assets like precious metals.

Now, gold and silver IRAs happen to be a great way to invest for the long term for the following reasons:

Diversification

Diversifying your retirement savings with gold reduces the volatility of your returns. It means that you won’t have to worry about losing money when the stock market crashes. Gold has always been valuable for over 4,000 years running.

Tax efficiency

Investing in a traditional Gold IRA means that you’ll not incur any taxes on the growth of your gold assets until you withdraw them. Effectively, you’ll enjoy the appreciation of your gold without paying any capital gains tax or income tax on it.

Stability

Gold prices are determined by the global supply and demand that has remained relatively constant. Unlike other assets that may fluctuate due to inflation, currency devaluation, or political instability, Gold has tended to retain its value and purchasing power over time.

Global currency

Despite the US abandoning the gold standard in 1971, gold has never lost its status as one of the most important reserve assets for many countries, including the International Monetary Fund (IMF), which holds one of the largest gold reserves in the world.

No counterparty risk

One of the less obvious advantages of gold is that it has no counterparty risk. It doesn’t depend on any other party to fulfill its obligations or uphold its value. Assets such as stocks, bonds, or currencies tend to rely on the performance and solvency of the issuer and intermediary.

Emerging industrial uses

Gold is more than a precious metal for jewelry. It continues to experience increased demand in emerging industries, such as electronics, biotechnology, and nanotechnology. Gold will play an important role in the next e-revolution and space travel, thanks to its unique properties and applications.

Limited supply

Gold is valuable because of scarcity, and a demand that keeps increasing. Mining gold now requires more time and effort. In fact, digital currencies like Bitcoin have tried to mimic this scarcity by limiting their supply and making them hard to create.

Review of Best Precious Metals IRA Companies

Augusta Precious Metals has been helping retirement savers roll over to gold IRAs since 2012, with a mission to educate and empower their clients with the information and choice needed to protect their wealth and realize their financial reality. They are headquartered in Casper, Wyoming, with satellite offices across the country.

The company has a minimum required amount of at least $50,000 if you want to roll over an existing account to a gold IRA. While the amount may seem high, it does come with its benefits as new clients can enjoy ZERO fees for up to 10 years. That means there are no setup fees, no storage fees, and no maintenance fees. As typical annual fees are at $100 and the setup cost is $50, within that time, you will have saved up nearly $1,000, which will maximize your returns on your metals investment.

Another benefit of working with Augusta Precious Metals is their emphasis on education. They provide free guides on their website, which explain the advantages and risks of investing in gold and silver. Their support service can have a call with you to discuss your goals and options.

Prominent figures, such as Mark Levin, the host of the Mark Levin Show have endorsed the company. Levin says that Augusta Precious Metals are not out to just sell gold, but they educate you so you’re capable of making your own decision. Another fan is Joe Montana, the hall-of-fame quarterback, and multimillionaire. When tasked his financial team with finding a reputable gold IRA company, they choose Augusta over others. He subsequently became a customer and superfan.

Augusta Precious Metals has also received stellar ratings and accolades from various consumer websites, such as:

- Better Business Bureau – 4.95 Rating from 119 reviews

- Google My Business – 4.9 rating from 341 reviews

- Business Consumer Alliance – AAA rating

In addition to these ratings:

- Money magazine named them the “Best Overall Gold IRA Company” for 2022 and 2023;

- Investopedia ranked them as the “Most Transparent” gold company in their list of top gold IRA providers.

These accolades along with customer ratings prove that Augusta Precious Metals is not only an experienced player, but also a leader and innovator in the field of precious metals investing.

Augusta Precious Metals step process

Here is the process you’ll go through after choosing Augusta as your metals company:

Step 1. Meeting your agent: You will be assigned a personal customer success agent who will answer any questions about gold IRA investing.

Step 2. IRA processing: Whether you’re opening or rolling over to a gold IRA, your agent will help you navigate the required paperwork and select the best gold products. But all the final decisions rest with you.

Step 3. Order desk: Once your IRA or your cash account is ready, you can place the order with Augusta’s order desk, which gives the most favorable prices on the market for chosen gold products such as the 2017 Royal Canadian Mint .25 oz Gold Eagle or the American Eagle gold coins. The team will also confirm the shipping or storage preferences.

Step 4. Confirmation: After placing the order, Augusta sends a confirmation email with the details of the purchase and a tracking number if there is a shipment of physical metals. Otherwise, you’ll be handed over to the custodial service that will coordinate the storage.

Pros of Investing in Augusta Precious Metals

Some pros of investing in Augusta Precious Metals are:

- There is account lifetime support from the team of gold professionals who can guide customers through every step of the way.

- The company has stellar customer reviews and an A+ rating from the Better Business Bureau.

- You get access to a broad range of IRA-compliant precious metals, including gold, silver, platinum, and palladium coins and bars.

- Augusta Precious Metals provides secure storage options to the Delaware Depository which is IRS-approved.

- Annual fees for administration and storage are waived for the first 10 years and are quite affordable at only $100.

Cons

So, one of the biggest cons is the fact that new gold IRA investors will require at least $50,000 so they can work with the company. While most of the reviews are positive, there are few comments about shipping delays and the responsiveness of the customer support team.

Birch Gold Group is a leading dealer of physical precious metals in the United States, with over 20,000 customers since 2003. The company is based in Burbank, California, across the street from the Warner Bros. studio. The management team comprises former wealth managers, financial advisors, and commodity brokers, with prior stints at companies like Citigroup, Dun & Bradstreet, and IBM.

They offer two ways to purchase physical precious metals: as part of an IRA or as a cash purchase for physical possession. You’ll need a minimum investment of $10,000 to open an IRA with Birch Gold Group that should be in a retirement account such as:

- Traditional IRA

- Roth IRA

- SEP IRA

- SIMPLE IRA

- Eligible 401(k), 403(b), 457, and other retirement plans

Birch Gold Group works with custodians that mainly use Delaware Depository and Brink’s as the depositories. The company is careful about the extra fees you’ll incur, and their partners only charge up to $200 in management fees annually, which is within the industry average.

If you prefer to take physical possession of your precious metals, you can make a cash purchase. They have a variety of coins and bars that are approved by the IRS for investment purposes and collectible coins that have numismatic value. Birch Gold Group will deliver your metals to your home or any location of your choice with free shipping, insurance, and discrete packaging.

Now, education plays a central role at Birch Gold Group. New customers can review free information kits, newsletters, videos, and articles. You can also request a free consultation with one of their specialists who will guide you through your options and goals.

You can also try out some of their handy tools, including a gold allocation calculator that shows you how allocating some of your assets to gold can affect your investments. A handy calculator on Birch’s website shows how allocating your retirement to gold can affect growth based on real metrics since 2000.

Aside from this, Birch Gold Group has earned a reputation for excellence over the two decades it has been operating since 2011. The company has an A+ rating with the Better Business Bureau: 4.66/5 based on 89 reviews. It also has an AAA rating from the Business Consumer Alliance and numerous other 5-star ratings on top review websites like Consumer Affairs.

The company has attracted prominent endorsements from figures like Ron Paul, Steve Forbes, Ben Shapiro, Jim Rogers, Peter Schiff, and Floyd Brown. They have praised the company for its expertise, professionalism, customer service, and integrity.

Birch gold group step process

Here are some of the steps required to open an account and buy metals for your IRA from the Birch Gold Group:

Step 1: Choose your funding source

You can either transfer an existing IRA or roll over a 401(k) into a new self-directed IRA,

Step 2: Pick your gold options

You’ll need to decide how much you want to buy and allocate your funds. Your assigned agent can help ensure that the metals meet the IRS standards for purity and quality.

Step 3: Place your order

Your account specialist can confirm your order details, complete the necessary paperwork and process the payment.

Step 4: Store your metals at a depository

Your precious metals specialist will assist you in choosing a suitable depository and custodial service. Birch Gold Group works with reputable depositories such as Brink’s Global Service and Delaware Depository,

Step 5: Monitor your IRA performance

You can call your assigned specialist anytime to check how your investments are doing, make any changes, or ask for a buyback quote.

Pros of Investing in birch gold group

Here are some of the pros of choosing Birch Gold Group as your partner:

- Start investing with as little as $10,000, which is lower than other companies in the industry offer.

- Pay a fixed management fee for your depository, regardless of the size or value of your account. This means you won’t have any variable charges.

- Benefit from the long-term service and reputation of Birch Gold Group, which has been in business since 2003 and has an A+ rating from the Better Business Bureau.

- The website has plenty of educational materials, such as articles, videos, guides, and FAQs.

Cons

Birch Gold Group has a limited selection of products, mostly coins and bars. While most of the reviews are overwhelmingly positive, some customers have complained about delays, oversights, and unsatisfactory customer service.

American Hartford Gold Group got its start in 2015 as the brainchild of Sanford Mann who has over a decade of experience in the precious metals industry. The gold company offers a variety of services, such as the gold IRA Rollover, silver IRA rollover, and purchase of precious metal bars and coins.

You’ll need to invest $10,000 for IRA rollovers, but cash purchases are as low as $1,500. While the company is not clear about annual fees, they tend to range from $180 to $200 depending on the size of the account and may be free for some customers. For accurate details, you’ll need to get in touch with the account executives.

So, what makes the American Hartford Gold Group different from other companies? Well, it has to be its commitment to customer education and satisfaction. The company strongly believes that an informed client is a successful client. That’s why they provide free access to their Data Center with important market trends, live charts, and gold price comparisons with other markets.

Each client works with a dedicated account executive who can answer any questions and guide them through the rollover process. American Hartford Group also has a price match and buy-back guarantee, meaning that they are willing to match any competitor’s price and buy back your metals at any time. Additionally, you’ll not pay any additional liquidation fees, and they have a quick and simple 3-step liquidation process.

Moreover, the company offers free insured shipping and a large gold catalog that includes products from the St.Helena Mint, The Perth Mint, U.S. Mint, Royal Canadian Mint, and more. They also highlight IRA-approved options so you don’t make any mistake buying the wrong coins.

The American Hartford Gold Group has also received accolades and recognition for its excellent service and performance. They have an outstanding 4.9 Trustpilot rating based on 1,142 reviews. Customers mainly state they didn’t feel pressured and they received great customer service. They also ranked as the #1 Gold Company by Inc. 5000 for 2021, which is a prestigious award that honors the fastest-growing private companies in America.

To bolster their trust, American Hartford Gold Group has sought endorsements from well-known personalities in the media and politics. Some of their endorsers are Rick Harrison, the star of Pawn Stars; Bill O’Reilly, the former host of The O’Reilly Factor; and Rudy Giuliani, the former mayor of New York City. These endorsers have personally invested with the American Hartford Gold Group and they recommend them to anyone who wants to protect their wealth and diversify their portfolio.

American Hartford gold step process

Opening an account with American Hartford Gold is easy and convenient:

Step 1: Launch a self-directed IRA

You’ll get help to convert any existing retirement account, such as a 401(k), 403(b), TSP, or IRA, to start your gold IRA with American Hartford Gold Group.

Step 2: Fund your gold IRA with wire or rolling over from a previous IRA

Your assigned account executive will guide you through the process of wiring or transferring funds to your new gold IRA account.

Step 3: Get help purchasing metals for your gold IRA

Once your account is funded, the account executives will assist you in selecting from various approved IRA-eligible products, such as gold bars, coins, and rounds, and walk you through the process of custodial, storage, and delivery.

Pros of Investing in American Hartford gold ira

Some pros of working with the American Hartford Gold Group are:

- American Hartford Gold is a trusted leader in the space, offering gold, silver, and platinum in both bars and coins.

- They provide both physical delivery to one’s doorstep or inside of a retirement account like an IRA, 401K, or TSP.

- American Hartford Gold has an A+ rating with the Better Business Bureau and a 5-star customer satisfaction rating on multiple review platforms.

- Their buyback commitment encourages clients to contact them first if they wish to sell their metals, without any additional liquidation fees.

- The initial investment amount is reasonable.

Cons

The only downside to American Hartford Gold is that there is no online account access or consistent live chat support. Additionally, there is no clarity about the fees for the annual maintenance of gold IRA accounts.

Located in Los Angeles, California, the Oxford Gold Group is on a quest to educate clients, secure their retirements, and help people make smart decisions for themselves. They have operated since 2017 and have served over 10,000 clients across the United States. Their main services include gold and silver IRAs, gold and silver bars and coins, and other products.

For the gold self-directed IRA, you’ll need a minimum investment amount of $10,000. The annual maintenance fee is $175 for accounts valued at less than $100,000, and $225 if it is over $100,000. The fees cover custodial and depository services.

While Oxford Gold Group doesn’t have any celebrity endorsers on its roster, they have still received positive feedback from the customers who have used its services. On Trustpilot, they have a rating of 4.9 out of 5 stars based on over 150 reviews. Customers mainly praise their expertise, professionalism, responsiveness, and transparency. They have an A+ rating on the Better Business Bureau (BBB) where they have been accredited since 2018 with no complaints filed against them,

Even if you are not interested in opening a gold IRA right away, you can still benefit from visiting the Oxford Gold Group website. There, you can find various guides, including Investing News Roundups, educational articles, and precious metal charts and prices. You can also request a free gold and silver guide that will teach you how to set up a gold IRA and why it can help secure your retirement.

Oxford Gold Group step process

To start your Self-Directed IRA, follow these steps:

Step 1: Fill out the paperwork

With the help of your Oxford Gold Group Account Manager, you will complete the necessary forms to open a self-directed IRA with a reputable gold IRA custodian that specializes in precious metals.

Step 2: Add funds to your new Self-Directed IRA

After opening your self-directed IRA, the dedicated IRA Department will assist you and your new custodian to fund your account. You can fund your account by either moving or rolling over existing retirement funds or making a new cash contribution.

Step 3: Purchase

When your self-directed IRA is funded, your Account Manager will help you choose and securely buy qualified precious metals. Your metals are then shipped securely to an IRS-approved depository for safekeeping.

Pros of Investing in Oxford Gold Group

Here are some of the benefits of working with the Oxford Gold Group:

- Their team of knowledgeable and experienced professionals will advise you on the best options for your goals and budget.

- You can receive a personalized investment strategy that suits your risk tolerance, time horizon, and financial objectives.

- Oxford Gold Group allows clients to sell their metals back at any time and at a fair and competitive price with transactions handled in-house.

- The company provides secure and worry-free shipping, allowing you to receive your metals in a timely and discreet manner, with full insurance and tracking.

- Before any transaction is initiated, the company discloses all the fees and costs upfront and makes a pledge to honor its commitments and promises. You will pay only what you agree to, with no surprises.

Cons

Oxford Group generates a few cons as the initial investment amount is reasonable, and so are the ongoing maintenance fees. You’ll only miss out on 24/7 customer support, which at times, can make it difficult to access the customer support team.

For more than 10 years, Goldco has assisted thousands of customers in protecting their retirement savings with Precious Metals IRAs. You only need to spare $25,000 from your existing IRA, 401(k), 403(b), TSP, or other qualified retirement plans so that it’s rolled over into an IRA.

Customers can also purchase gold and silver coins and bars that have them delivered. However, to enjoy benefits, you need a custodian to manage and track your assets, as required by the IRS.

Goldco partners with reputable self-directed IRA custodians who charge a one-time set-up fee of $50, a wire fee of $30, an annual maintenance fee of $100 for non-segregated storage, and $150 for segregated storage.

So, why should you work with Goldco? Well, they are known for their outstanding customer service and high ethical standards with no major incidents. You also get valuable education and resources on precious metals investing. Goldco has an A+ rating from the Better Business Bureau and a Triple A rating from Business Consumer Alliance.

They have also placed over $1 billion in gold and silver, providing their expertise and experience. Additionally, Goldco has been featured on Inc 5000’s list of Fastest Growing Private Companies for six consecutive years.

Some of the celebrities who endorse Goldco are Sean Hannity, Chuck Norris, and Stew Peters. But note that some of the endorsements are paid agreements and don’t necessarily mean that the endorsers have invested through Goldco.

Goldco step process

Step 1: Start your precious metals IRA

A Goldco representative will guide you through the first process which entails signing a standard customer agreement that confirms your purchase and acknowledges God’s business terms.

Step 2: Fund your self-directed IRA

You’ll get help funding your IRA by moving assets from your existing retirement accounts in a matter that doesn’t lead to tax implications.

Step 3: Choose your precious metals

Once your Goldco’s IRA is funded, you can form a variety of gold and silver coins and bars that are eligible for IRAs.

Pros of Investing in Goldco gold and silver

Here are some of the benefits of choosing Goldco Gold for your IRA:

- You can easily find coin options that suit your taste and budget thanks to the large catalog of IRA-eligible gold coins, from reputable mints around the world, including the East India Company of London, New Zealand Mint, Royal Dutch Mint, Royal Canadian Mint, or Perth Mint.

- With the Goldco Buyback Program, the company will buy back your IRA-approved gold coins at the highest price. It allows you to sell your gold coins anytime, without the worry of finding a buyer or losing money on the transaction.

- Goldco ships metals fully insured and provides the option to store your assets in segregated accounts.

Cons

With Goldco, you don’t really get a full disclosure of the fees, as they are mentioned on their website, or how they work. You’ll need to be clear with the team about what fees you’ll be expected to pay. Additionally, they don’t go into depth about their custodial and depository partners.

Noble Gold Investments has over seven years of experience managing retirement precious metal accounts. It was founded in 2016 by Collin Plume, the president, and CEO of Noble Gold Investments, who himself has over 15 years of experience in property insurance, commercial real estate, and precious metals investments.

The company provides the option of buying metals directly at only $2,000, but if you’re rolling over from another investment account, you need at least $20,000 to get started.

Noble Gold works with International Depository Services (IDS) to provide you with state-of-the-art storage. You can keep track of your metals online or schedule to see them in person. You can even choose where to store your metals: Texas or Delaware.

The fees for Gold IRA accounts are reasonable: there is a recurring annual fee of $80 and a $150 annual fee if you store in Texas or Delaware. Included in this cost is secure segregated storage of your physical precious metals, insurance, and access to your online account which tracks your assets in real-time. There are no taxes or penalties as long as you are moving from one qualified IRA to another, as long as the 60-day rule is satisfied.

Why has Noble Gold Investments carved out its niche of customers? Well, there are a few reasons:

- The founders have more than 20 years of combined experience in buying gold and silver, securing more than $1 billion in precious metals for their clients.

- You’re offered help at every step of the process with full guidance on the best gold and silver IRA investments for your retirement portfolio. They won’t leave you hanging or confused about what to do next.

- First-time investors have a chance to claim free coins as part of the sign-up offer.

Noble Gold step process

Step 1: Open an account

You’ll get help from your account manager in filling out an application to get you started. Once you have your account set up, you’ll get linked to your IRA custodian.

Step 2: Sign transfer document

Noble Gold will facilitate the funds’ transfer by working directly with your custodian to roll over assets from qualifying retirement accounts.

Step 3: Buy precious metals

After the purchase, the company will ship acquired coins or bars to the depository for safekeeping.

Pros of investing in Noble Gold

Some benefits of investing in Noble Gold are:

- The company stores assets in segregated accounts that assure full ownership of your metal because it is stored separately from other clients’ assets at the depository.

- Customers can easily liquidate their metal assets with the buyback program.

- They have a fast sign-up process that only takes 5 minutes to complete.

- Account managers will expound on your investment clearly and don’t use pressure tactics to get your account.

Cons

The annual fee for storage and administration of gold individual retirement accounts tops out at about $230 and may be higher than other gold IRA companies.

Based in Seal Beach, California, Patriot Gold Group has been in the gold market since 2016, but their team boasts over 50 years of combined experience. Unlike other dealers, Patriot Gold Group assures you of the best prices for metals by allowing you to buy directly from owners, meaning that you’ll not pay retail or extra fees. It’s part of their Patriot Commitment, which ensures that you get the most value for your money.

Their gold IRA account allows you to diversify your retirement savings with physical gold, but you can also add silver to your portfolio. The minimum deposit for opening a gold-backed IRA account is $25,000, which comes with a setup fee of $225. However, if you deposit more than $30,000, you can get the setup fee waived, along with the $260 rollover fee for the first year. Additionally, you can qualify for free storage for one to three years depending on how much you deposit.

The annual fees for maintaining your gold IRA account depend on the custodian you choose: $150 for Strata Trust or $180 for Equity Institutional. If your account balance exceeds $100,000, you can enjoy no fees at all, and if it reaches $250,000, you can qualify for the “No Fee for Life IRA” program. This means that you can grow your portfolio without worrying about extra costs. However, be aware that there may be some additional fees for optional services, such as wire transfers, account termination, etc.

Patriot Gold Group is not only a reputable provider of precious metal investments, but also a highly rated one. According to Consumer Affairs, it’s one of the best-rated gold IRA dealers in the U.S., with an average rating of 5.0 out of 5 stars from over 100 reviews. It also has an A+ rating with the Better Business Bureau (BBB) and no complaints, indicating its commitment to customer satisfaction and ethical business practices.

The company has received an endorsement from Dick Morris, a political advisor, Newsmax host, and NYT bestselling author. He is not only a supporter of Patriot Gold Group, but also a long-time client.

Patriot Gold Group step process

The company promises a quick three-step process:

Step 1: Consult with their specialists

You’ll get started by completing their online form to receive a complimentary Gold IRA Investor Guide along with a follow-up talk from one of their agents.

Step 2: Transfer or roll over

The 401(k) and IRA Rollover departments offer guidance through all the steps of the tax-free transfer process. Note that you may be required to choose a beneficiary (custodial) and specify the source of funds. But in most cases, you get help with the paperwork.

Step 3: Acquire precious metals

Once your self-directed IRA account is funded, you’ll receive assistance purchasing and storing precious metals.

Pros of Investing in Patriot Gold Group

Here are some of the benefits of working with Patriot Gold:

- Direct access to owner pricing will give you the best deal on gold devoid of intermediaries.

- You can easily qualify for fee waivers by just depositing $30,000, which is a lower entry point than most competitors. You can even become eligible for the free-for-life program.

- The company provides a smooth and fast account setup within 24 hours, allowing you to start investing right away.

- There are multiple support options, including live chat, phone, and email. So, it’s easy to reach out to them anytime you need help or advice.

- You will tap into a wealth of experience, as the team has over 50 years of combined experience in the markets.

Cons

A big drawback of Patriot Group is that they do not disclose real-time coin prices. If you want to know the prices of coins, you have to contact their team.

Co-founded in 2014 by Kirill Zagalsky, a former Senior Account Executive at a United States Mint, Advantage Gold helps you acquire a stake in precious metals through a self-directed IRA or direct delivery. You can invest in IRS-approved gold, silver, platinum, and palladium coins and bars in one place.

With their gold IRA services, you can roll over your existing 401(k), IRA, or another retirement account into a secure gold IRA. This way, you can enjoy the benefits of an IRA while investing in physical gold and silver.

As mandated by the IRS, this premier gold IRA company works with reputable custodians and depositories for the safekeeping of physical metals. For your storage needs, you can store your metals with Brink’s Global Services USA, Inc. (in either Los Angeles or Salt Lake City) or the Delaware Depository (located in Wilmington, DE). They work with STRATA Trust Company and Equity Trust Company as their recommended partners.

You’ll need a minimum investment amount of $25,000, which is at par with most gold IRA companies. The fees are also transparent and competitive. New customers pay a setup fee of $80, and the annual account management fees range from $180 to $250, depending on your choice of custodial and storage services.

So, why does the company deserve a spot in your consideration? Well, for starters, they have excellent customer service and ensure client satisfaction throughout every step of the process. They have been voted a seven-time #1 Trusted Gold IRA Company by TrustLink, a platform that collects verified reviews from real customers. They also have an A+ rating from the Better Business Bureau and a 5-star rating on Trustpilot from over 1500 reviews. One reviewer mentioned that that was the best company for first-time buyers, as their gold agents take time to get to know you before doing business with you.

Advantage Gold Step process

Step 1: Get free guidance

If you need help or advice on how to begin investing in precious metal coins, it’s recommended that you start by requesting the free gold IRA kit. You can also request a callback with the team to clear your doubts.

Step 2: Explore your choices

Advantage Gold agents will outline the options for precious metal investment, and pinpoint gold investments that suit your risk appetite and financial objectives.

Step 3: Secure and watch your investments grow

You’ll store your metals in an IRS-backed depository, where you can track the increase in value using online tools and by speaking to the team. You can also liquidate the account by choosing to receive your physical gold via direct delivery or by selling metals back with the buy-back program.

Pros of Investing in Advantage Gold ira

Here are some of the pros of choosing Advantage Gold IRA:

- The buyback program allows you to sell back any metals that you bought at any time, and at fair market value.

- There is a wide range of tools and charts on the website that can help you track the growth of your portfolio or weigh the choice of whether to transition to gold. For example, you can compare the performance of gold versus the S&P 500 over different time periods.

- You can choose from the top gold-IRA-approved coins from renowned mints.

Cons

Before deciding to open an Advantage Gold IRA, you should be aware of some of its drawbacks. You need to invest at least $25,000 to open an account, a sum that may be too high for some investors. The company doesn’t have options to waive fees for rolling over larger amounts.

Lear Capital sets itself apart from the crowd by allowing customers to place their orders online. It creates convenience for retirement savers who want to invest in gold without having to visit a physical location or talk to a salesperson. They also have a solid track record in the industry, having completed over $3 billion in transactions since 1997.

The entry requirements are quite friendly as the minimum investment amount is $10,000, and there is a one-time payment of $280 for the first year, which covers the setup and maintenance fees. After that, the annual fee is $200. However, Lear Capital can waive some or all of these fees depending on the purchase amount. For instance:

- Lear Capital will cover your $50 setup fee if you buy at least $10,000 worth of limited mintage coins;

- If you buy between $25,000 and $50,000 worth of limited mintage coins, Lear Capital reimburses the first-year fees after one month in storage;

- The company will waive your first and second-year fees if you buy between $50,000 and $75,000 worth of limited mintage coins;

- For purchases of over $75,000 in limited mintage coins, your year one, two, and three fees will be waived.

After purchasing your metals, they will be insured and shipped directly to the Delaware Depository, an IRS-approved vault that provides secure storage for other precious metal IRA dealers. You can access your account online at any time and monitor the performance of your investment. You can also request a buyback or liquidation of your metals from Lear Capital at competitive prices whenever you want.

Lear Capital step process

Step 1: Opening your new IRA account

You will need to fill out a simple application with the help of a dedicated account team member. This takes about 10 minutes to complete. Lear Capital will process your application and set up the new IRA account. You should receive your new IRA account number in under 24 hours.

Step 2: Transferring your funds from your current IRA custodian to Lear Capital

Your account manager will contact your current IRA custodian and arrange for a tax-free rollover. It may take up to 5 business days to complete the transfer or may be faster.

Step 3: Buying the metals

After funds are transferred by bank wire or rolled over into your IRA account, you are ready to invest in physical gold or silver coins.

Step 4: Tracking your investment performance

You can then monitor your portfolio online or request a free quarterly or monthly report. Lear Capital even allows you to track your portfolio, even if you haven’t purchased it from them.

Pros of Investing in Lear Capital

Here are some of the benefits of choosing Lear Capital:

- The company provides a 24-hour grace period to cancel your order without any penalty if you change your mind for any reason.

- You can reach out to a dedicated staff available from 9 a.m. to 6 p.m. Pacific time to answer any questions or address any concerns.

- Lear provides competitive pricing on gold and silver coins and bars, thanks to their Price Advantage Guarantee that ensures a fair appraisal of your gold assets when you sell.

- The company is ready to waive fees after investing a certain amount of funds, and their minimum investment amount is quite affordable.

- You can opt to receive price alerts that will notify you by email whenever the price of your chosen metal changes.

Cons

Lear Capital only offers gold, silver, and platinum metals for its gold IRA, which may not suit retirement investors who want more diversity in their portfolios. For instance, they don’t have palladium and other precious metals that have performed well in recent years

Regal Assets

Regal Assets is the only company on this list that specializes in precious metals, cryptocurrencies, and luxury watches as optional retirement savings options. They have been in business since 2009 and earned the trust and endorsement of celebrities like Dennis Miller, Laura Ingraham, and Lars Larson.

Some of the milestones that Regal Assets has achieved in the past decade include becoming an INC.500 company in 2013, where it ranked #20 for financial services, adding cryptos to its product offerings in 2017, and becoming a Forbes Finance Council member in 2018.

You’ll get a variety of products that can help diversify your savings plan. The company offers all four types of metals: gold, silver, platinum, and palladium. You can buy the physical metals and have them delivered directly to your doorstep, or you can set up a precious metals IRA.

The minimum investment for direct purchase is $5,000, but if you want to roll over from an existing retirement account, you need at least $10,000. Keep in mind that with an IRA, there are other fees involved like a yearly administration fee of $100, and about $150 for storage in a segregated account. First-year fees are waivered for initial investments exceeding $25,000.

Regal Assets also offers cryptocurrencies such as Bitcoin, Litecoin, and Ethereum. You can buy the digital coins and store them in a secure wallet, or you can add them to an IRA account.

Another unique product that Regal Assets offers is luxury watches from Frank Muller. He is a Swiss watchmaker who creates highly complicated and sophisticated timepieces. The men’s and women’s collections of watches can serve as a store of value and status symbol. Regal Assets also partnered with Frank Muller in 2019 to offer the first-ever crypto watch in the world. But all the watches are limited edition and come with a certificate of authenticity.

Regal Assets step process

Step 1. Complete the online form

The first step is to complete the registration form by visiting their website. It should only take a few minutes.

Step 2. Process your application

Within 24 hours the Regal IRA™ team will contact you to guide you through the process of transferring your IRA and to request any additional information as needed.

Step 3. Transfer your IRA account

The team will work with your selected custodian to move funds from any of your existing accounts into your new Regal IRA™ Account.

Step 4. Place your order for metals, cryptos, or watches

After receiving the funds, Regal Assets will fulfill your request for metals, watches, or cryptos for your new IRA.

Pros Invest in Regal Assets

- The company doesn’t use a pushy sales approach but instead focuses on availing products that suit the individual needs of each investor.

- There are plenty of assets from the US and other offshore destinations like Singapore.

- They have a transparent fees and commission schedule that is discussed with you before you sign up.

- Regal Assets utilizes segregated storage on all accounts to keep clients’ funds secure.

- You enjoy a 7-day guarantee on shipping for direct purchases.

- They buyback metals or cryptos on any business day with funds expected to arrive in 24 hours.

Cons

On closer introspection, the company doesn’t have good ratings as other IRA companies. They cannot also boast of high ratings on Consumer Affairs and Trustpilot.

How We Ranked the Best Gold IRA Companies

If you’re looking for the best gold IRA companies to invest your retirement savings with, you’ve definitely seen our list of top picks. But how did we determine who made the cut? Well, we know how important it is to find a reliable and trustworthy provider for your metals IRA because this is not something you want to mess around with. Here is a list of selection criteria that our team considered:

Reputation and gold IRA company reviews

One of the main criteria we used to rank the top gold IRA companies was their reputation in the industry. We did not rely on what affiliate sites claimed about them, but rather on what real customers shared based on their actual experience with the company.

We paid attention to how the company addressed any complaints or issues raised by the customers, and how quickly they resolved them. We also looked for any recurring problems that might indicate a larger or systemic issue with the company’s service or quality.

Ease of setup

Every company will promise a fast account setup, but we didn’t take anything at face value. We dug deeper to determine how fast the company set up accounts, and if any customers complained of a delay process that resulted in them having to pay taxes after not meeting the 60-day rule for rolling over their retirement savings into gold IRA accounts. It was paramount that the company offered support channels for customers, and free consultations and explainers.

Costs and gold IRA fees

Costs are a big part of setting up your retirement accounts. More costs, meaning that your retirement savings will decrease. So, the first thing when determining the costs was to actually ensure that the setup fees and maintenance fees for gold IRA accounts were not too prohibitive.

Most of the companies we recommended actually tended to have flat-rate pricing, meaning that you’ll not pay more management fees as your account grows. We also paid attention to past customer reviews where customers complained about being charged exorbitant fees or commissions.

Selection of gold and silver products

Visiting a prospective gold IRA website and finding only a limited number of coin options can be a dull experience. And worse off, not having access to IRS-approved gold options. We carefully selected companies that provided a good list of options for physical coins from renowned mints around the world.

Buybacks

When you invest in gold IRAs, you may want to sell your assets at some point. The best gold IRA companies should make this easy for you and offer you a fair price. That’s why we evaluated the buyback policies of different providers and gave priority to those who promised to match or beat the offers of competitors.

Tips for Finding the Best Gold IRA Account

Given our experience selecting the best gold IRA companies, here are some tips you can incorporate yourself to find the best Gold IRA account:

Do your research

You need to do your research if you’re looking for the best gold IRA account as things change fast in this industry. One day, a company might be the most-recommended provider, and the next day, it might be overtaken by a newcomer with better offers and services.

You also need to dig deep into the details of each company, like their fees, their deals, and their leadership. Are they reliable? Are they trustworthy? These are the questions you need to answer before you invest your retirement savings.

Ask for recommendations

Asking for recommendations from people who have already used a certain provider is a straightforward way of finding reliable companies. This way, you can get first-hand information from a person, who has worked with a previous provider. You can learn about their experience, their satisfaction, and what you can do or who you can speak to get the best service.

Read gold IRA company reviews

There are many reasons why people leave reviews, one of which is when they receive exceptional service that brings them great joy and prompts them to share their experience with others.

Or, they are seriously aggrieved and want everyone to know how the company wronged them. When a company has five-star reviews it is a good sign. Equally, they might also have a few negative reviews, but they need to have been ultimately resolved.

Review costs and fees

Costs and fees are crucial when working with a Gold IRA company. You should watch out for the setup fee. Ideally, it should be flat-rate to ensure that you don’t pay more if you’re depositing a larger amount. Secondly, watch for the annual maintenance fee and take note of any incentives to waive the fees for depositing a certain amount.

Storage options

Storage is not a big issue as most companies tend to work with the same providers. But you can run a further background check on the custodians and depositories to ensure they have high ethical and security standards. You can further make sure that you’re getting segregated storage, which gives you more assurance of ownership of your gold.

Speak with a representative of a company

Having a first call is quite encouraged in this industry, and companies make the commitment to offering specialists who can talk to and educate customers. Make a point of getting in touch with these specialists to discuss your needs, and gauge how professional or reliable the company is.

Investing in Precious Metals IRA for Your Retirement: Understanding the Types Allowed in a Gold IRA

Gold

Gold has been used for various purposes throughout history, such as jewelry, electronics, coins, and investments. Unlike paper money, gold has a real and intrinsic value that doesn’t depend on the shared belief that something is valuable, like digital assets or paper currency. But not all gold is eligible for a gold IRA. The IRS requires that the gold must be at least 99.95% pure, except for the American Eagle coin with a lower purity of 91.67%.

Platinum

Platinum is another precious metal that can be used to fund a self-directed retirement account as it tends to retain its value over time. It’s because platinum is a rare and valuable metal that has many industrial and jewelry applications, especially in the automotive sector where it’s contained in catalytic converters that reduce harmful emissions. The IRS requires IRA-eligible platinum bars and coins to be 99.95% pure or higher.

Silver

Silver, a more economical alternative to gold, is indispensable for many industries because of its unique properties. It’s the best conductor of electricity and heat and has antibacterial and catalytic effects. You’ll find it used in electronics, solar panels, water filters, and medical devices. The demand from a wide range of industrial applications continues to keep its demand high. For investment purposes, silver has to meet the highest purity standard of 99.99%.

Palladium

Palladium has many applications in various industries, including its use as a catalyst in cars to mitigate harmful emissions, as well as in aerospace, electronics, dentistry, and jewelry. It’s up to 15 times more rare than platinum, meaning that it is also more expensive per ounce. For precious metal IRAs, Palladium has a high purity requirement of 99.95%.

Benefits of Investing in a Gold IRA for Retirement

A lot of sources will taunt the benefits of investing in a gold IRA. Yes, there are benefits as you’ll shortly see. But most importantly, you need to be aware of the risk. Like all assets, the cost of gold in international markets is subject to fluctuation, and may even be on a downtrend for months. So, you’ll need proper timing when making the switch to a precious metal IRA. That said, here are the likely benefits you may get by investing in a Gold IRA:

Gold has a stable value

Unlike fiat currencies that easily lose their purchasing power due to inflation or devaluation, gold has relatively maintained its worth in the face of economic uncertainty. For example, during the 2008 financial crisis, its value rose from $800s in the beginning months of 2008 to $1,200 per ounce by 1st December 2009, while the US dollar lost 12% of its value against other major currencies. Gold is also a scarce, durable, and reusable resource that cannot be easily created or destroyed, which enhances its appeal as a store of value.

Gold metal is a hedge against inflation

Inflation tends to erode the purchasing power of global currencies. But gold has some immunity to inflation as it has a low correlation with other assets like the US dollar or the EURO, allowing it to act independently from fluctuations in the stock market, bond market, or currency market. Additionally, during times of inflation, Gold trading tends to increase as many people and countries view it as a reliable asset.

Gold is protection against deflation

Deflation is when prices for various goods fall, meaning that money becomes more valuable and can buy more goods and services. Now, gold prices don’t reduce along with falling commodity prices. In fact, gold becomes more valuable in deflationary periods, as history shows. People seek a way to store their wealth and prevent their retirement portfolios from being watered down in the face of lower prices for commodities.

Diversify your portfolio

Unlike typical retirement accounts that only allow you to invest in stocks, bonds, and other securities, gold affords you more flexibility and security by allowing you to invest in tangible items that you can actually see, touch, and hold.

Stocks and bonds also lose value if companies fail to perform or the economy suffers, but gold is above all this noise. Even when prices fall over the short term, Gold still has a long history of increasing in value over time, providing a secure supply in uncertain times.

Understanding How Gold IRA Rollovers Work

A gold IRA rollover is a process where you transfer funds from your existing retirement account, such as a 401(k) or an IRA, to a new IRA that holds gold and other metals. It leads to double-fold benefits as you can benefit from the stability and growth potential of gold, while still enjoying the tax advantages of an individual retirement account.

So, does a rollover attract a penalty? Well, there are no tax penalties involved, as long as you follow the IRS rules. One of these rules is the 60-day rule, which means that you have to complete the rollover within 60 days of receiving the distribution from your old account. Otherwise, you might have to pay income taxes and a 10% early withdrawal penalty on the amount you withdrew.

Another thing to consider is that there are different types of gold IRAs, and each has different tax implications. The most common ones include:

- Traditional precious metals IRA: It’s quite similar to a regular traditional IRA, except that it contains physical metals. You make contributions with pre-tax dollars, allowing you to deduct the contributions from your taxable income for the year. However, when you withdraw money from your traditional precious metals IRA, you will have to pay income taxes on the entire amount, including the gains from the gold.

- Roth precious metals IRA: The major difference with a traditional IRA is that the contributions are with after-tax dollars. So, you can’t deduct them from your taxable income at the end of the year. That said, you don’t have to pay any taxes when you finally withdraw money from your Roth IRA, as long as you meet the eligibility requirements.

Frequently Asked Questions about Gold IRA Companies

What is a precious metals IRA?

It’s an individual retirement account (IRA) that holds its value in physical gold, silver, platinum, or palladium.

What types of precious metals can be held in a precious metals IRA?

Mainly physical gold, silver, platinum, and palladium can be held. These metals are considered rare and have many industrial applications.

What are the benefits of investing in a precious metals IRA?

Here are some quick benefits of having a precious metal IRA:

- It diversifies your retirement investments, reducing risk.

- Hedges against inflation allowing you to retain your purchasing power.

- Protects your wealth from deflation, geopolitical risk, and other factors.

- You will enjoy tax advantages.

- It offers access to physical metals that can easily trade or liquidate.

Are precious metals IRAs insured by the FDIC?

Precious metals IRAs are not insured by the FDIC as the institution only insures deposits in banks. Physical metals IRAs are held by custodians or depositories, but not banks. Still, these custodians will provide some form of insurance.

What are the IRS rules for precious metals IRAs?

You need to store your metals in an approved depository and buy coins or bullion that meet certain purity standards. For example, gold bullion or coins must be at least 99.95% pure.

Can I roll over funds from an existing retirement account into a precious metals IRA?

In most cases, you can roll over funds from an existing retirement account that offers some tax advantage. However, not all retirement accounts are eligible for a rollover. It’s paramount to get a confirmation from your current custodian and future precious metals dealer to see if you can roll over funds.

Are there any tax implications for investing in a precious metals IRA?

No. You can roll over part of your retirement savings into a IRA but you need to do so before the 60-day window closes. Additionally, if you liquidate your metal IRAs before you’re 59 ½, you may incur the early-withdrawal penalty.

How are precious metals valued in a precious metals IRA?

The value of these metals is often based on the spot prices: what the metal is selling for on the world’s markets. And this value is determined by various factors, such as supply and demand, market conditions, geopolitical events, investor sentiment, etc.

Can I take physical possession of the precious metals in my precious metals IRA?

You have the option to take physical possession of your precious metals IRA by liquidating them or requesting the dealer to ship the coins to your address.

How do I choose a reputable precious metals IRA custodian?

You can use the following tips:

- Research the company’s reputation and reviews;

- Compare the fees and services offered by different custodians;

- Check the custodian’s accreditation and compliance with IRS rules;

- Speak to their representatives;

- Compare more than one precious metal IRA dealer;

- Consult a financial advisor or an attorney if needed.

How do I open a precious metals IRA account?

To open a metals IRA account:

- Find a precious metal dealer that offers this option;

- Transfer funds from your existing IRA to the new account;

- Use the funds to purchase silver and gold coins from the dealer;

- Store your metals in an approved depository.

Can I add additional funds to my precious metals IRA over time?

Sure, you can, as long as you follow the IRS rules and limits. The maximum amount you can contribute to an IRA in 2023 is $6,500 per year, or $7,500 if you’re 50 or older.

How do I sell the precious metals in my precious metals IRA?

You can use the buyback program offered by some providers. Alternatively, you can take delivery of your metals and sell them yourself to local buyers interested in gold, silver, platinum, or palladium. A third option is to work with your custodian service to arrange sales by finding buyers, helping with the paperwork, and transferring.

What fees are associated with a precious metals IRA?

Some fees for a precious metals IRA are:

- One-time setup fee;

- Annual account maintenance fee;

- Storage fee;

- Delivery fee;

- Transaction charges such as wiring costs;

- Commissions for custodial IRAs if applicable.

Can I transfer my precious metals IRA to another custodian?

The answer is yes, you can transfer your IRA to another custodian without any tax consequences or penalties. You should check with the new custodian if they accept the type and form of precious metals that you have in your precious metal IRA.

Are there any restrictions on when I can withdraw funds from my precious metals IRA?

Generally speaking, you can withdraw funds from your precious metals IRA at any time, but you may face penalties and taxes if you do so before reaching the age of 59 and a half. But there are some exceptions to this rule, such as if you become disabled, incur medical expenses exceeding 10% of your adjusted gross income, or if you use the funds to buy your first home (up to $10,000).

Can I include other assets in my precious metals IRA, such as stocks or real estate?

You cannot include other assets in your precious metals IRA, such as stocks or real estate as these assets are not allowed by the IRS and could result in penalties or taxes if you try to add them to your account.

Are there any prohibited transactions with a precious metals IRA?

Some of the prohibited transactions by the IRS include:

- Borrowing money from your precious metals IRA or pledging it as collateral for a loan;

- Selling or exchanging your precious metals to yourself or a disqualified person, such as your spouse, parent, or child;

- Using your precious metals for personal use or benefit, such as wearing jewelry made from them or storing them at home;

- Buying or selling your precious metals at an unfair price or with a commission that’s beyond the acceptable market rate.

How does a precious metals IRA fit into my overall retirement plan?

It can fit into your overall retirement plan as a long-term investment strategy that offers benefits, flexibility, and security. You also get the advantage of reducing the risk to your savings, mitigating the effects of inflation and market volatility, and preventing the devaluation of your estate.

Can I convert my traditional IRA to a precious metals IRA?

Yes, but note that you can only invest in certain types of coins and bullion that meet the IRS standards. You also need to store the metals in an IRS-approved depository not at home to enjoy the benefits.

How do I store the precious metals in my precious metals IRA?

The safest way to keep your precious metals in your IRA is to use a reputable depository that meets IRS requirements. Storing them yourself or in a bank safety box may not comply with the rules and could result in penalties, as it has in the past for unfortunate investors.

What happens to my precious metals IRA when I pass away?

Upon your death, your IRA custodian can distribute your precious metals to your designated beneficiaries according to your instructions. It’s possible to name one or more beneficiaries and specify how you want them to receive your IRA assets.

What is the difference between a gold IRA and a silver IRA?

Gold and silver have different prices and market trends. Gold is usually more expensive and stable than silver, while silver is more volatile and has more potential for growth. During storage, silver takes up more space and requires more fees than gold.

How do I determine the best allocation of precious metals in my IRA?

To determine the right mix for your precious metals, you can consider the following tips:

- Risk tolerance and investment goals: For instance, Gold has more stability, while silver and palladium have more potential for growth.

- Historical performance and price ratio: Check the historical price movements of precious metals, and how their prices move relative to each other, which can help you determine how to balance your savings portfolio with several options.

- Consult a reputable dealer or advisor: Get advice from a professional as some things may be confusing for first-time precious metal investors.

What is the process for buying and selling precious metals within a precious metals IRA?

You can buy and add more precious metals to your IRA up to the allowed limit per year. If you want to sell the assets, you can roll over the assets to another IRA type without tax consequences. But liquidating the precious metals and selling them yourself may attract tax implications for early withdrawal if you’re not over the age of 59 and a half.

Are there any penalties for early withdrawal from a precious metals IRA?

Yes, there are penalties for early withdrawal from a precious metals IRA. You may have to pay taxes on gains and a 10% penalty fee.

Can I use my precious metals IRA to purchase physical gold or silver coins?

You use your gold or silver IRA to purchase more coins through a rollover, where you just roll over your existing metals to equivalent amounts. But note that the IRA has a one-rollover-per-year rule.

How do I track the performance of my precious metals IRA?

Most custodial services offer convenient ways to track your retirement portfolio’s value and performance. You can either access a secure web portal that shows your account details and transactions, or you can contact their customer service team to get updates and reports on your IRA.

Conclusion About Investing in a Gold IRA Company

Reputable gold IRA companies provide a valuable service for investors who want to diversify their retirement portfolio with precious metals. They can allow you to establish a self-directed IRA account, where you have full control over the type and quantity of metals you purchase. In fact, while they have team members who offer recommendations and answer your questions, all the final decisions are yours to make.

It will be a different investment than your other IRA accounts because you’ll actually own the physical metals in a gold IRA only that they are stored in secure and IRS-approved depositories to meet the tax regulations. Thanks to this setup you can still benefit from the tax advantages of an IRA account, while also protecting your wealth from inflation and other market events.

Summary of the Top Gold IRA Companies

Before you go, the following table summarizes the top gold IRA companies across different points like the fees, minimum deposits, and available metals:

| Company | Setup fee | Annual fees | Minimum Investment | Precious Metals |

| Augusta Precious Metals | $50 setup fee | $100 annual fee

(10 year fees waiver for all investors) |

$50,000 | Gold

Silver |

| Birch Group Gold | $40 setup fee | $175

*Waiver of first-year fees for accounts of 50K+) |

$10,000 | Gold

Silver Platinum Palladium |

| American Hartford Group | A setup fee of $50 | $180 to $200 | $10,000 | Gold

Silver Platinum |

| Oxford Gold Group | Setup fee waived for new customers | $175 for accounts valued at less than $100,000, and $225 if it is over $100,000 | $10,000 | Gold

Silver Platinum Palladium |

| Goldco | Set-up fee of $50 | $100 & $150 | $20,000 | Gold

Silver |

| Noble Gold | $50 setup fee |

$80 or $150 |

Gold

Silver, Platinum Palladium |

|

| Patriot Gold Group | Setup fee $225

*Waived for 30k+ investments amounts |

$150 or $180 | $25,000 | Gold

Silver |

| Advantage Gold | $80 | $180 to $250 | $25,000 | Gold

Silver Platinum Palladium |

| Lear Capital | Setup fee $50

*Waived for depositing 10k+ |

$200

*First year’s fee reimbursed for $25 to $50K investments |

$10,000 | Gold

Silver, Platinum |

| Regal Assets | $0 initial setup fee | $250

*Waived for the first year |

$10,000 | Gold

Silver Platinum Palladium |

*Note that setup, annual, and minimum investment amounts are subject to change from time to time. For accurate costing details, please request a quote from the company’s support team.

The contents of this article are for information purposes only. All financial investments carry a level of risk, and it is recommended that you do extensive research and/or consult a trusted financial advisor prior to making a financial investment.

Members of the editorial and news staff of the Las Vegas Review-Journal were not involved in the creation of this content.