Macau gross revenue grows to highest level in 2 years

Macau gross gaming revenue surged 18 percent in February to the highest level in more than two years, beating Wall Street expectations and easing concerns that the rebound on the Chinese island was fading.

Gross gaming revenue reached $2.88 billion, the highest since January 2015, according to DICJ, the Macau gaming regulatory body. Wall Street was expecting February growth to come in around 10 percent.

Macau had been mired in a two-year gaming slump as the Chinese state cracked down on corruption, prompting many VIP clients to skip trips to the casinos. Gaming revenue growth resumed in September, rallying about 10 percent over the last four months of the year.

However, January numbers dashed growing optimism, rising a mere 3 percent. That significantly missed analysts’ expectations and worried some that Macau’s rebound was weakening.

An earlier start to the Chinese New Year may have negatively impacted last month’s growth numbers making a look at two-month revenue a more accurate snapshot of the situation.

Gaming revenue over the first two months of 2017 is up 10.6 percent, roughly in line with the end of 2016. Analysts expect growth of around 9 percent to 10 percent for the full year.

While growth last year was mainly driven by mass market, that may not have been the case for February, said David Katz, a gaming analyst at Telsey Advisory Group in New York.

“The upside appears anecdotally to be driven by sustained strength in the junket and VIP play as well as premium mass market play throughout the month after the Chinese New Year, which would be a surprising trend if correct,” Katz said in a note.

Wells Fargo estimates March growth will slow to between 10 percent and 16 percent. Analysts forecast 12 percent.

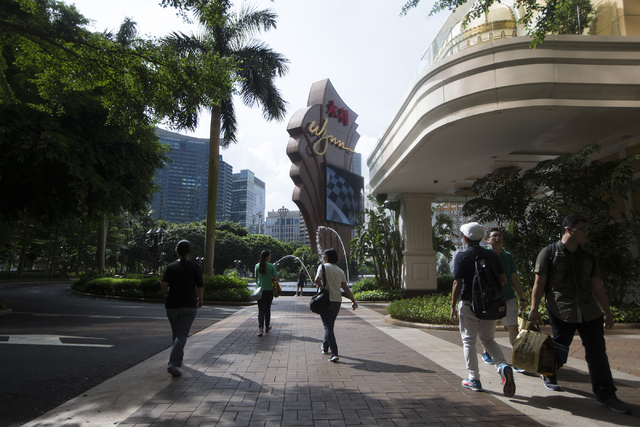

Shares of Las Vegas-based gaming companies rallied on the Macau numbers. Wynn Resorts Ltd. rose $6.56, or 6.82 percent, to close at $102.71. Las Vegas Sands Corp. gained $2.01, or 3.8 percent to close at $54.96. MGM Resorts rose 52 cents, or 1.98 percent, to close at $26.83. Wynn has the most exposure to Macau while MGM has the least among the three.

The Review-Journal is owned by the family of Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson.

Contact Todd Prince at tprince@reviewjournal.com or 702-383-0386. Follow @toddprincetv on Twitter.

RELATED

Macau gambling revenue falls 3.3 percent in 2016, 3rd year in a row

Macau gaming revenue projected to grow nearly 10 percent in 2017

Look for further 'Vegasization' of Macau in 2017