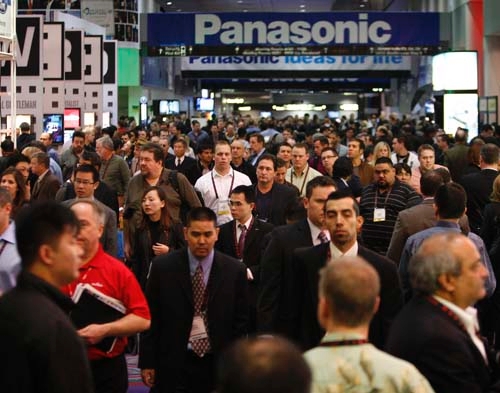

CES crowds help bolster convention officials’ hopes for future

All the hotel room sellouts from the International Consumer Electronics Show and other industry indicators have local convention executives detecting modest, if uneven, improvements in the year ahead.

Thousands of people attracted by CES spent big for boom-time-style hotel room rates. But this by itself doesn't signal better times after a rough couple of years, observers said.

"CES was just two nights in January," said Richard Harper, MGM Resorts International's executive vice president of sales and marketing. "We still have to worry about the other 363."

Convention bookings for the coming months lead him to expect an upswing in the coming year. But a recent history of groups buying only a fraction of the rooms blocked off for them or conventioneers holding down spending once they arrive injects a note of caution in his outlook.

"I feel good about what we are seeing," he said. "But I am not ready to put a stake in the ground and say we are completely back to normal."

Other convention and meeting sector observers express much the same view, one that applies for almost the entire visitor industry: a long, slow climb out of an economic hole seems to have taken hold. However, weak spots still show up along the way.

Treasure Island, which caters to smaller groups and some citywide shows, saw improving conditions in the fourth quarter of last year, Vice President of Sales and Marketing Don Voss said.

"It's looking pretty good, but it's all relative," he said. "It's nothing like 2007, but it's much better than last year."

Although clients in the past couple of years demanded deep discounts on rooms and spent sparsely on catering, he now sees groups willing to spend more freely on at least one component. For example, low room rates might be paired with more entertainment, such as a champagne toast at a dinner.

Nevertheless, he said shorter bookings are still frequent, such as one or two nights for CES instead of four.

For the 10 months through October, the 3.95 million people who attended conventions marked a 0.7 percent improvement from 2009, the Las Vegas Convention and Visitors Authority reported. The number of meetings held, however, dropped 5.6 percent to 15,500.

This was on a pace to run well short of the peaks hit in 2007, when 6.2 million conventioneers attended nearly 24,000 events.

Meeting traffic usually accounts for less than 20 percent of the total visitor count. But it plays a key role in a hotel's business because conventioneers tend to spend more. Authority numbers for 2010 show that the average trade-show attendee spent $942 per visit and the conventioneer, without exhibit booths, spent $710. For regular tourists, the total dropped to $590.

Chip Meyer, the authority's vice president of sales, forecasts a 5 percent to 8 percent gain in attendance this year. Much of the gain will come from shows involving the wireless communications, automobile and retailing sectors, he said; anything having to do with real estate remains anemic.

The Las Vegas Hilton is on a track to boost its meeting business 2 percent to 4 percent this year, Vice President of Sales Gavin Mealiffe said.

"People are starting to loosen the purse strings a little more, spend a little more on food and beverage," he said.

An American Express survey of chief financial officers last year seems to support Mealiffe's observation. Thirty-four percent of the respondents said they would restrict travel to conferences, a steep fall from the 81 percent who said they would cut back on travel in 2009. And 26 percent thought they would boost their travel budgets compared with 2 percent in 2009.

This has produced a "much better" outlook at CB Display International operations manager Jeffery Harms said. Nevertheless, he added, corporate clients are being more modest, renting 600-square-foot pads instead of 900 square feet. At the current pace, what he suspects a full recovery may take three or four more years, he said.

Business continued to grow throughout the recession at the booking agency Victoria's Event Productions, managing director Henry Marshall said. But this was only because the company decided six years ago to broaden its geographic base to follow clients who thought Las Vegas hotels were paying little attention to them in the boom times.

"My clients had the feeling that the city was not providing value as much as other locations," Marshall said.

Because numerous convention centers or additions opened in the past decade, he said more venues in other cities could offer discounted deals.

MGM International's Harper said convention sales staffs have redoubled their efforts to make Las Vegas more attractive.

"Everybody has elevated their game in the city," he said.

But Marshall recalled a client that wanted to book a meeting for 3,000 in 2013 but was stymied when he tried to negotiate a $10-a-night cut in room rates at a hotel he did not identify. The sticking point, he said, was that group wanted a weekend.

"Either the hotel's accountants knew something I didn't know, or (the hotels) still don't get it when it comes to booking meetings," he said.

Contact reporter Tim O'Reiley at toreiley@reviewjournal.com or 702-387-5290.

FOLLOWING CES

WEDNESDAY: The convention sends room rates sharply up.

THURSDAY: How attendance shapes up for 2011.

FRIDAY: What’s new, cool and hot.

SATURDAY: Disruptive technologies force changes.

TODAY: Does the convention reveal that better times lie ahead?

ON THE WEB: Follow Al Gibes’ blog at lvrj.com/onlineguy