Credit union boss blames new rules for higher costs

Atidal wave of federal regulations is responsible for the continued rise of compliance costs for most credit unions, Big Valley Federal Credit Union President and CEO Linda Sweet said.

“At Big Valley, I have seen our compliance costs steadily climb from year to year, and skyrocket over the last few,” Sweet recently told the House Small Business Subcommittee on Investigations, Oversight and Regulation.

Sweet said this trend is the same at many credit unions.

“A recent survey of National Association of Federal Credit Unions found that of those credit unions that are increasing their education budgets for (this) year, 84 percent cited increasing compliance burdens as the most important factor for this increase,” Sweet said.

Sweet, who oversees the $56 million credit union in Sacramento, Calif., said the new regulations are making it harder to provide quality customer service and to offer the same level of products and services it has in the past.

“Now, we are often slower to offer services that our members want, and there are some services we have been forced to cut back on,” Sweet said in her testimony before Congress. “In many cases, we are unable to offer a member a mortgage product that we were once able to. We have actually started to outsource many of our mortgages because we cannot afford a loan officer with the qualifications that the new CFPB regulations require.”

The recent hearing focused on regulations for small financial institutions. Sweet said outsourcing mortgages has led to members facing several thousands of dollars in increased costs.

“That certainly seems like an unintended and unnecessary cost to the consumer that the new agency was meant to protect,” Sweet said.

Sweet also emphasized the increased paperwork, time and costs associated with the regulations and guidelines from the Consumer Financial Protection Bureau on the National Credit Union Administration examination process.

“The examination time at Big Valley, from start to finish, takes roughly 90 days,” Sweet said. “It seems that these exams are taking longer due to the large number and complexity of regulations and not because of the increasing size or complexity of the credit union.”

Credit unions in Southern Nevada also face rising compliance costs.

“We are dealing with an ever- increasing requirement to comply with more and more complex regulations that make it a larger burden to provide many of the products and services our members want and need,” said Rick Schmidt, CEO of WestStar Credit Union in Las Vegas.

Schmidt said that although he supports the intent of many of these new regulations, credit unions are being challenged to comply with new rules when they were not the source of the original problems.

He said in “many cases credit unions were a type of safe haven for consumers seeking quality products and services that they could rely upon.” Schmidt said ensuring compliance with the Ability to Repay/Qualified Mortgage rule and the new Truth in Lending/RESPA rule has consumed “a great deal of our staff’s time and energy.”

“In both cases, we will be in compliance so that we can continue to offer mortgage loan products to our members,” Schmidt said. “However, we have incurred expenses to update documents, policies, procedures, staff training … to ensure we are up to speed with the new rules.”

Schmidt said he has concerns about the effect the Ability to Repay/Qualified Mortgage rules will have on the real estate lending market. The rule, known as Regulation Z, partly prohibits a creditor from making a higher-priced mortgage loan without regard to the consumer’s ability to repay the loan.

“No one knows exactly how these new rules will impact the marketplace, but there is real concern that it will cause many lenders to pull back on their underwriting to ensure they only approve qualified mortgages,” Schmidt said. “This has the potential to restrict the availability of some borrowers to have access to funds to purchase a new home.”

EXPORT LOANS

Plaza Bank will participate in a unique federal loan program in Nevada and California aimed at manufacturers and other companies. The program, which offers a 90 percent loan guarantee, assists small and midsize businesses that export their goods and services.

Plaza Bank President and CEO Gene Galloway compared the Export-Import Bank of the United States program to loans offered by the Small Business Administration. He said Plaza Bank was the largest community bank in Nevada participating in the program.

“We believe this will help businesses in the community, and it will strengthen our economy,” Galloway said.

Eric Fenmore, vice president of Irvine, Calif.-based Plaza Bank, will lead the export loan program.

Galloway said these loans were a “natural fit” with the bank’s other loan products. The community bank operates a branch in Las Vegas.

“I think there is an untapped manufacturing market that is sort of operating in the shadows, Galloway said. “There is a lot going on in Las Vegas that’s under the radar.”

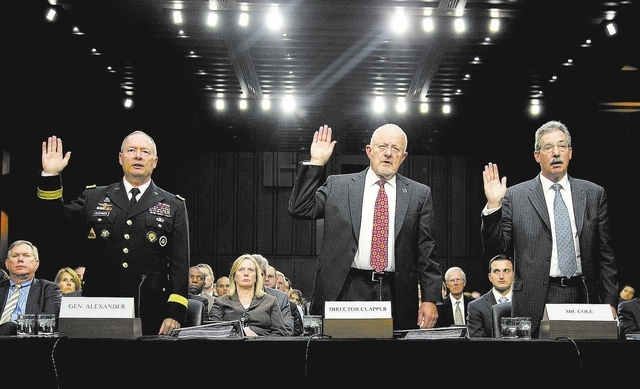

JUSTICE ISSUES WARNING

The U.S. Department of Justice is warning compliance officers at banks in Nevada and nationwide that more needs to be done to prevent financial crime at their companies.

The Justice Department also warned that it will aggressively pursue a company when misdeeds can be traced back to failures in compliance programs.

“We are committed to holding banks and their employees responsible for their misconduct,” Deputy Attorney General James Cole said in a recent speech at the Money Laundering Enforcement Conference.

Cole cited a case in October in which a jury in the Southern District of New York held Countrywide, Bank of America and a senior executive responsible for making bad loans and removing quality-control checks. He said they’ve also seen violations of the International Emergency Economic Powers Act related to Cuba and Iran.

He said financial institutions have agreed to pay about $17 billion in settlements in the United States in 2013 alone.

“Despite years of admonitions by government officials that compliance must be part of a corporation’s culture, we continue to see significant violations of law at banks, inadequate compliance programs, and missed opportunities to prevent and detect crimes,” Cole said.