Las Vegas Valley’s ‘shadow inventory’ in housing smaller than forecast

The new phenomenon in Las Vegas is the vanishing "shadow inventory" of foreclosed homes being held by the banks, a private-home investor believes.

Despite estimates of 50,000 to 100,000 foreclosures yet to hit the market, the inventory of real estate-owned homes available for sale dropped to 401 in December, a report from Ticor Title of Nevada shows.

REO inventory is up from a couple of months ago, but it's not from the shadow inventory released by banks. Instead, it's from homes sitting on the market longer because they're in terrible condition, said Zolt Szorenyi, chief executive officer of Lenders Clearing House LV.

The real shadow inventory is the number of people who will go into default during the next two years. And with Nevada's robo-signing law firmly in place, that's likely to remain low, he said.

"We took down 450 homes to sell to first-time buyers, and at the same time AB 284 came into place, and overnight stopped banks from foreclosing," Szorenyi said.

The law requires lenders to provide affidavits of authority to foreclose and makes it a felony for anyone to sign documents without "personal knowledge" of who owns the promissory note.

To skirt the law, banks are approving more short sales, or sales for less than the principal mortgage balance. Ticor reported 47.1 percent of December home closings were short sales, compared with 9.6 percent for REOs.

That's flip-flopped from a couple of years ago when roughly half of all sales were foreclosures and short sales were rare.

Richard Lee, vice president of Ticor Title in Las Vegas, said it's difficult to quantify the shadow inventory because nobody has really defined it. Some people consider it homes already in foreclosure; others estimate it's how many underwater loans will eventually default.

"Shadow inventory, the overhang, whatever you want to call it, it makes some people cautious," Lee said. "I'm cautiously optimistic because there's such a demand for housing product right now. It doesn't seem to affect it, but it's hanging back there. Is it going to jump up and bite us?"

FEWER FORECLOSURES

Discovery Bay, Calif.-based foreclosure listing service ForeclosureRadar.com reported REO inventory of 3,825 for Clark County in December, down from a peak of 15,669 in May 2011. Homes in preforeclosure, or those that have received a notice of default but have not yet been scheduled for sale, fell to 12,469 in December after running as high as 47,550 in August 2010, ForeclosureRadar.com said.

"Clearly, the legal change in Nevada was part of it. We know that," ForeclosureRadar Chief Executive Officer Sean O'Toole said. "The other thing we know for sure is banks really started to step up on loan modifications and short sales. Those two things clearly put downward pressure on foreclosure numbers."

There's also a strong "anti-foreclosure sentiment" across the board from state attorneys general and the government telling banks it's not OK to foreclose on homeowners, he said.

"I think that's wrong," O'Toole said. "Certainly short sales and loan modifications are better, but I'd rather see foreclosures than leaving people stuck in a prison of debt."

Foreclosure prices have continued to rise entering 2013, and the inventory of REO homes is shrinking, said Travis Olsen, president of Loan Resolution Corp., a Scottsdale, Ariz.-based company specializing in distressed mortgages and real estate. Lenders completed more than 58,000 foreclosures nationwide in October, he said.

"I think the vanishing inventory of foreclosures is due in part to the National Mortgage Settlement and you're seeing a temporary decline in foreclosures," Olsen said. "That said, there are more defaults and foreclosures to come. We're not out of the woods yet. We'll continue to feel pain for the next couple of years, though increases in prices will help ease that pain."

SHORT SALES ON THE RISE

Foreclosures will rise again if Assembly Bill 284 is repealed in the 2013 Legislature, but that's unlikely to happen, Szorenyi said. There may be minor changes made to the law, which choked notice of default filings from 4,000 a month to less than 1,000 after it took effect in October 2011.

"AB 284 is not going away. That means banks are not going to come back with shadow inventory. It's not going to happen," Szorenyi said. "The new phenomenon is there is no shadow inventory. They're selling notes to Condor (Capital) and doing short sales."

Brian Gordon, analyst for Las Vegas-based housing research firm SalesTraq, said key factors to watch in the coming months are the shift in contingent resales and regulatory changes to the foreclosure process.

SalesTraq identified nearly 11,000 homes as contingent, or pending sale, and about 86 percent of those units are listed as short sales.

"The resolution and timing of these properties could impact availability on a forward basis," Gordon said. "Similarly, should modifications to Assembly Bill 284 occur, or lenders move forward with increased volumes of foreclosures, the supply-demand dynamics may shift for a period of time."

If successful short-sellers and occupants of foreclosed homes leave those properties and stay in Las Vegas, the net effect on overall housing conditions over the longer run will be modest, he said.

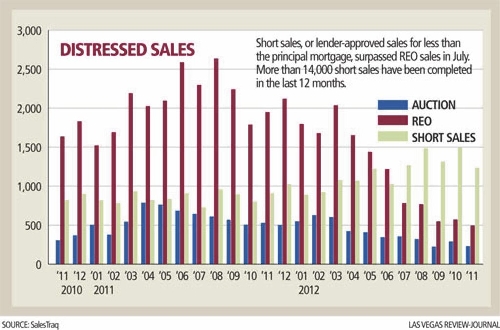

SalesTraq showed short sales surpassing REOs in July, and the gap has widened since then. The latest figures show 1,235 short sales in November, compared with 494 REO sales. In November 2010, REOs outnumbered short sales 1,636 to 821.

Lanny Baker, chief executive officer of Zip Realty, an Emeryville, Calif.-based online brokerage, said the national housing market in general is better than it was five or six years ago, but it's not what some reports make it out to be.

Investors are going to Atlanta, which replaced Las Vegas as the nation's worst housing market in 2012, Baker said before a presentation at Citi Equities' investor convention at Bellagio. Places like Boston and Baltimore are "having trouble getting their feet under them," he said.

"Clearly, Las Vegas got hit worse than anybody," Baker said. "You're getting total transactions in Las Vegas that are eye-popping year-over-year gains, but consider those are gains off numbers that were ground down to nothing."

BATTLE AGAINST BLIGHT

Szorenyi formed Lenders Clearing House LV in 2006 to help banks dispose of their foreclosure inventories. Banks neglected these properties and worked poorly with potential buyers, leaving them to deteriorate and create neighborhood blight, he said.

Szorenyi began attending trustee auctions, acquiring 300 to 450 foreclosed homes a year and restoring them to move-in condition with a home warranty offer.

He was part of the Hope Now partnership unveiled two years ago by the Las Vegas Chamber of Commerce to help people buy foreclosed homes through the government's Neighborhood Stabilization Program. The program was established by the U.S. Department of Housing and Urban Development to assist banks in reducing large inventories of real estate-owned homes in the Las Vegas market.

Nonprofit organizations that comprised the partnership were unable to secure many homes because "their hands are tied," Szorenyi said.

When Nevada's robo-signing law took effect last year, banks stopped the foreclosure process almost overnight, cutting REO inventory from several thousand homes to a few hundred.

"All of a sudden, no inventory. Regular nonprofits were unable to get properties," he said. "There's no way for them to buy and sell a home without losing money for the government."

Banks won't lend money on a home that's missing the air conditioner, plumbing fixtures and anything deemed essential by the lender, Sorenyi said.

Szorenyi said it takes nonprofits 12 months or more to rehabilitate a home and sell it to first-time homebuyers. He said his company turns the home in 60 to 70 days.

"Our client went in to do the same thing, but with private money, which means we don't have the restraints of public money," he said.

Szorenyi said the ratio of financing shows more owner-occupants are buying homes through Lender Clearing House. Whereas it was once 60 percent cash and 20 percent Federal Housing Administration financing, it's now 60 percent FHA and 13 percent cash.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.