IN BRIEF

CHICAGO

Quarterly earnings increase for Target, TJX Cos., Saks

Deal-craving shoppers helped a trio of prominent U.S. retailers report Tuesday that their third quarter managed to improve this year.

At Target, in-store revenue rose along with customer traffic during the three-month period, but shoppers were still buying fewer items during each trip. But shoppers at both stores and discount retailer TJX Cos. surprised analysts in seeming more willing to indulge.

Target's third-quarter profit was helped by cost-cutting, better sales in its stores and better profit from its credit-card business.

The Minneapolis-based company earned $436 million, or 58 cents per share, during the three-month period that ended in late October. Last year, it earned $369 million, or 49 cents per share.

Revenue rose 1.1 percent, to $15.28 billion from $15.11 billion.

Analysts polled by Thomson Reuters expected a profit of 50 cents per share and revenue of $15.25 billion.

Framingham, Mass.-based TJX, meanwhile, earned $347.8 million, or 81 cents per share, in the three-month period ended Oct. 31, up from earnings of $235.8 million, or 58 cents per share, a year earlier.

Revenue rose 10 percent, to $5.24 billion from $4.76 billion. Analysts polled by Thomson Reuters expected the company to earn 80 cents per share on revenue of $5.25 billion.

New York-based Saks, which hadn't turned a profit since the first quarter of 2008, earned $1.9 million, or 1 cent per share, in the three months that ended Oct. 31, reversing a loss of $43.7 million, or 32 cents per share, a year earlier.

Revenue fell 8.5 percent to $631.4 million.

Analysts polled by Thomson Reuters forecast a loss of 11 cents per share on revenue of $625.6 million.

NEW YORK

CIT Group loss widens to $1.07 billion in third quarter

Commercial lender CIT Group Inc. provided a further glimpse into its troubled finances, saying it lost $1.07 billion during the third quarter as customers jumped ship and it tried unsuccessfully to avoid filing for bankruptcy protection.

Third-quarter results showed that CIT, one of the nation's largest lenders to small and midsized businesses, was struggling to keep its customers and that those that remained during the summer were having difficulties repaying their loans. That points to more uncertainty for the company even after it emerges from bankruptcy protection; many small businesses still have cash flow problems.

New York-based CIT said in a regulatory filing late Monday that it lost $2.74 a share in the quarter ended Sept. 30, compared with a loss of $317.3 million, or $1.11 per share, a year earlier.

WASHINGTON

Value of loans at biggest banks declines during September

The value of loans held by the largest banks who received the largest amounts of government bailout support fell for an eighth consecutive month in September, the Treasury Department reports.

Further declines in lending will act as a severe drag on the economy as it struggles to rebound from the longest recession since the 1930s, analysts said.

Critics contend that the long string of drops in value proves the bailout program failed at its stated goal of boosting loans to consumers and businesses. The Obama administration says it's typical for lending to fall sharply during a recession.

WASHINGTON

Factory output slips in October, signaling sluggish recovery

A decline in factory production in October signals that consumers and businesses remain cautious in their spending, which could make the economic recovery sluggish.

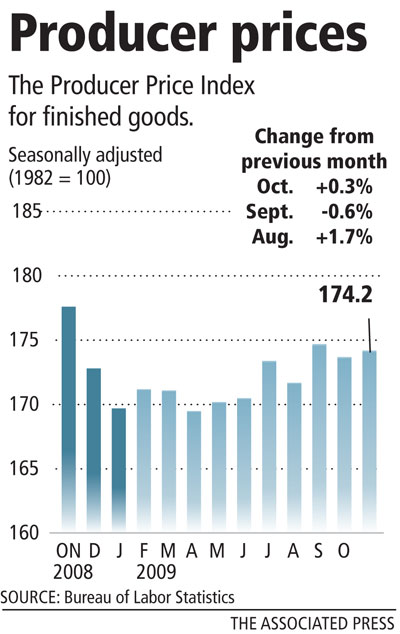

Meanwhile, wholesale prices rose less than expected last month, giving the Federal Reserve more leeway to keep interest rates low to try to spur a stronger economic rebound.

Industrial production rose 0.1 percent last month, the Fed said Tuesday. It was the poorest showing since output fell 0.4 percent in June.

Since then, industrial output had posted strong gains, helped by a rebound in auto production.

But auto output slipped 1.7 percent last month. That helped drag down total factory output, the biggest portion of industrial production.

NEW YORK

Home Depot's third-quarter profits dip from year earlier

Consumers are buying washers to fix leaky faucets rather than replacing the faucets themselves, and professional contractors are spending less overall on projects, Home Depot Inc. reported Tuesday.

The nation's largest home-improvement retailer said third-quarter profit fell 9 percent as demand remained soft amid the weak housing market. No. 2 home-improvement chain Lowe's reported a third-quarter drop in revenue and profit a day earlier.

Cost cuts helped Home Depot top expectations. Net income at the Atlanta-based chain fell to $689 million, or 41 cents a share, in the quarter ended Nov. 1, from $756 million, or 45 cents a share, a year earlier.

Sales fell 8 percent to $16.36 billion.

Analysts polled by Thomson Reuters had forecast earnings of 36 cents per share on revenue of $16.36 billion.

ATLANTA

In price dispute, Costco opts not to stock Coke products

Costco customers may have to look elsewhere for Coca-Cola products now that the retailer has stopped carrying them because the pair are fighting over prices.

The public squabble between one of the nation's largest wholesale club operators and the world's largest soft drink maker is likely to fizzle quickly. But it reveals real tensions as retailers and product makers clash on prices.

As shoppers continue to grapple with the recession, retailers want to win their favor by giving them low prices. But that has been creating tension between product makers like Coca-Cola Co., who are working hard to maintain profit margins while meeting retailer demands.

"Beneath this surface of harmony, it's a dogfight out there," Gerry Khermouch, editor of Beverage Business Insights, said Tuesday.

Retailers want to wield more power in determining pricing with product makers, who they depend on to stock their customers' favorite brands.