IN BRIEF

KANSAS CITY, Mo.

H&R Block profits exceed expectations

H&R Block Inc., the nation's largest tax preparer, reported better-than-expected profit for its fiscal fourth quarter on Monday as higher fees and more consumer financial services income offset a decline in the number of tax returns it prepared.

The Kansas City, Mo.-based company said it earned $706.9 million, or $2.09 per share, during the three months ended April 30, up from year-ago profit of $543.6 million, or $1.66 per share. That beat the $2.05 per share forecast by analysts polled by Thomson Reuters.

Revenue sank 3 percent to $2.47 billion, coming in shy of Wall Street's $2.52 billion estimate.

SIOUX FALLS, S.D.

China promise to boost reserves lifts oil prices

Oil prices settled above $71 a barrel Monday, as China said it would boost oil reserves and Nigerian militants partly shut down an offshore oil platform belonging to Royal Dutch Shell PLC.

Benchmark crude for August delivery gained $2.33 to settle at $71.49 a barrel on the New York Mercantile Exchange.

Alaron Trading Corp. analyst Phil Flynn said China's plans to increase its strategic crude oil reserves by 60 percent should provide the market with some long-term support.

Monday's jump in oil came despite a report from the International Energy Agency predicting a slower rebound in global energy demand.

The IEA said demand is likely to grow by an average of 0.6 percent annually over the 2008-2014 period.

SEATTLE

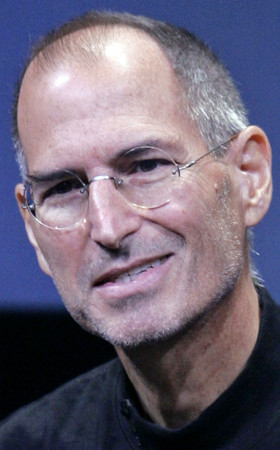

Apple co-founder Jobs comes back to work

Apple Inc. co-founder and CEO Steve Jobs is back at his office a few days a week after taking a five-month medical leave and getting a new liver.

Jobs, 54, will work from home on days he doesn't work from Apple's Cupertino, Calif., headquarters, company spokesman Steve Dowling said Monday. Dowling did not say exactly when Jobs returned to the office.

The state of Jobs' health and the timing of his return have been watched closely by investors and the media, as Jobs is seen as the visionary behind Apple's popular iPod music players and the iPhone, which left far more experienced mobile phone makers scrambling to catch up with similar touchscreen devices.

RENO

Fees for mining stakes on federal land climbing

Annual and one-time fees paid for mining stakes on federal land are going up.

The U.S. Bureau of Land Management on Monday announced the one-time "location" fee has been increased from $30 to $34 for all new claims staked hereafter.

Additionally, the annual maintenance fee for unpatented claims, mill and tunnel sites where no federal land has been transferred is now $140, up from $125.

The adjusted fees are due on or before Sept. 1.

NEW YORK

GM will seek approval for restructuring plan

General Motors Corp., hoping for a quick exit from Chapter 11, on Tuesday will ask a bankruptcy judge to approve its plan to refashion itself as a leaner automaker owned mostly by the government.

The nation's largest automaker still faces hundreds of objections from bondholders, state officials, unions and individual retirees and shareholders, but could enjoy an easier trip through the bankruptcy process thanks to the legal trail blazed just weeks ago by rival Chrysler LLC.

Last month, objections from a group of bondholders and others dragged out for three days Chrysler's hearing on its plan to sell the bulk of itself to a group led by Italy's Fiat Group SpA.

Under the government-backed deal, GM will sell most of its assets to a newly created company, 60 percent owned by the U.S. government. The Canadian government will get a 12.5 percent stake while the United Auto Workers union will take a 17.5 percent share to fund its health care obligations. Unsecured bondholders receive the remaining 10 percent.

Existing GM shareholders are expected to be wiped out.

The remaining pieces of the company, including some closed plants, will become the "Old GM" and be liquidated.

HOUSTON

Enterprise Products to acquire Teppco Partners

Enterprise Products Partners LP will acquire Teppco Partners LP in a sweetened all-stock deal worth about $3.3 billion, forming what the two pipeline operators say will be the nation's largest publicly traded energy partnership.

The new partnership, announced Monday and expected to close by year's end, will have operations throughout the United States, on the east, west and gulf coasts.

Keeping the name Enterprise Products Partners, it will own nearly 48,000 miles of crude and natural gas pipelines; 200 million barrels of storage capacity for natural gas liquids, crude and refined products; and 27 billion cubic feet of natural gas storage capacity.

DEARBORN, Mich.

Ford plans to increase third-quarter output

Citing better-than-expected sales and traffic at dealerships, Ford Motor Co. said Monday it plans to increase third-quarter production by 25,000 units -- marking the automaker's second production hike in recent weeks.

Ford spokesman Mark Truby said that will bring total quarterly production to 485,000 units, a year-over-year increase of 16 percent or 67,000 units. Last month the company said it would raise third-quarter production by 42,000 units.

WASHINGTON

Interest rates mixed in Treasury auction

Interest rates on short-term Treasury bills were mixed in Monday's auction. Rates on six-month bills rose to the highest level since mid-April, while three-month bills were unchanged.

The Treasury Department auctioned $30 billion in six-month bills at a discount rate of 0.35 percent, up from 0.335 percent last week. Another $32 billion in three-month bills were auctioned at a discount rate of 0.195 percent.

STUTTGART, Germany

Volkswagen takeover bid rejected by Porsche

Porsche has rejected Volkswagen AG's bid to take a 49 percent stake in the sports carmaker, a company spokesman said Monday.

Porsche Automobil Holding SE spokesman Albrecht Bamler said the offer by VW "is not a viable option."

Bamler said Porsche's board Chairman Wolfgang Porsche received the offer in a letter by courier last week. But the company's CEO Wendelin Wiedeking and management board weren't told.

Porsche holds a roughly 51 percent stake in Volkswagen, but ran up big debts in accumulating that holding and is now seeking a merger with the larger company. How that is to happen remains unclear.

PHILADELPHIA

Court won't block new recording system

TV operators won a key legal battle against Hollywood studios and television networks on Monday as the Supreme Court declined to block a new digital video recording system that could make it even easier for viewers to bypass commercials.

The justices declined to hear arguments on whether Cablevision Systems Corp.'s remote-storage DVR system would violate copyright laws. That allows the Bethpage, N.Y.-based company to continue plans to start deploying the technology this summer.

With remote storage, TV shows are kept on the cable operator's servers instead of the DVR inside the customer's home, as systems offered by TiVo Inc. and cable operators now do.

The distinction is important because a remote system essentially transforms every digital set-top box in the home into a DVR, allowing customers to sign up instantly, without needing to pick up a DVR from a cable office or waiting for a technician's visit.

Jury decides Abbott should pay settlement

Abbott Laboratories should pay $1.67 billion to Johnson & Johnson's Centocor unit for using its invention to produce the Humira arthritis drug, a federal jury said in the largest patent verdict in U.S. history.

The jury sided with J&J, the world's biggest health-care company, after five hours of deliberations, finding Abbott's actions were willful and J&J is owed $1.17 billion in lost profits and $504 million in royalties. Abbott pledged to appeal the verdict.

NEW YORK

Treasury prices climb as demand increases

Treasury prices climbed Monday, boosted by end-of-the-quarter demand.

The yield on the benchmark 10-year Treasury note fell to 3.49 percent from 3.50 percent late Friday. Its price rose 0.5 points to 97.03.