IN BRIEF

CAIRO, Egypt

OPEC downplays prospects of cut

OPEC ministers, arriving in Cairo for a meeting today, said they may delay a decision on production levels until December as they assess the impact of their last supply cut amid falling demand.

"Now we are preparing the data and we will take the final decision in Algeria," Iranian Oil Minister Gholamhossein Nozari said at his hotel in Cairo. Saudi Oil Minister Ali al-Naimi declined to speak as he arrived in Egypt today.

Kuwaiti Oil Minister Mohammed al-Olaim and his counterparts from Qatar and Angola also said the group would probably wait until its Dec. 17 conference in Oran, Algeria, before making a final decision. OPEC agreed last month to reduce production quotas by 1.5 million barrels a day.

The 13 members of the Organization of Petroleum Exporting Countries, which supply more than 40 percent of the world's oil, are meeting for the third time in as many months to discuss a further cut in production after crude prices plunged 65 percent from July's record of $147.27 a barrel in New York.

"The market is very related to the global economic crisis," Qatari Oil Minister Abdullah bin Hamad al-Attiyah said after arriving at Cairo airport Friday. "There's pressure on demand."

Crude oil for January delivery declined 1 cent to settle at $54.43 a barrel Friday on the New York Mercantile Exchange.

Waiting three weeks will give OPEC "a better chance to assess how effective they have been themselves in implementing the cuts," Mike Wittner, head of oil market research at Societe Generale SA in London, said in a Bloomberg Television interview.

NEW YORK

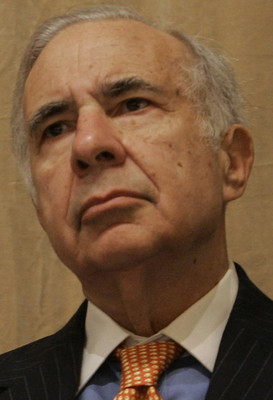

Financier snaps up millions of Yahoo shares

In a move likely to fuel speculation over Yahoo Inc.'s search for a new chief executive, activist investor Carl Icahn has bought up close to 7 million additional shares of the Internet company, according to regulatory filings.

Icahn, a billionaire hedge-fund manager who threatened to oust Yahoo's board this summer after it rejected a deal with Microsoft Inc., snapped up about $67 million worth of shares over three days this week, according to a filing with the Securities and Exchange Commission.

Icahn bought 6.8 million shares for an average of $9.92 each in three batches from Monday through Wednesday, bringing his total stake to 75.6 million, or nearly 5.5 percent of the company, according to the filing made Wednesday.

In his original $1.5 billion investment in Yahoo, Icahn paid an average of about $25 dollars per share.

WASHINGTON

Fed boosts lending to commercial banks

The Federal Reserve boosted its lending to commercial banks and investment firms over the past week, signaling that a severe credit crisis was still squeezing the financial system.

The Fed released a report Friday saying commercial banks averaged $93.6 billion in daily borrowing for the week ending Wednesday. That was up from an average of $91.6 billion for the week ending Nov. 19.

The report also said investment firms borrowed an average of $52.4 billion from the Fed's emergency loan program over the week ending Wednesday, up from an average of $50.2 billion the previous week.

The Fed said its net holdings of business loans known as commercial paper over the week ending Wednesday averaged $282.2 billion, an increase of $16.5 billion from the previous week.

LONDON

British will take over Royal Bank of Scotland

The British government will take over Royal Bank of Scotland Group PLC with a majority stake of almost 60 percent after the shareholders of the nation's second-largest bank shunned an emergency share issue.

The 20 billion pound ($31 billion) rescue takeover, the result of a plan announced last month, means that dividends on common shares will be scrapped and top executives' bonuses will be canceled. Chief Executive Fred Goodwin has resigned and Chairman Tom McKillop, who last week personally apologized to shareholders for the 85 percent fall in the bank's share value, has said he will retire next year.

RBS's 1.8 trillion pounds in assets are topped among U.K. banks only by those of HSBC.

KIRKLAND, Wash.

Clearwire closes deal with Sprint Nextel unit

Clearwire Corp. has completed its merger with the unit of Sprint Nextel Corp. that is building a new wireless data network, the companies said Friday.

The company formed by the merger keeps the Clearwire name. It aims to create a network that uses WiMax, a new wireless technology that promises faster data speeds than most current cellular broadband networks.

Clearwire already has about 400,000 customers on a network that uses similar technology. The new company will absorb Sprint's existing Baltimore-area WiMax network, which the company developed under the Xohm brand, in addition to Sprint spectrum covering much of the country.

Sprint, based in Overland Park, Kan., will own 51 percent of the company while investors in the original Clearwire, founded by cellular pioneer Craig McCaw, will own about 22 percent.

The rest of the company will be owned by investors including Comcast Corp., Intel Corp., Time Warner Cable Inc., Google Inc. and Bright House Networks, which have put in $3.2 billion in cash.

WAUKEGAN, Ill.

Wait a minute ... can this bonus be this big?

Year-end bonuses are rare these days. But a family that founded a ball bearings manufacturer in suburban Chicago is giving eye-popping bonuses this year.

A total of $6.6 million is being shared by just 230 employees.

Some workers at Waukegan-based Peer Bearing Co. couldn't believe their eyes when they opened checks for $10,000 and more. Amounts varied and were based on years of service.

Dave Tiderman, an assistant product manager at the company, says he thought the decimal point must be in the wrong place when he saw his $35,000 check.

Peer Bearing was sold to a Swedish company earlier this year. Danny Spungen says his grandfather launched the company in 1941. He says it was an unanimous family decision to thank employees with the bonuses.

Treasury yields drop as pessimism lingers

Yields on long-term government debt sank to new record lows Friday, the last trading day of the month, as investors continued to bet on an extremely weak economy.

The 10-year note rose 0.5 points to 107.03 and yielded 2.92 percent, down from 3 percent.

The 30-year bond rose 1.59 to 119.41 and yielded 3.44 percent, down from 3.52 percent.

The rate on the three-month Treasury bill edged only modestly higher to 0.05 percent from 0.03 percent -- indicating that investors were willing to earn virtually nothing for the safety of short-term government debt.