Index of gambling stocks declines during November

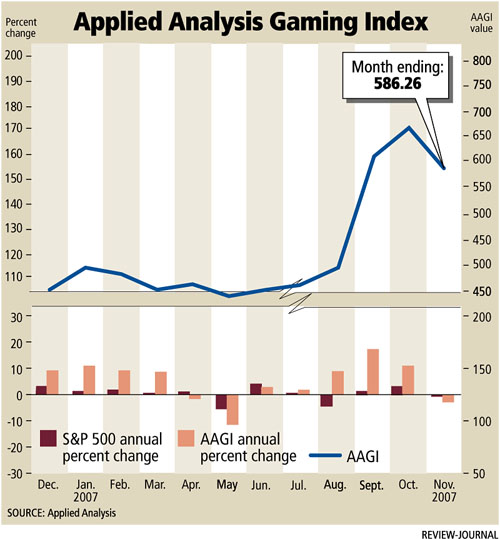

After riding a wave of good fortune in September and October, the average daily stock prices for Nevada's major gaming companies tumbled during November.

Only two of the nine casino operators and slot machine manufacturers tracked for an index by Applied Analysis, a Las Vegas-based financial consulting firm, showed increases when comparing stock prices from November and October.

One of those companies, Station Casinos, was taken private through a $5.4 billion management-led buyout early in the month and will be removed from the index.

Brian Gordon, an Applied Analysis principal, said the economic fundamentals that helped propel gaming stock values in the previous two months didn't change this month.

What did change was how investors looked at their holdings. Many sold some of their holdings during the month to reap rewards from their investments.

"Investor profit-taking placed downward pressure on valuations of gaming companies," Gordon said.

The Applied Analysis Gaming Index, which recorded its two largest ever monthly gains in September and October, fell more than 80 points in November, the largest monthly decline since the company began the index in 1998. It finished at 586.26.

Gordon said casino operators with a presence in Macau continued to drive the index, in both directions. Speculation on revenues generated by Macau's casinos helped boost the share prices of Las Vegas Sands Corp. and Wynn Resorts Ltd. to record levels before November.

The companies rebounded in price somewhat in November. Las Vegas Sands shares traded 15 percent lower on a daily average compared with October. Wynn Resorts shares were off almost 14 percent compared with the previous month. The average daily share price for MGM Mirage, which announced it would open the $1.2 billion MGM Grand Macau on Dec. 18, tumbled more than 6 percent in November.

"Las Vegas Sands, Wynn Resorts, and MGM Mirage to a lesser extent, witnessed valuations reach new highs in recent months as the Macau gaming market expanded at a robust pace," Gordon said.

Several companies made news that helped offset some of the stock-price declines. MGM Mirage announced a partnership to compete for one of the potential casino licenses in Kansas. The company also completed a joint-venture deal with the investment arm with the government of the Persian Gulf state of Dubai, which provided a $2.5 billion cash distribution to MGM Mirage.

Wynn Resorts announced a $6 per share dividend that will be paid to investors in December.

Gordon noted the Wynn dividend was announced right after a negative article on Macau in Barron's magazine caused stock prices of the Macau operators to slip.

Station Casinos traded on the average within a penny of its $90 per share buyout price in which the company's founding Fertitta family and Colony Capital took the casino operator private. Harrah's Entertainment, which is being bought out in a $17.1 billion private equity deal, is also expected to go private after the first of the year.

The only gaming company showing a significant gain was resurgent Bally Technologies. The Las Vegas-based slot machine maker saw its average daily stock price climb more than 5 percent in November. The company's average daily price was almost 104 percent higher in November compared with the same month a year ago.

Many gaming analysts said Bally displayed some of the best slot machines at the three-day Global Gaming Expo trade show in November.

"Over 70 percent of Bally's products on the slot floor were ready to be placed in casinos, thus highlighting the current strength of Bally's games," Goldman Sachs gaming analyst Steven Kent said in a note to investors.

CIBC World Markets gaming analyst David Katz said Bally, along with International Game Technology and WMS Industries, the other slot makers tracked in the index, are all positioned to benefit once domestic slot machine expansion takes place.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or (702) 477-3871.