Las Vegas jobless rate falls to 13.3 percent in March

So this is what the battle for economic recovery looks like in Nevada.

As an army of food servers, lawyers, nurses and accountants marches the Silver State toward employment stability, the foot soldiers in construction, banking and manufacturing have gone AWOL.

New numbers from the state Department of Employment, Training and Rehabilitation show that hiring in a few key sectors in March bolstered labor markets statewide, including in Las Vegas, where job growth posted its best performance in years. But gains came unevenly, with some sectors flourishing as others lagged.

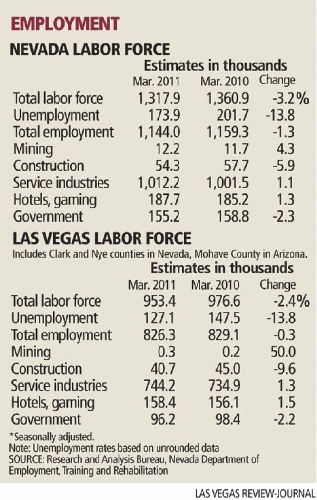

Overall, unemployment in the Las Vegas Valley dipped to a 16-month low of 13.3 percent as employers added 10,100 positions, 1.2 percent, to the city's jobs base from February to March. Year over year in March, local employers added 3,900 jobs, for growth of 0.5 percent.

Statewide, unemployment dropped to 13.2 percent in March, down from 13.6 percent in February and 14.9 percent in March 2010. It was Nevada's first year-over-year jobless drop in nearly four years, and the state's best job-formation rate for a single month since the halcyon days of September 2005.

And unlike unemployment declines in January and February, March's improvements came not from a shrinking labor force but from new jobs. The state's work force grew by a seasonally adjusted 2,000 jobs from February to March, for a labor pool of 1.32 million.

One month does not a trend make, but experts and observers say year-over-year comparisons in March provide a more defined picture of how recovery in Nevada, and in Las Vegas in particular, will look through 2011 and into 2012.

WINNERS

Employment categories that grew well in the past year and probably will continue to advance through 2011 include leisure and hospitality, professional and business services, education and health services and mining.

Operators in the local hotel and restaurant businesses added 2.1 percent to their staffs year over year in March, for a gain of 5,300 positions. No local industry added more jobs in the year.

The employment department credited the improvements to increased demand for leisure and hospitality services. Visitor volume in Las Vegas has risen in 17 of the past 18 months, and taxable sales, which partly measure consumer spending, are up more than 5 percent compared with a year ago.

"Leisure and hospitality is really the driving force for Southern Nevada. Nothing else can improve before it does," said Steve Brown, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas.

Companies providing business and professional services appear to be feeling the broader effects of a healthier primary industry. The category, which includes accounting firms, law firms, architecture studios and employment agencies among others, added the second-largest number of local jobs year over year in March, growing by 4,800 positions, 4.9 percent.

The employment department credited the hiring uptick to increased demand for services in office administration, human resources, document preparation, collections, security and surveillance, cleaning and waste disposal.

Brian Gordon, a principal of local research firm Applied Analysis, said that growth in the sector represents a "positive sign" that there's some diversity in the city's bounce-back.

The combined category of education and health services also turned in strong gains in the year, adding 4,100 jobs, 5.9 percent. It's a sector with strong fundamentals in both the past and future: Since the recession began in December 2007, the category has added 11,000 jobs, including 5,000 positions in the past year alone.

The health field has benefited as doctors and hospitals work to catch up to an under-served population's health care needs, said Jered McDonald, an economist with the employment department. An aging population has bolstered the sector too.

And in education, which includes private providers of training and professional degrees, a flood of unemployed workers seeking new skills to boost their job prospects has proven a life raft.

On top of education and health services, the natural resources and mining industry has provided one of Nevada's few steady growth sources in the downturn. The sector is nearly nonexistent in Las Vegas, where it claims just 300 jobs. But statewide, the industry employs more than 12,000, and its jobs base jumped by 500 positions, 4.3 percent, in the year.

Global unrest and financial insecurity have pushed gold prices to records approaching $1,500 per ounce, and that has meant single-digit unemployment rates in rural, mining-heavy areas such as Elko and Eureka counties.

LOSERS

For each sector that gained jobs in the last year, there is a jobs category that continues to suffer. Faring especially poorly were construction, manufacturing, the public sector and financial activities.

Construction just can't seem to claw its way out of its quagmire.

Builders slashed 4,300 positions year over year in March, for a 9.6 percent decline in their industry's jobs base. The construction sector ended March with 40,700 jobs in the valley.

Construction's decline remains so dramatic because Southern Nevada essentially borrowed big demand for real estate from the future, Gordon said. Homebuilders and commercial developers overbuilt entire subdivisions of homes and thousands of square feet of office, industrial and retail space. With tens of thousands of homes standing empty and commercial vacancies at or near all-time highs, there's no need for new construction, a situation that experts agreed will endure for years to come.

That bleak outlook has implications for two other slumping sectors, McDonald said.

First, many manufacturers locally and statewide focus on products related to construction, he said. Manufacturers in the valley pared 1,200 jobs, 6.2 percent, from their work forces year over year in March, as companies needed fewer of the goods they produced.

Financial activities continued to take it on the chin as well. Finance-related businesses cut 2,100 jobs, 5.3 percent of their positions, as little new development meant less need for construction loans, insurance policies and rental and lease agreements. Financial companies probably will hurt until new construction picks up, McDonald said.

Also buffeting the financial sector? Scarce demand for business loans. Studies show that 15 percent of local businesses are applying for new lines of credit, compared with about 55 percent of businesses nationwide, Brown said. Plus, banks turn down a third of all local businesses seeking credit, while denying loans to around 11 percent of applicants nationwide, he said.

And then there's government, a lagging employment sector that will need time to turn around, if it does, economists said. The public sector has 2,200 fewer local workers than it employed in March 2010. That's a 2.2 percent drop in the sector's jobs base.

Experts said they expect existing employment trends to largely continue through 2011 and into 2012.

The employment department obtains its unemployment numbers from household and business surveys. If you include discouraged workers who have quit looking for jobs and underemployed workers who would rather work full-time, the jobless rate continues to exceed 20 percent, McDonald said.

Joblessness nationwide was 8.8 percent in March.

Nevada has led the nation in joblessness since May. The U.S. Bureau of Labor Statistics hadn't reported March jobless rates for all of the states as of late Monday.

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512.