Little faith in stimulus

Looks like Nevadans aren't too keen on forking over dollars to shipyards, TV converter boxes or biofuel research.

A new Review-Journal poll shows a resounding majority of residents see little to no benefit in the $787 billion stimulus package Congress passed in February to lavish on programs and services nationwide.

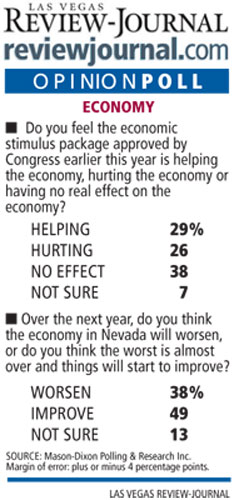

Nearly two-thirds -- 64 percent -- of survey respondents said they believe the stimulus is either having no effect on the economy, or is hurting the commercial climate. Another 29 percent said they think the spending is helping the economy. Democrats were likeliest to see good in the stimulus, with 51 percent of them approving of the plan. Among Republicans, 96 percent frowned on the spending, while 70 percent of independents gave the cash infusion a thumbs-down.

The Review-Journal's results back up a nationwide USA Today poll published Monday. In that survey, 57 percent of respondents said the stimulus either harmed the economy or had no effect on it. Nearly 80 percent of those questioned said they worried that stimulus money was being "wasted."

Put Las Vegan Donna Potter squarely on the anti-stimulus side.

Potter sees sustained job loss -- Nevada's unemployment rate hit a record 12 percent in June -- and sluggish consumer spending, and she senses little positive impact from the funds.

"Just the way things are going, and how everything has tightened up so much, the stimulus spending has done absolutely nothing, as far as I can see," Potter said Thursday, as she accompanied out-of-town guests on a visit to Texas Station.

Potter was among the millions of seniors who received $250 stimulus checks from the government in the spring. She dropped her cash on clothes and food, but she remains unimpressed.

"It was one shot, and now it's gone," she said. "And this bailing out of car companies and all that, where's it gotten us?"

It's not just carmakers and dealers benefiting from all that federal largesse.

The stimulus package, most of which hasn't yet been distributed, included nearly $500 billion in new spending on unemployment and social services and almost $300 billion more in tax credits, all for a wide range of recipients. About $100 million in stimulus funds went to shipyard grants, and another $500 million funded research in "leading edge" biofuel projects. Also included: $2 billion to expand the Cash for Clunkers car-buying incentive, $6.6 billion to give first-time homebuyers an $8,000 tax break and $20 billion in tax credits for renewable-energy projects. It's a spending package that gives pause to many Nevadans.

Take Wayne Laska, a principal with local homebuilder StoryBook Homes.

Laska said the tax credit for first-time homebuyers boosted his company's business by at least 30 percent; about half of all homes StoryBook sold this spring and summer involved the credit. But the spending volume concerns him.

"In the last eight months, something needed to happen, so do I think it was smart to put some of these programs in place to get the economy back on track? Absolutely," Laska said. "But go back and look at our $2 trillion deficit and find all the pork in there. It's just too much waste. In my opinion, there's not much control over where those monies went, and I'm not sure it's necessarily going to help."

Laska said he'd like to see the government give the swelling national debt a break by canceling stimulus spending that hasn't yet left federal coffers.

Despite survey participants' overall dim view of the stimulus, a plurality of Nevadans said they believe the state's economy will improve in the next year. Forty-nine percent foresee better days ahead, while 38 percent expect tougher times. The rest wouldn't hazard a guess.

Potter feels the downturn is permanent. The national debt is just too big, she said, and there's "not a person in this country who can get us out of this mess."

But Donald Romagnola, who retired from the auto industry and moved here from upstate New York five years ago, foresees an uptick. Romagnola said he believes the economy is well on its way to recovery, partly because of stimulus spending and partly because of the economy's cyclical nature. Recessions never last forever, and Romagnola likes the recent upward directions of some key economic indicators. Romagnola and his wife, Julie, just bought a home, and they've sustained their spending on dining out and other discretionary purchases. Thursday, they were gambling at Texas Station.

Local businessman John Arena said he also expects the economy to strengthen soon. Customers who visit the Metro Pizza restaurants he co-owns tell him their situations have improved, and they're more willing to spend today than they were a few months ago. Consumer confidence is what's most important, Arena said, and a surging stock market and a massive infusion of federal cash into the economy have bolstered confidence. Patrons who were coming in just once a month have upped their Metro outings to twice a month. Some of the added business comes from less competition, as existing restaurants close and fewer new restaurants open, but some of it also traces back to diners' expectations for a better economy, Arena said.

Americans are "justifiably alarmed about debt the government is incurring through stimulus spending, Arena added, but he said he still feels positive about the future. The country is remarkably resilient, he said, and he expects to see economic growth return by mid-2010.

"I'm very optimistic about the economy of Las Vegas. I think we're uniquely positioned to offer visitors a great and cost-effective vacation experience, and we're uniquely positioned to offer the best convention experience in the country," Arena said. "Companies are learning to run more efficiently, and that will have a residual positive effect on the economy as people once again spend money."

Mason-Dixon Polling & Research of Washington, D.C., conducted the poll on Monday and Tuesday. The company surveyed 400 registered voters in the state and has a margin of error of plus or minus 5 percentage points.

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512.