Nevada’s taxable sales down 12.9 percent

Tyler Corder's looking for a dose of positive economic news.

That's what it'll take, Corder figures, to chase consumers off the sidelines and into the dealerships belonging to Findlay Automotive Group, where he's chief financial officer.

Well, Corder might want to hide the newspapers inside his dealerships' lobbies this morning, because the Review-Journal has one more bit of bad news to get out of the way.

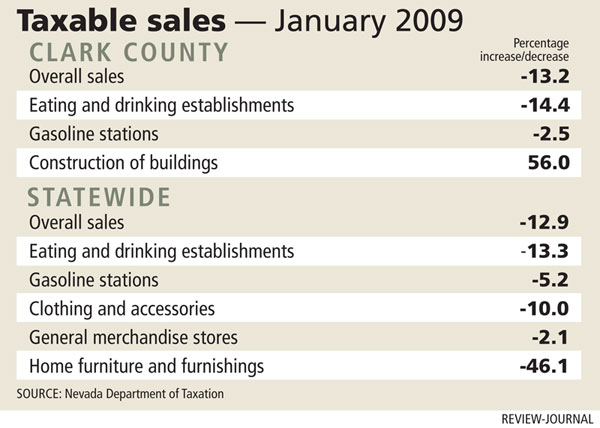

Taxable sales, which help finance the state general fund that pays for schools and prisons, dropped 13.2 percent in Clark County and 12.9 percent statewide in January when compared with the same month a year earlier.

Especially hard-hit were dealers of cars and car parts, which saw sales volumes plummet 30.2 percent statewide, and furniture retailers, which experienced a sales drop of 46.1 percent year over year in January.

"The challenge for us right now is just getting some consumer confidence. People read so much negative news that they're sitting on the sidelines," Corder said. "We've seen reports that something like a third of all people intend to buy a car in the next year, but they're waiting to see what the economic news is like."

At Findlay, the number of new cars sold fell roughly 30 percent year over year in January, while sales of used cars dropped 20 percent. Sales of parts and services stayed even, Corder said, so overall, Findlay's dealerships outperformed statewide results. But pain in the auto industry is widespread, Corder noted, consuming dealers of domestic and foreign cars alike.

Nor is the luxury class immune to the recession any longer, said Greg Thomson, president and owner of Milton Homer Fine Furniture in Boca Park.

The market for Milton Homer's high-end furnishings dipped four to six months ago and hasn't recovered since. March was one of the store's worst months ever.

Thomson blames the downturn on slackened consumer confidence. Most of his clients still hold executive-level jobs and relatively handsome investment portfolios, but they fret over economic events.

"People see the stock market fluctuate, and they see more people around them losing their jobs. It makes them say, 'I could be next,' " Thomson said. "It's that fear factor."

Some sectors expanded sales in January. Sales for accommodations rose 16.4 percent, and specialty trade contractors improved sales by 15.9 percent. Building construction sales were up 45.3 percent, while mining sales leapt 171.2 percent.

Despite broadly slumping sales, the general fund portion of the sales and use tax collected through the first seven months of fiscal 2009 came in 0.1 percent, or $883,000, above projections from the Economic Forum, a forecasting entity that estimates incoming revenue.

Still, gross revenue collections from sales and use taxes declined 13.76 percent year over year in January, to $227.5 million.

Gov. Jim Gibbons said the numbers showed both continued softness in the economy and the glimmer of a bottoming-out in some hard-hit sectors.

"The latest release of taxable sales and revenue collection data for the month of January indicates our businesses and citizens once again are feeling the effects of a contracting state and national economy, the slumping housing market and the increasing unemployment rate," Gibbons said in a statement. "Although Nevada's economy continues to decline, overall construction activity recorded positive gains for the month, which suggests that we may be seeing some indications of economic stabilization."

For Milton Homer, steadier sales may be a few months off.

The company hasn't laid off workers, though Thomson has to cut hours in especially slow times. Its salespeople have rustled up interior design work, though, and relatively strong sales in that area sustain the company. But Thomson doesn't expect any significant gain in furniture sales until 2010, when the housing market begins to recover.

At Findlay, Corder sees signs of improvement. The dealerships enjoyed a small uptick in business from February to March, and Corder talked of pent-up demand for cars heading into the industry's high-sales season from March through October. Plus, lenders have begun to relax once-stringent borrowing requirements. Oh, and an assist from the media could help as well, Corder added.

"When people start to see a little more good news than bad," he said, "then they'll get more free with spending their money."

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512.