Office vacancy rates soar in third quarter

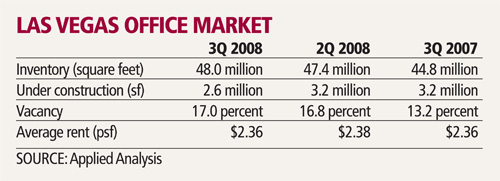

Office vacancy in Las Vegas reached its highest level in recent history, rising to 17 percent in the third quarter from 13.2 percent in the same quarter a year ago, Applied Analysis research firm reported.

Vacancy has averaged 9.7 percent over the past 10 years in Las Vegas.

New supply of 651,000 square feet far outpaced 458,000 square feet of net absorption, or the amount of space taken during the quarter. About 2.6 million square feet of office space has been completed through the first nine months of the year, while 623,000 square feet was leased.

Vacancy rates are expected to remain elevated through the next several quarters, Applied Analysis principal Jeremy Aguero said Tuesday.

"It's the same concern we've raised for two or three quarters. The reality is we continue to bring new space online and job growth is at a standstill," he said.

The lease-up period for new-office construction is longer than it's been for years and new product built in 2008 has an average vacancy of 60 percent, Aguero said.

"It was in the pipeline long before the economic picture was as clear as it is today," he said.

Colliers International brokerage showed 17.7 percent vacancy for nearly 40 million square feet of office inventory in the third quarter, compared with 16.1 percent in the previous quarter and 11.2 percent a year ago.

Average asking rent dropped to $2.43 a square foot for full service, or accounting for all operating expenses, from $2.47 in the second quarter and $2.51 a year ago.

While demand for office space in 2006 and 2007 was relatively strong, it was in some ways driven by an overheated Las Vegas economy and commercial real estate markets, which in turn were driven by huge amounts of easy credit, Colliers International managing partner Matt Stater said.

Landlords continue to aggressively negotiate with new tenants by offering higher tenant improvement allowances, or the cost to build out office space, and increased amounts of free rent, research analyst Dave Dworkin of Grubb & Ellis said.

It's a great time to be a buyer, he said. Asking prices for shell office buildings in desirable submarkets have decreased to price levels comparable to two or three years ago.

Despite rising vacancy, institutional and out-of-state investors have increased their presence in Las Vegas, targeting stable-tenant properties in prime locations with capitalization rates in the mid- to high-6 percent range, Marcus & Millichap said in its office market research report.

Institutions comprise a large share of the buyer pool, as this segment has been able to secure deals for premium properties over the last year, driving up the median price 10 percent to $255 a square foot, Marcus & Millichap reported.

Deirdre Waitt, president of Woodland Hills, Calif.-based Blue Marble Development, said her company bought 7,500-square-foot and 16,000-square-foot office buildings in Las Vegas, but she would not disclose the price.

Blue Marble suspended plans to build Paxton Walk mixed-use development in northwest Las Vegas and has instead focused on distress sale acquisitions, including 40 units in two buildings at Terra Bella condos in Anthem and the Uptown condo project in North Las Vegas.

"We've been developing real estate here for over 15 years," Waitt said. "We're big believers in Vegas bouncing back, so we're still buying office buildings, condo projects and land. We'll build, lease and sell as the market allows -- we're here for the long haul."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.