Sales tax summary: Buying is up, building is down

More buying, less building.

That's Nevada's new normal, if the state's latest taxable sales numbers are any indication.

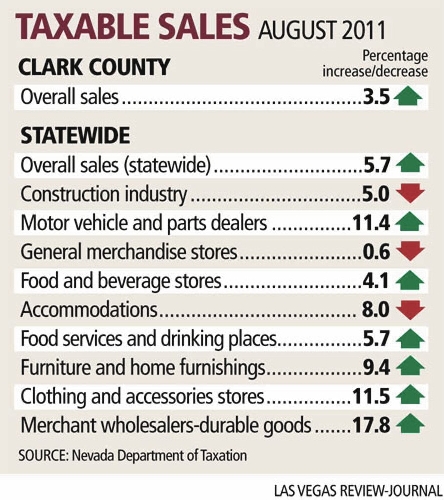

Wednesday figures from the Taxation Department show that sales in consumer-oriented categories such as clothing, restaurants and cars grew nicely in August, even as construction activity continued to slide. The upshot? Taxable sales remain well off of their peak, and at current growth rates, it could be at least half a decade before they return to record levels. Get used to slow, single-digit -- albeit sustainable -- growth for the foreseeable future.

"Big gains are unlikely, if not impossible, within the next several years," said Brian Gordon, a principal in local research firm Applied Analysis. "That's partially a function of the construction industry. It's also unlikely consumers will spend at a faster pace, given the current job and housing climate."

Taxable sales are important as an economic indicator and as a revenue stream for public services, including prisons and schools.

As economic growth visited several key categories, that revenue stream looked a bit better in August. Sales of goods among Nevada's businesses came in at $3.4 billion in the month, up 5.7 percent when compared with August 2010's $3.2 billion. In Clark County, taxable sales jumped 3.5 percent to $2.4 billion, up from $2.3 billion a year earlier.

But those numbers are considerably below their apex. August taxable sales peaked in 2006, reaching $4.2 billion statewide and $3 billion in Clark County. Statewide and local sales in August were 20 percent below those highs. Remove the woefully performing construction categories from the data, and taxable sales are still 18.7 percent off their August 2006 pace. At current growth rates, it would take four to five years to get back to prerecession levels, said Steve Brown, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas.

Yet, the numbers show that state and local economies are recovering, and at a brisker pace than some economists expected. August can be a slow month for tourism, travel and discretionary spending, Brown noted, so the fact that the month's numbers held up is a positive sign. Plus, he added, a year ago few indicators pointed to economic expansion in any arena.

The improvements have come almost exclusively from consumer spending, which has jumped locally in 10 of the last 11 months, even as construction spending has languished well below its boom-era levels.

Spending in local bars and restaurants -- the biggest sales category, claiming 27.6 percent of total dollars -- rose to $664 million, up 6.3 percent from $624.5 million in August 2010. Dealers of cars and car parts saw sales jump to

$238.5 million, up 8.6 percent from $219.6 million. Clothing retailers sold $252.1 million in goods, up 14.4 percent from $220.3 million. General merchandise stores, including department stores, did $204.9 million in sales, up 1.8 percent from $201.3 million.

But local construction stumbled further, falling to $39.2 million. That was down 20 percent from $49 million in August 2010. It was also off 65 percent from $111.2 million in August 2006, and down 77 percent from $171.3 million in August 2008. And with the resort corridor "severely overbuilt," an 8.5 percent vacancy rate in single-family homes and years' worth of inventory in office and commercial real estate, don't count on building activity ever returning to its boom levels of 2002 to 2005, Brown said. That means the city and state will need strong population growth to push taxable sales back toward their peak.

For now, Gordon said the current sales growth rate is likely the "new normal."

Brown said Nevada and Las Vegas haven't yet reached their new normal. He believes average growth could be higher than today's pace if the national economy starts expanding according to its potential growth rate. That could take five or six years, he said.

Contact reporter Jennifer Robison at

jrobison@reviewjournal.com or 702-380-4512.