State taxable sales jump in March

Nevada's taxable sales jumped in March thanks mostly to steep spending increases in counties up north.

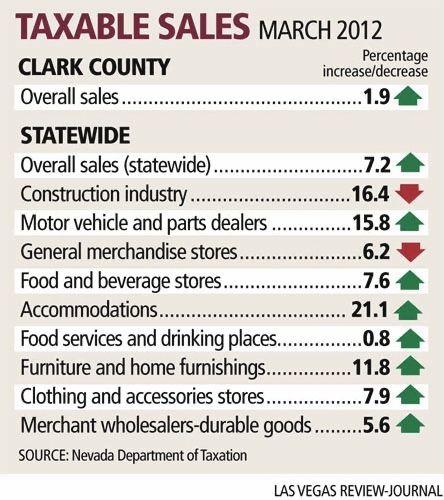

Sales of tangible goods by Silver State businesses jumped to $3.9 billion in the month, a 7.2 percent increase from $3.6 billion in March 2011, the state Department of Taxation reported Tuesday.

Clark County's was less dramatic: Sales ticked up to

$2.8 billion, a 1.9 percent gain compared with $2.7 billion a year earlier.

It was the smallest increase in local taxable sales in the past year, noted Steve Brown, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas.

"These series tend to be bumpy, but I do think it's a little bit of a concern that the numbers have flattened out," Brown said. "It's not time to pronounce the patient dead, but it is time to watch and see whether other signs are in the same vein."

Brian Gordon, a principal in local research firm Applied Analysis, noted that taxable sales increased 9.6 percent in the same period a year ago and about 11 percent in February. After such strong increases, and coming out of a downturn, it's natural for sales numbers to ebb and flow.

"The data will bounce around as the economy continues to move beyond the recession, but taxable sales remain in positive territory," Gordon said. "We would like to have seen more positive gains, but we continue to tread water as we move farther away from the recession."

The biggest spike came in White Pine County, where sales jumped to

$161.3 million, up 672 percent from

$20.9 million in March 2011. That improvement accounted for more than half of the state's overall sales uptick.

For privacy reasons, the Taxation Department doesn't disclose specific companies or projects behind higher collections, but the agency's numbers show that most of the county's sales bump came in the utilities category. And a March report from the Ely Times noted that 66 wind turbines had begun to arrive at the Spring Valley Wind power plant under construction 30 miles east of Ely.

White Pine County is also home to the power substation that will connect NV Energy's One Nevada transmission line (ON Line) to the utility's Harry Allen plant in Apex, 20 miles north of Las Vegas.

Elko County also saw a noticeable sales jump. Sales there rose to

$132.3 million, up 16.4 percent from $113.6 million, driven mostly by an uptick in sales among merchant wholesalers of durable goods, or big-ticket items designed to last three years or more.

In Clark County, dealers of cars and car parts led the way in growth among major sales categories. Car dealers, which made up nearly 11 percent of taxable sales here, saw sales jump 17.1 percent year over year in March, to nearly $300 million. Clothing and accessories stores, which equaled almost 10 percent of all sales, posted a 6.9 percent gain, to $271 million. The biggest local spending category, bars and restaurants, saw flat sales, with an increase of 0.2 percent, to $752 million. Bars and restaurants made up

27 percent of all March spending in the county.

Local construction spending continued its slide, falling to $35 million. That was down 31.6 percent from

$51.1 million in March 2011. Construction accounted for just 1.3 percent of total spending in Clark County in March, down from nearly 10 percent at the peak.

March sales in Clark County peaked at $3.34 billion in 2007. So sales were

16.5 percent below their high for the month.

Still, Gordon and Brown agreed that Clark County's taxable sales, at least, are no longer in recession. Barring April 2011, taxable sales have risen every month in the last 17 months.

"Clearly, we've moved beyond the floor in terms of taxable-spending volumes," Gordon said. "Part of that is the result of pent-up demand or recession fatigue. At the same time, many consumers feel much more comfortable with their personal financial situation as the employment base in a number of sectors stabilizes."

Added Brown: "Absolutely, we're growing. We've seen a bumpy upward trend in taxable sales since early 2010. The last 20 months, we've seen favorable trends, with some months more favorable than others. Right now, I would say March might be a one-month blip."

Gross revenue collections from sales and use taxes, which help fund prisons and schools, were nearly

$300 million in the month. That's a 4 percent increase year over year and a 6.6 percent increase through the first nine months of fiscal 2012.

Contact reporter Jennifer Robison at

jrobison@reviewjournal.com or 702-380-4512.