Vacant land prices tumble

Vacant land prices have tumbled to a six-year low in Las Vegas and are likely to stay there as the recession lingers into 2010, a local real estate analyst said.

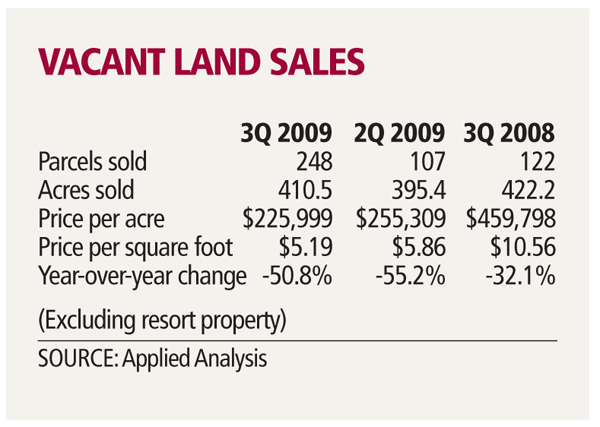

The average price for raw land in the third quarter was $225,999 an acre, down 50.8 percent from $459,798 an acre in the same quarter a year ago and a steep drop from the peak of more than $900,000 an acre in fourth quarter of 2007, reported Applied Analysis, a Las Vegas business advisory firm.

Land values will remain depressed as long as the commercial sector continues to post high vacancy rates, foreclosures persist in the housing market and access to credit remains tight, Applied Analysis principal Brian Gordon said.

That doesn't mean investors will let an opportunity pass them by, Gordon said. With nearly 90 percent of land transactions involving a lender through trustee sale or deed in lieu of foreclosure, pockets of opportunity may emerge as both buyers and sellers reset their pricing expectations, he said.

"The fundamentals of the market will ultimately dictate pricing," Gordon said Tuesday. "The exit strategy on land acquisition impacts the price people are willing to pay. Property acquired with the intent to develop and lease up ... that (time period) can span several years and that carrying cost factors in."

FedEx Corp. found value in the southwest Las Vegas Valley, paying $4.85 million, or $519,317 an acre, for a 9.3-acre parcel at 7000 W. Post Road, near Rainbow Boulevard. That's more than twice the market average.

Gordon said many owner-users need to have a specific building in a certain area. Companies such as Pepsi, Freeman Cos., International Game Technology and Creel Printing all bought land in the southwest valley, which is relatively undeveloped and offers easy access to the Strip and McCarran International Airport.

Grubb & Ellis research analyst Dave Dworkin said many lenders have been forced to foreclose on property that was purchased at an inflated price, mostly from 2004 to 2006.

"Banks are the new land sellers," Dworkin said. "2010 will be the year of opportunity for buyers to strike deals with banks for attractive pricing."

It will be difficult to assess true land value going forward because recent appraisals were based on atypical deals, foreclosures or seller financing, he said.

Jerry Ritchie, senior vice president of Wells Fargo, said Las Vegas benefited from nearly two decades of tremendous growth, leading to a run-up in prices. Wells Fargo is considering foreclosures case by case, he said.

"We're really trying to work with borrowers on the front end to restructure and modify their loan," Ritchie said. "Our first objective is to find a plan. There are situations where it's best to dispose of the asset. I don't like to predict the future, but we're not out of the woods with unemployment where it is. We've got to see better economic improvement across the United States before we see it in Las Vegas."

Dworkin expects commercial land pricing to follow the residential trend that began in late 2006. Two years ago, finished residential lots could be had for less than the cost of development. Toward the end of this year, those transactions are closing at a price that exceeds development cost.

"In other words, residential land regained positive value after only a few years," Dworkin said.

The rate of decline in vacant land pricing has slowed since the beginning of the year as traditional arm-length transactions represented only 9.8 percent of total sales in the third quarter, Applied Analysis reported. Values have remained relatively stable for the past three quarters.

Including resort property, land prices increased to $264,040 an acre in the third quarter from $255,309 in the previous quarter. The 5.2-acre site of the former Klondike Inn was sold for $17 million in a trustee sale during the quarter.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.