Official: Sighs of relief that state insurance marketplace works

Everybody can exhale now.

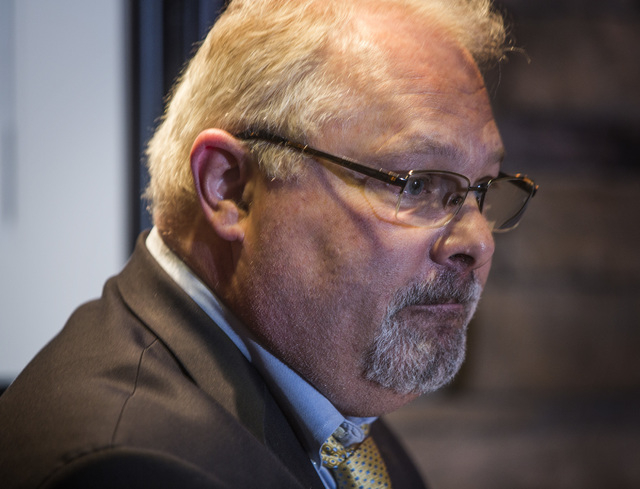

If Nevada Health Link officials, insurance brokers and consumers “went into open enrollment holding their collective breath,” then today, there are sighs of relief that the state’s insurance marketplace works, said its executive director, Bruce Gilbert.

The federal Department of Health and Human Services said Tuesday that 73,596 Nevadans had enrolled in a 2015 plan through the exchange between Nov. 15 and Feb. 22. That was more than double the 36,000 enrollees the exchange had in the first session from Oct. 1, 2014, through May 30.

Now, the exchange is at a “tipping point,” Gilbert said. Open enrollment proved the marketplace is “conceptually viable.” But it needs improvements.

“We got there. We made it. It worked,” said Gilbert, speaking Tuesday at a Clark County Association of Health Underwriters’ luncheon. “Thank you for suspending disbelief, and for working hard to insure people. We’ve done great work together, and there’s more to do. We need to make changes to better serve our partners — in this case, brokers and consumers.”

Exchange officials don’t have a concrete list of improvements because open enrollment ended less than a month ago and they’re still in their “post-mortem phase,” Gilbert said. But one area the exchange is eyeing would involve more selective targeting of specific demographic groups.

Gilbert said he didn’t have an enrollment target for the next session in October, calling “numerical goals the bane of my existence.”

Exchange officials may look at an enrollment “sweet spot,” he said, adding that one report pegged the potential total market for Nevada Health Link at 93,000.

“If I accept that number, and then we see that we have 73,000 of our 93,000 potential customers, who wouldn’t love that market share?” he said.

Based on current enrollment, the exchange can stand on its own financially when federal grants end in December, Gilbert said. After 2015, exchange funding will come from a per-member, per-month fee — now $13 — that insurers pay.

Nor is a case before the U.S. Supreme Court a threat to Nevada Health Link, Gilbert said. The case, involving tax credits for exchange buyers, won’t apply to Nevada even though it uses the federal healthcare.gov system. Nevada Health Link is still a state-run marketplace because the state manages and certifies plans and uses state funding for marketing and navigators.

That hybrid system is getting interest as the Supreme Court weighs its decision. Thirty-six states have federally run exchanges, and officials from 23 of those states are set to discuss the Nevada model at an April industry meeting, Gilbert said.

Of a bill draft resolution from Assemblyman Brent Jones, R-Las Vegas, to kill the exchange, Gilbert said it’s not a discussion for Carson City.

“The debate about whether exchanges are good or bad belongs in Washington, where the (Affordable Care Act) was passed and can be amended,” he said.

Also on Tuesday, the exchange announced a special enrollment period for Nevadans who owe a tax for lacking 2014 coverage. The enrollment period begins Sunday and runs through April 30, and is for consumers “who were unaware or didn’t understand the implications of the fee for not enrolling in coverage,” the exchange said in a statement.

Contact Jennifer Robison at jrobison@reviewjournal.com. Find her on Twitter: @J_Robison1.