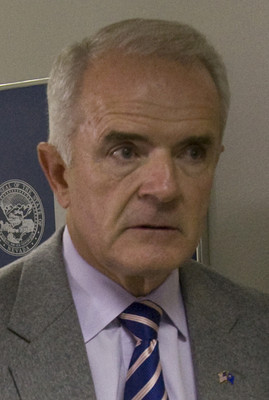

Gibbons didn’t pressure assessor

CARSON CITY -- There is no evidence that Gov. Jim Gibbons pressured an Elko County assessor into giving him an unwarranted tax break on ranch land he purchased near Lamoille, a state Ethics Commission investigator said Wednesday.

Investigator Mike Vavra, who interviewed Gibbons, retiring Assessor Joe Aguirre and others, said the evidence does not support allegations that Gibbons and his lawyer, John E. Marvel, pressured Aguirre into reducing his property taxes on 40 acres of rangeland to $39.71 from what Vavra said was a possible $1,893.

Previous reports put the higher figure at close to $5,000.

Vavra's findings are crucial since they will be reviewed during a 9 a.m. Sept. 11 hearing when Ethics Commission members Tim Cashman and Erik Beyer decide whether there is sufficient evidence to find that Gibbons pressured Aguirre to give him an agricultural use assessment on his Lamoille land.

If they do, the case will go before the full Ethics Commission where Gibbons could be charged with breaking state ethics laws.

State Democratic Party Executive Director Travis Brock filed complaints against Gibbons and Marvel after The Associated Press in July quoted Aguirre as stating he felt uncomfortable and pressured by the governor and Marvel into giving Gibbons a tax break.

But Vavra, in a report released by the Ethics Commission, said that was not the case and in his opinion Gibbons qualified for the lower tax.

Agricultural land is assessed at lower rates than other property as long as it can be shown that the land produced $5,000 in revenue.

"Like any other citizen, Gibbons has a right to apply and receive an agricultural use assessment if his land qualifies," Vavra wrote.

Gibbons' press secretary Ben Kieckhefer said Vavra's findings make it clear that the governor never did anything inappropriate.

"This was a political move by the Democratic Party and nothing more," Kieckhefer said.

"It is a shame the Democrats are focusing on frivolities and have offered nothing to solve the worst fiscal crisis in the history of the state."

Brock could not be reached for comment.

Gibbons bought the land for $575,000 in August 2007 from former Washoe County District Judge Jerry Carr Whitehead.

Gibbons' 40 acres is part of a larger cattle ranch owned by Whitehead.

Since he is not using the land now, Gibbons leased it back to Whitehead so he could continue to graze his cattle on the unfenced property.

Gibbons said he wants to build a home on the property and retire there.

In his report, Vavra said Gibbons' land does not have to earn any income, since it still is being used as part of Whitehead's ranch and that ranch produces more than $5,000 in annual income.

Nonetheless, according to the Elko County assessor's own calculations, Vavra said, Gibbons' property alone would receive $6,444 to $8,524 a year in agriculture income.

He said Aguirre never asked Gibbons for a copy of his lease with Whitehead, nor did he take steps to confirm that Gibbons actually had cashed two checks totaling $5,777 that he received from Whitehead under their lease.

Those checks were cashed by Gibbons on Aug. 29, 2007, and $4,227 on Jan. 24, he added.

Aguirre told Vavra during an Aug. 21 interview that Gibbons did not pressure him when he inquired about the agricultural use classification on Sept. 1, 2007

"There was no pressure," Aguirre said in transcripts released by the Ethics Commission. "I mean I have respect for the man. ... He didn't do anything that would (have) put pressure on me."

But Aguirre said he later felt uncomfortable when Gibbons hired Marvel to handle the tax matter.

Marvel also serves on the state Tax Commission, and Aguirre said Elko County lost a $65,000 case before the commission, which handles appeals of county assessors' tax decisions throughout the state.

Aguirre said he always has had trouble getting Marvel to produce records he needs to determine whether people qualify for the agriculture classification.

Marvel still has not produced land lease records in Gibbons' case, Aguirre said.

Gibbons, however, told Vavra that he did not know Marvel served on the tax panel when he hired him as his lawyer.

Contact Capital Bureau Chief Ed Vogel at evogel@reviewjournal.com or 775- 687-3901.