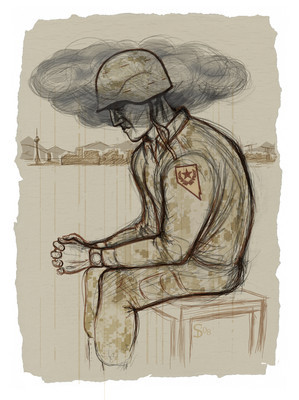

Now veteran fights to find work in a tough economy

Gregory Kamm of Las Vegas did close combat on the streets of Fallujah, Iraq, in 2004. He didn't think he'd have to fight just as hard to find a job in Las Vegas in 2008, after completing earlier this year his third deployment.

Kamm, 25, is one of many veterans back from Iraq or Afghanistan struggling to reintegrate into the recession-wracked civilian workplace.

Kamm, wife Corinne, and 1-year-old son Skyler have two special applications pending, beyond the numerous job apps. One is for a food allotment through the federal Women Infants Children program, the other for food stamps.

As of mid-December, the Kamms were dangerously behind on the rent for their tiny North Las Vegas apartment. They risked eviction until a local church provided financial aid.

The Kamms are behind on their car payment, too. So the dealership that granted the loan has electronically "locked" the vehicle until the Kamms pay up. Gregory Kamm takes the bus to file job applications and attend job interviews. Corinne is also looking for work.

"The economy is bad in Las Vegas. We're all tourist-related," Gregory Kamm acknowledges.

Kamm has almost eight years of honorable service in military security, as an active-duty Marine and then as Army Reservist. He returned in April from Iraq, this time with the Army Reserves 314th Combat Sustainment Support Battalion.

Before deploying with the reserves, he had notified his civilian employer, a casino that caters to locals, of his departure. Federal law requires employers to take back workers after they serve in the military, if properly notified.

Kamm did get rehired into the casino's security department -- which fulfilled the letter of the federal law. But other job conditions had drastically changed.

According to Kamm, during the four months he worked at the casino this time around, the new security chief was ineffectual and abusive. The veteran also felt the casino was jeopardizing public safety by running short security crews during graveyard shifts in order to save money.

How safe is it, Kamm asks, for two guards to attempt "to handle 512 intoxicated adults that don't speak English?" He is referring to a popular weekly event marketed to Hispanics, held in a space rated to hold 512 occupants.

Kamm didn't only think about his concerns. To express them in person, he says he went to the property's human resources office twice, and once to the casino's offsite corporate headquarters.

Kamm quit abruptly Oct. 27, after a supervisor told the soldier that he, with three years cumulative on the payroll, was outranked by a newer hire with less experience. Kamm figured that if he didn't find work right away, unemployment pay would kick in. He believed he had quit for "just cause."

Turns out, casino reps later told the state unemployment insurance division they had no record of Kamm contacting human resources to complain about his work conditions.

Unfortunately, Kamm created no paper trail to prove otherwise, so the state found him ineligible for unemployment benefits. He says he wouldn't have quit without a new job lined up, if he had understood that in Nevada, his status as a recently returned veteran did not guarantee him unemployment pay.

To make matters worse, Kamm says the temporary military pay he got this autumn, for attending a mandatory two-week leadership training after he made sergeant, is now counting against his family in the food-stamp application process.

To date, the soldier estimates he has applied for a job at every Strip hotel's security department, at multiple security companies and at businesses outside his expertise, including a cabinetry company in Henderson, which would also require a lengthy bus commute.

Kamm's job struggle is not isolated. Other local veterans who served in Iraq or Afghanistan also are reporting job snags. Some can't find work at all; others find the prior job or employer has altered in ways that put the veteran at a disadvantage.

Pfc. Nicole Cranor of the Nevada Army National Guard's 72nd Military Company got back from Iraq in September. As of late November she had not located permanent work. She has a suspicion, but no proof, that companies don't want to hire a young, relatively inexperienced Guardswoman who may have to re-deploy. But federal law only addresses returning employees; it doesn't prevent a prospective employer from holding a job candidate's continuing military obligation against him or her.

Veterans who return to Nevada can apply for unemployment benefits, says Lynn Baird, a spokesman from the state's Southern Nevada unemployment claims office.

"Just because you've worn the proud flag of America on your sleeve, it doesn't make it harder, or less hard," to qualify for benefits, he says.

Completing a tour of active duty -- 90 days or more -- for the Guard or Reserves is equivalent to being laid off, in the eyes of Nevada unemployment officials.

Many returning veterans qualify for unemployment if they don't find jobs, Baird says. But not all veterans do, because the receipt of Nevada benefits is based on the applicant's work history up to 18 months prior. A veteran who deployed for only a short time, but did not work at all in the civilian period preceding deployment -- perhaps because he or she was a student -- may not have accumulated past earnings to be eligible for unemployment.

A returning soldier who lands a job and then quits, as Kamm did, is a different story, according to Baird, who did not comment on Kamm's case.

Self-employed soldiers face unique challenges when they reenter the civilian workplace. At least one soldier with the 314th lost his livelihood, according to 1st Sgt. Wesley Deegan, who is in the same division. The soldier owned a small landscaping outfit that was doing fine when he went overseas in April 2007. By the time he returned in April 2008, it was out of business. The economy had soured during his absence, and he could not shore up the company from long distance.

Thomas Grande, 32, found his job in maintenance at the Forum Shops secure, at the same pay, when he returned in September from duty in Iraq with the Nevada Army National Guard 72nd Military Police Company. But the job description was entirely new.

Before deploying, Grande had coordinated tenant improvements at the mall, which is attached to Caesars Palace. He enjoyed the challenging work, which involved "lots of (safety) rules and regulations they have to follow." While Grande was overseas, those duties were absorbed into a different level of management. So he is supervising a group of employees who maintain the heating and cooling systems.

At first Grande was bummed. "I lost my (work) cell phone. I lost my (work) e-mail." But he has since come to terms with the change: "No. 1, I'm home alive. No. 2, I have a job. With the economy as bad as it is, I'm just glad I have a job."

Sharon Dixon, 50, returned from deployment to Iraq in late 2003, well before the present economic downturn. She returned to the same large employer, the public utility now known as NV Energy.

Before going to Iraq, she had supervised employees who took customer cash. While serving with the 72nd Military Police Company, she was injured in an IED explosion. When she got back, she found herself uncomfortably startled at the end of the shift, whenever employees dropped a heavy cash drawer at her work station.

Eventually, Dixon transferred to her present position as an executive assistant, in which she no longer deals with cash drawers. But with memory and concentration problems that have developed since she served, Dixon finds herself stretched learning the new computer software programs required for the position.

Empathy of co-workers and supervisors toward the side issues that veterans face is finite. Bottom line, the private sector wants employees to perform, according to Dixon.

"Still today, I'll sit and the tears will come," she says of her frustration at her slowed pace of computer learning. "But I jump back in the game."

Contact reporter Joan Whitely at jwhitely@reviewjournal.com or 702-383-0268.

ON THE WEB Online interactive SURVEY: VETERANS FACE JOB CHALLENGESBy FRANK GEARY LAS VEGAS REVIEW-JOURNALA major survey of veterans discharged between late 2004 and early 2006 found that 18 percent of “recently separated service members” were unemployed. It also found that 25 percent of the veterans with a job earned less than $21,840 annually. Abt Associates did the “Employment Histories Report” for the Department of Veterans Affairs in 2007, so its data does not capture employment patterns set in motion by the economic meltdown of 2008. The report looked at 1,941 veterans in the 2004-2006 time frame. The Abt report has been helpful but preliminary, said Laura O’Shea, director of the Policy Analysis Service of the federal agency. A follow-up survey presently under way will provide more information. Unemployment is a problem for veterans, especially within two years of separation from the military, according to a section of the Abt report that looked at a larger group of veterans discharged since 1990. Between 1991 and 2003, the average annual unemployment rate for veterans separated from the military for less than two years was 9.5 percent — or more than double the 4.3 percent for nonveterans of the same age, sex, race, education level, marital status and region of the county. Eight years after separating, former service people had an unemployment rate of 4.4 percent compared to 2.5 percent for similar nonveterans. Returned veterans also earned less than nonveteran counterparts, and the difference was more pronounced among more educated people. Returned service people with an advanced college degree received an average of $7,573 less than nonveterans. Laura O’Shea, director of the Policy Analysis Service for the Department of Veterans Affairs, said some the follow-up survey might put certain data, such as earnings differences, into better context. “What is being displayed, for a veteran that has been out two to three years ... mirrors the transition that all people go through when they transition to a new career,” she said. “And, that is what I think we will learn during the second wave of the survey.” Over time, the study found that the overall income of a veteran is comparable to that of a non-veteran, once the entitlements that veterans receive — such as compensation for injuries suffered during their service — are factored in.Contact reporter Frank Geary at fgeary@reviewjournal.com or 702-383-0277.