Roads rated a priority

The last time federal and state fuel taxes were increased, Bill Clinton was president and Rollie Massimino coached the UNLV Rebels basketball team.

That was 1993.

Although many Nevada voters lean toward keeping it that way, a majority say they would raise fuel taxes, either just enough to improve local roads or to expand them.

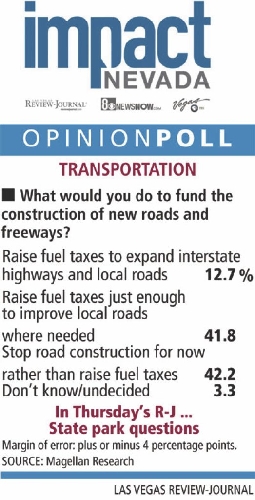

According to the new Impact Nevada poll of 600 likely voters, 42.2 percent favored halting road construction altogether rather than increasing fuel taxes, but 41.8 percent favored raising taxes just enough to improve local roads where needed, and 12.7 percent would raise them enough to expand interstate highways and local roads.

The poll, commissioned by the Review-Journal, 8NewsNow and Vegas PBS, has a margin of error of 4 percentage points.

Those polled were separated into numerous categories including income brackets, party affiliation, ethnicity and the county in which they reside.

Constituents who would prefer that construction stop were largely Republicans. Washoe County residents were far more favorable to raising taxes just to the necessary level than Clark County voters.

And more women than men -- 47 to 37 percent -- say they would rather see construction stop than pay additional taxes.

Marvin Longabaugh, president of Magellan Research, believes the gender split might be caused in part by older couples typically owning one vehicle and the man doing most of the driving. Also, women are more interested in social services, education and health.

"There might be a tendency for women to say that roads are less important than some of the female-oriented questions like schools," he said.

Longabaugh also noted that the transportation questions were at the end of the lengthy poll. In response to previous questions, most voters opted for a middle-of-the-road solution such as raising taxes just to the necessary levels. Historically, two services that voters consistently backed were law enforcement and transportation.

"These questions were the last questions asked. By this time, people might be saying, 'Oh my God, I don't know how we're going to pay for all this stuff.' It might be poll weariness at this point," Longabaugh said. "It also might be people thinking we're not growing anymore so why are we building more roads?"

The results came as a surprise to Susan Martinovich, director of the Nevada Department of Transportation. Martinovich said polls performed by transportation agencies indicated otherwise.

"Previous polls showed people get frustrated with congestion and frustrated with backups," she said. "It seems like an inconsistency. This reverses what has been expressed."

Martinovich suspected that some of the responses might be caused by frustrations over the number of road projects throughout the Las Vegas Valley.

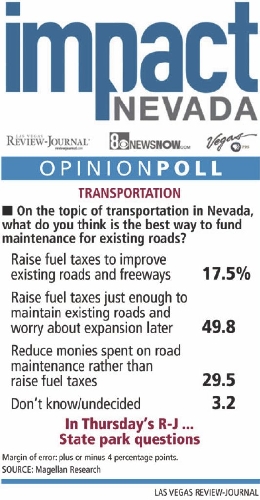

Almost half those polled said they approved raising fuel taxes just enough to maintain existing roads, compared with about 30 percent who would support reducing the amount of funding designated for maintenance.

Those figures seem to support the maintenance programs already used by state transportation officials. Martinovich said her department is proactive when it comes to maintaining roads because if they are ignored too long, the problems only worsen and the price tag to fix them skyrockets.

Bumpy pavement, such as portions of Interstate 15, not only cause traffic flow problems but also damage motorists' vehicles.

"Having a smooth road and using it is like going to your faucet and turning on your water; it's there," Martinovich said. "You don't appreciate that luxury until it's not there."

For the most part, Nevadans are spoiled because the roadway system is newer compared to older cities in the country, Martinovich said.

The Department of Transportation has not proposed raising fuel taxes, Martinovich said, but identifying a new source of funding is becoming increasingly vital.

When motorists fill up, they pay -- for each gallon -- about 18 cents in federal taxes, 18 cents in state taxes, 6 cents in county taxes plus up to 9 cents more in an optional tax implemented by the county. That tax revenue lands in the highway fund and is used to improve the state's network of roadways and maintain the existing ones.

Tax revenue has decreased with the popularity of hybrid and more fuel efficient vehicles.

Transportation experts have struggled with how to deal with the new vehicles that don't contribute as much in taxes but still cause congestion and the wear and tear of roadways.

Earlier this year, the Department of Transportation floated the idea of a Vehicle Miles Traveled program, which would attach a fee for each mile driven. If the entire nation hopped on board, the fee eventually would replace fuel taxes. Martinovich said her department is still studying the idea and soon might introduce pilot vehicles to test it.

Another proposal is adjusting the taxes based on the price of gasoline. More revenue could be generated if the taxes fluctuated, rather than remain a steady 18 cents no matter if a gallon of gas costs $2 or $4.

Washoe County adopted a fluctuating tax structure during the last legislative session. Washoe County was the only county to ask for the policy change.

The state must continue to fund roadway projects with or without a fuel tax revenue. If it doesn't, it risks losing federal funding. Nevada must supply a 5 percent match to federal monies provided. State money is used to buy guard rails, paving, sealing, striping and signage while the federal funds are dedicated to longer term capital projects, Martinovich said.

If Clark County can't match the federal funds, Regional Transportation Commission General Manager Jacob Snow said, the money would be diverted to Washoe County, which can provide a match because of the revenue generated from the fluctuating tax.

"That is a significant issue," he said. "We would not have the matching dollars to get our fair share."

Maintaining and expanding roads is crucial to Nevada's ability to bounce back from the recession, Snow said. Road projects, whether they are large or small, help employ construction workers who have been hardest hit by the economy.

"If we don't continue to build the roads and keep up infrastructure, we risk Las Vegas and the state ever coming back economically," Snow said, adding that the state will never attract new companies and industries with deteriorating roads.

Snow said he was pleased yet surprised that there was support for an increase in fuel taxes.

Sen. Mike Schneider, D-Las Vegas, who during the last legislative session served as chairman of the Energy, Infrastructure and Transportation Committee, doesn't believe the poll helps guide lawmakers because voters were not informed that fuel taxes haven't been raised in nearly two decades or that there is a $7 billion shortfall in the transportation fund.

"If you start putting all that in there and let people think about it, you'll get different answers," Schneider said.

Schneider reiterated that hybrid vehicles, while environmentally friendly, are hurting the state's transportation coffers. And it will only get worse when electric vehicles such as the Nissan LEAF are released, he said.

"I understand where people are coming from on all their answers," he said. "It's tough right now; people are saying, 'Let's cut back, let's suck it up right now.' But cars are getting better mileage all the time so we're falling further behind."

Schneider is no proponent of toll roads, which are operated by private companies who charge motorists enough to make huge profits. He believes the state should bump up fuel taxes and also phase in the Vehicle Miles Traveled program. He said the state should also look at methods in which to tax tractor-trailer drivers.

He noted that expansive segments of highways linking northern and southern Nevada are in portions of the state with no communities, which means tax revenue generated in Las Vegas, Carson City and Reno must go toward repairing and maintaining those roads.

"The 18-wheelers cut through the roads in the state of Nevada, but they don't gas up here," Schneider said. "We need to go after them. We have been a tax shelter place for everybody in the world."

Contact reporter Adrienne Packer at apacker@review

journal.com or 702-387-2904.

News, poll results

COMING STORIES

Thursday: Parks

Friday: Education

Saturday: Law enforcement

Sunday: Respondents' final word