Barney Frank, salary czar

In a free market, we're so familiar with how prices are set -- how manufacturers decide how much of a thing to make and what they can afford to pay for labor and raw materials -- that we rarely even think about it.

Set salaries too high and charge too little for the product, go bankrupt. Pay too little, your unskilled workers can't do the job.

Yuri Maltsev, a former Soviet economic planner, reminds us the Communists had no such "consumer feedback loop." Trying to figure out what their national production quota should be for ice cream, they simply snitched the production figures for France, then corrected for the population difference between the two nations.

But the Soviets forgot that the French had a well-developed network of freezer trucks and trains to deliver their ice cream to the four points of the compass, year-round. The Soviets did not. Come summertime, Siberia and Tajikistan got no ice cream, while the capital was left swimming in more vanilla than Muscovites could consume. Meantime, other would-be users of milk and sugar ran dry. No one had been able to recognize the tell-tale jump in milk and sugar prices that predicted an upcoming shortage, because prices weren't allowed to go up during the government-caused shortage.

Now, incredibly, the people in charge in Washington want to abandon the free-market system that made America the most efficient and prosperous nation in the world, instead allowing office-bound bureaucrats with none of their own capital at stake, to decide how much things should cost ("New cars? $4,500 off!") and how much everyone should be paid.

Nearly two weeks ago, "The House of Representatives, acting in a near frenzy after the disclosure of bonuses paid to executives of AIG, passed a bill that would impose a 90 percent retroactive tax on those bonuses," reports Byron York of the Washington Examiner.

Despite the overwhelming 328-93 vote, support for the measure began to collapse almost immediately. Within days, the Obama White House backed away, as did the Senate Democratic leadership. The bill stalled.

But now, in a little-noticed move, the House Financial Services Committee, led by Chairman Barney Frank, has approved a measure that would, in key ways, go beyond the most Draconian features of the original AIG bill. The new legislation, the "Pay for Performance Act of 2009," would impose government controls on the pay of all employees -- not just top executives -- of companies that have received a capital investment from the government.

The bill gives Treasury Secretary Tim Geithner the authority to decide what pay is "unreasonable" or "excessive."

The bill passed the Financial Services Committee last week, 38-22, on a nearly party-line vote.

Would you voluntarily work under such a scheme?

Even if we luck out and this precedent never goes beyond the financial firms now targeted, how on earth can Barney Frank know better than the stockholders of a bank how much they need to pay for a competent staff? If these firms end up being run by discount second-stringers who drive them into the ground, does Rep. Frank think he can sell his Washington party condo and raise enough money to make the private investors whole out of his own pocket? Would he even try? Of course not.

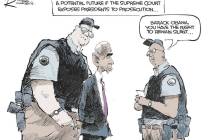

Do Barney Frank, sitting in his office on Capitol Hill, and even Timothy Geithner, sitting across the street from the White House, have the information necessary to overrule the stockholders and boards of directors of many of the biggest private outfits in America, telling them how much each employee should be paid? Or do these goofballs more closely resemble the stern but clueless former commissars of Moscow, pretending to be able to foresee how much ice cream should be manufactured for the entire nation of Russia?

And if this bunch is as wrong as that last bunch, who's going to end up swimming in the soup?