Doing business ‘a privilege’?

Everybody else has one, so Nevada needs one, too -- a corporate income tax, that is.

That's what lawmakers on the Assembly Taxation Committee heard in Carson City this week. The bill's backers gleefully pointed out Nevada is one of only four states that has no corporate income tax.

Assembly Bill 336, being pushed by prolific tax pusher Assemblywoman Peggy Pierce, D-Las Vegas, would extract a 4.5 percent income tax from businesses earning more than $500,000 a year. The Review-Journal account of the meeting by Capital Bureau chief Ed Vogel said backers of the bill claimed the tax would grab $1.2 billion in the next biennium from the cash registers of private businesses for the state's government coffers.

Craig Stevens of the Nevada State Education Association, which commissioned the analysis of the revenue that would be produced by the corporate tax, revealed the mind-set of those demanding more taxes.

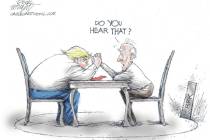

"Doing business in Nevada is considered a privilege," Mr. Stevens testified. Really? "In order to make money off the hard-earned dollars of the workers of our state, that should come with a price."

Mr. Stevens again: "This tax is simply reinvesting in your state, which has enabled you a life of great wealth and prosperity, should you get the honor to pay it."

Bob Fulkerson, president of the tax-championing Progressive Leadership Alliance of Nevada, testified jeans cost $2 more at a Reno Wal-Mart than at a Wal-Mart in Idaho, where the company must pay corporate income taxes. He seemed to be saying that the tax will not be passed on to Nevada consumers in the form of higher prices.

Assemblywoman Teresa Benitez-Thompson, D-Reno, who backed AB336, noted most states have a higher corporate income tax than the 4.5 percent proposed.

"The sky isn't falling in Utah," Ms. Benitez-Thompson said. "I want to know how the sky's going to fall in Nevada when this rate is lower than other states."

Well, Nevada has a payroll tax, a rather high sales tax rate, substantial property taxes, a tax on insurance premiums, a real estate transfer tax, gaming tax, mining tax, vehicle registration tax, tobacco tax, liquor tax, entertainment tax, etc.

In fact, when you take just Nevada's state taxes per capita, based on 2010 Census data, the state ranks 28th highest in the nation. Meanwhile, even with their corporate skims, Idaho ranks 38th and Utah is 39th. If a corporate income tax were piled on top of Nevada's other taxes, the state would climb to 19th highest in the nation for state taxation per capita.

In addition to the facile arguments, Carole Vilardo, president of the Nevada Taxpayers Association, pointed out that many aspects of the bill are unworkable, self-contradictory and likely unconstitutional, especially a section that says businesses may not challenge their tax bills.

Ms. Vilardo also noted there was no indication in the bill whether the Legislature intends to keep the current payroll tax on businesses.

Some will not rest until Nevada is No. 1 in something.