EDITORIAL: You can’t tax Nevada into prosperity

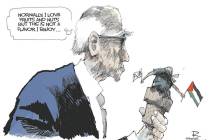

There are a great many flawed and fantastical arguments in favor of Question 3, but none more outrageous than the idea that Nevada can create more jobs and a stronger economy by enacting the biggest tax increase in state history.

Question 3 was placed on this fall’s ballot by the state teachers union through the initiative process. If passed, it would impose a 2 percent margins tax on companies that collect more than $1 million per year in revenue. Not profits, mind you, but revenue. Studies estimate the tax would subtract nearly $800 million per year from the top line of the state’s largest employers, the equivalent of imposing a nearly 15 percent corporate income tax rate on their bottom line. Passage of Question 3 would cost thousands of workers their jobs and immediately give Nevada one of the worst business climates and highest business tax burdens in the country.

However, supporters of Question 3 argue that this economic damage would be more than offset by spending new tax dollars on the state’s K-12 education system. They commissioned a study by UNLV’s Center for Economic and Business Research, which determined the tax would have a net positive effect on Nevada’s economy through the hiring of thousands of teachers and giving current teachers pay raises.

Economic growth through tax hikes? If a 2 percent margins tax is so great for Nevada, why didn’t the teachers union make the rate 4 percent? Or 10 percent? Heck, if a tax increase would boost spending and hiring, why isn’t the governor calling the Legislature into special session right now to raise every levy in the state?

The study, which is touted in advertising in support of Question 3, was such a joke that UNLV had to pull it back shortly after its release to tone down its pie-in-the-sky conclusions. But even upon its re-release, it’s deeply flawed. Tax increases cause economic harm. And a margins tax would be especially bad because of its massive removal of capital from the private sector. These are the dollars that allow businesses to buy new equipment, expand operations, create new positions and provide employees with pay raises. These are the dollars that sometimes require many years to deliver a return. If businesses can’t invest in themselves, they can’t grow and they can’t compete.

Might stripping enough revenue from a business to hire a single teacher provide a boost to the economy through that teacher’s spending? Certainly. But if that revenue is the difference between a business remaining profitable and having to close its doors, if that revenue would have helped a small business open a second or third operation four years down the road, the long-term effect on the economy is unquestionably negative.

And remember, because the margins tax hits business revenue, not profits, even money-losing companies would be stuck with a sizable tax bill.

When a government budget expands at the expense of the private economy, neither is sustainable.

And if you think businesses alone will cover Question 3’s burdens, guess again. Question 3 would hit utility companies, health care providers, retailers and insurance companies. Every Nevadan’s wallet will feel the pain of Question 3 — with no guarantee that increased spending will make Nevada’s schools any better.

Vote no on Question 3.

ENDORSEMENTS

For a list of all candidates endorsed by the Las Vegas Review-Journal so far this election season, click here.

See our online voter guide for candidate profiles and more