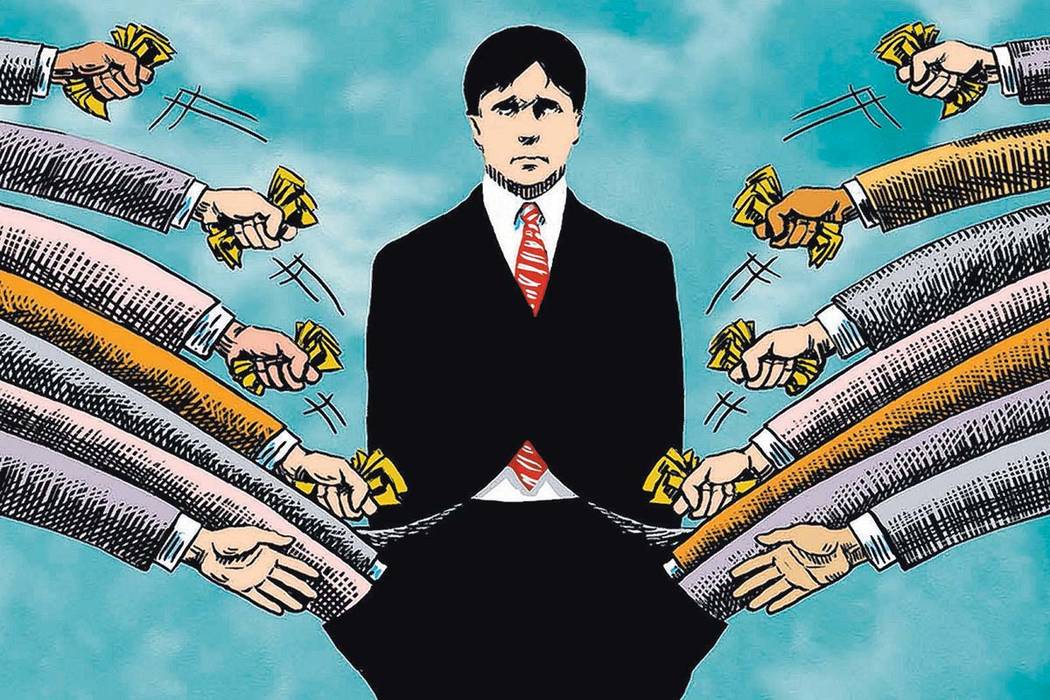

Tax hikes push millionaires from California

Want to drive millionaires away from sandy beaches, beautiful weather and one of the world’s biggest economies? Try raising their taxes.

That’s the tentative finding of a new working paper from Stanford University’s Center on Poverty and Inequality. Researchers Charles Varner, Cristobal Young and Allen Prohofsky looked at how California’s top earners reacted to the 2012 imposition of a “millionaire tax” by ballot initiative.

Under Proposition 30, the tax rate paid by millionaires jumped from 10.3 percent to 13.3 percent. The original plan was for the tax to sunset in 2019, but since temporary tax increases exist only in fairy tales, voters in 2016 extended the tax to 2030.

After the 2012 tax hike passed, the authors found a “statistically significant effect” in the number of millionaires leaving California, although it was not a mass exodus. The researchers had previously found that California’s 2004 imposition of a 1 percentage point tax hike on millionaires hadn’t led to an exodus of top earners.

Digging further into those numbers reveals some important nuances in the debate. For instance, if you earned $1 million this year, there’s a good chance you didn’t earn that much last year and won’t earn $1 million next year either.

“But in general and for most people, earning a million dollars a year is a temporary situation,” the authors write. “It is more of a spike in earnings than their usual, year-to-year income. For most people, the (millionaire) tax falls on a few unusually good years of earnings. This helps explain why we see so little responsiveness to the tax.”

Remember this the next time you hear a politician talk about the “1 percent” or act as if the rich are a stagnant group that controls the country. A dynamic economy means many people move up and down the income ladder, some temporarily becoming part of the “1 percent,” others dropping out.

This is why it will be interesting to see the impact of the 2017 tax reform bill. Democrats strongly objected to limiting the state and local tax deduction to $10,000 per year. By allowing millionaires in California to write off their state income tax payments, federal taxpayers previously provided them a de facto subsidy, which blunted some of the increase. There are anecdotal stories about millionaires looking to move from high-tax states, but it will take time to collect data on the matter.

The researchers caution that their findings at this point are preliminary and subject to revision. But the Stanford study’s tentative results show what should be obvious. Just ask officials in Illinois and Connecticut. Taxes may not be the sole reason residents flee, but higher levies can be a deterrent to retaining high-income earners — even for sunny California.