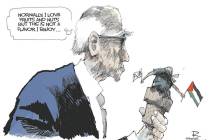

Housing shakedown

The 1977 Community Reinvestment Act, enacted under President Jimmy Carter, was intended to end "redlining," a practice in which banks supposedly ruled off many inner-city neighborhoods on their maps, refusing to issue mortgages within their boundaries.

The immediate result was that -- to please regulators who have the power to shut down private banks -- bankers started reducing their financial standards, issuing loans to low-income or low-net-worth customers who might not previously have qualified.

These lowered standards led, in part, to the housing market meltdown.

But the Community Reinvestment Act did something a lot more troubling than that. It allowed third parties to challenge bank mergers, expansions or ownership changes by claiming the banks had not done enough to promote loans to inner-city residents.

A decade ago, Sen. Phil Gramm of Texas unsuccessfully tried to gut the law, describing nonprofits that use the law to leverage "donations" from banks as "protection rackets." Events have proved Sen. Gramm prophetic.

The community activist group ACORN -- where President Barack Obama used to teach classes in street activism, and whose Chicago membership played an important early role in his political campaigns -- is now in trouble over a number of matters. And now Republican lawmakers contend that the way ACORN uses its ability to punish or reward banks by testifying that they either do or don't "do enough" under the Community Redevelopment Act amounts to a shakedown racket.

ACORN says nearly all the money it receives from banks is used to provide advice to first-time home buyers or homeowners who are at risk of losing their homes to foreclosures, and that the money isn't used for political advocacy.

Bull. First, money is fungible. Using one pile of money for one purpose frees up funds for other purposes -- like endorsing and working for the election of Democratic candidates, which ACORN does. A lot.

But secondly, so what? If a bank robber claims he used all his loot to buy medicine for crippled children, is his robbery forgiven? Shakedown rackets are still illegal, and the federal government should not be serving as an enabler.

Archived ACORN testimony on the Federal Reserve Web site shows ACORN has spoken against bank mergers, contending that banks weren't living up to the CRA, The Associated Press reports. In at least one case, however, ACORN supported a merger. The group acknowledged in the 1998 testimony that it was unusual for it to do so, but it said one of the banks involved, NationsBank, was a leader in community reinvestment and that its partnership with ACORN Housing Corp. had produced at least $236 million in mortgages.

Ah. A "good" bank!

"Should we repeal CRA? Absolutely," says Rep. Jeb Hensarling, Texas Republican, a member of the House Financial Services Committee. "Do we have the votes for it today? I seriously doubt that."

Discriminating against would-be mortgage borrowers because of their race or national original is already illegal, as it should be. The Community Redevelopment Act is precisely the kind of excessive bureaucratic meddling in the supposedly "under-regulated" banking industry that led to last year's financial meltdown. It should indeed be repealed.

If Rep. Hensarling can't find enough votes to start cleaning out the stables, it's the job of the voters to send him those votes -- starting next year.