Operation Choke Point could soon grip casinos

It has already hit gun and ammunition dealers. It has shut down pawnshops and short-term lenders. It has caused banks to discharge potentially thousands from their customer rolls who’ve done nothing illegal or improper. The next casualty will be America’s casino and gaming industry.

Operation Choke Point is a government program that the U.S. Department of Justice has said was designed to combat fraud in the marketplace, but its impact has been felt among law-abiding, legitimate businesses far more than unscrupulous bad actors. Operation Choke Point is a joint DOJ and FDIC program that allows these federal agencies to intimidate banks and payment processors into ending financial relationships with lawfully operating businesses. The casino industry is the next target.

This program isn’t just about cutting off bank accounts and ending relationships with payment processors. The controversial program is about fundamentally changing the liability that banks have in the client relationship. In practical terms, the bank is no longer just responsible for knowing how the casinos, for instance, are getting their money, but now they are responsible for knowing how the casinos’ customers are getting their money.

It is an impractical standard which will make compliance impossible for banks and casinos. Casinos already go to great lengths to prevent money-laundering or other financial fraud in their establishments, but the liability this new standard places on banks will have one of two possible outcomes. The first is that banks will see the risk of doing business with casinos and the cost of compliance too high, no matter how large their revenue line, and will end banking relationships, Automatic Clearing House processing and wire transfers. The second outcome is that banks will require casinos to deliver them detailed customer information and operational audits. Such a requirement would necessitate a substantial change in casino business practices, and force casinos to collect and share detailed personal information on every patron who plays at their property.

Compounding the threat from Operation Choke Point agencies such as the DOJ and FDIC is the threat from the Consumer Financial Protection Bureau. Organizations in Washington, D.C., that are ideologically opposed to gambling are advocating that the CFPB assert jurisdiction over the gaming industry. They claim that casino credit products constitute short-term credit, thus opening the door for the CFPB to regulate the industry under the Dodd-Frank Act. This is the same strategy being used by the Obama administration to substantially reform, or destroy, the short-term loan industry and pawnshops.

A multiagency approach where Operation Choke Point agencies (FDIC and DOJ) go after the banking infrastructure of these industries while another agency asserts regulatory jurisdiction will ultimately catch these industries off guard without a way to defend themselves. These agencies are calling this practice “co-regulation.” Other industries that this practice is currently affecting include for-profit education companies, guns and ammunition sellers, multilevel marketing and pharmaceutical sales. All of these industries were specifically identified on a list of “high-risk merchants” by the FDIC, which after sharp criticism recently removed the list from its website. This action by the FDIC should not be seen as a “win” against the program; rather, it enables the administration to continue to expand the program and achieve its goals away from the public eye, where Operation Choke Point was designed to operate.

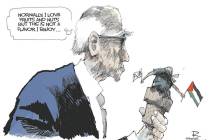

While the stated intentions of the DOJ and FDIC to fight consumer fraud may be laudable, Operation Choke Point violates the very principle of innocent until proved guilty. It now identifies any business associated with a particular industry as “high-risk” and is leading to a fundamental change in the way commerce is conducted in America. It is a frightening prospect that the government now feels empowered to choose winners and losers based on political or ideological principles.

The people who will end up getting hurt by this are the hard-working employees of casinos, many of whom belong to unions and who have yet been silent on the Choke Point program. Contrary to popular belief in the gaming industry, there is no viable legislative end to Operation Choke Point or a way to prevent it from damaging legitimate businesses. The casinos, the unions who represent their employees and the public at large must speak out to make it politically untenable for the Obama administration to mount this assault on our nation’s gaming industry and the people who support it.

Brian J. Wise is a senior adviser to the U.S. Consumer Coalition and the managing partner of Wise Public Affairs. The coalition is a national grassroots organization that advocates for consumers’ rights to access free-market goods and services. For more information: www.USConsumers.org.