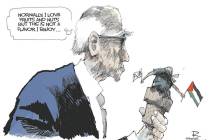

Spare change

Do you have any old gold or silver coins? If so, be careful what you do with them lest the federal government come knocking.

Consider the case of Robert Kahre, a Las Vegas businessman charged with numerous federal tax crimes. A year ago, federal prosecutors tried Mr. Kahre and eight other defendants on 161 tax crimes, but batted .000 when it came to convictions.

Last November, the government issued a new set of related indictments -- surprise! -- and Mr. Kahre will soon face another trial.

One of the major issues? Did Mr. Kahre and some of his employees try to avoid liability for federal income taxes by agreeing to be paid in gold and silver coins?

By calculating their earnings based on the face value of the coins, those involved could then argue they owed no federal income taxes because they didn't make enough money to have to file a return.

Of course, the government has a different view. Or does it?

Prosecutors argue that -- given the high price of precious metals in the current market -- many such coins are actually worth far more than face value.

But if that's the government's position, why didn't clerks in federal court issue refunds to defendants in the case who have at times paid various filing fees with combinations of the very same valuable coins and paper money?

Apparently, the face value of the coins is relevant only when the government is on the receiving end of a transaction.

Buddy, can you spare a double eagle? But watch how you deduct that charitable contribution on your income tax.