‘Stabilizing’ Nevada’s tax base

Every time Nevada's economy is on a roll -- which is most of the time, fortunately -- the big spenders in Carson City keep their mouths shut and spend to the hilt.

But they do more than that. They initiate programs, offices and positions with staffs and beneficiaries that can be relied upon to protest mightily when lean times arrive, making it hard to ever prune them back.

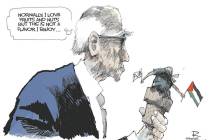

Sure enough, as soon as state tax revenues start to level off, these big spenders take up their ritual chant that Nevada's tax base is not sufficiently "stable" -- meaning their available revenues tend to level off or even drop a bit during tough times.

The answer, they insist, is a "more stable tax base."

They don't mean it, of course. Examine any proposal ever put forth to make Nevada's tax revenues "more stable." You will easily locate the new or higher taxes designed to generate more revenue during lean times -- no matter how destructive this may prove to job creation and private enterprise.

But ask to see the off-setting reductions or caps -- designed to guarantee that any changes aimed at making the tax base more "stable" don't tempt the lawmakers into overspending by ballooning revenues during the boom times -- and you'll be met with a shrug or a blank stare. Because when you hear some official or pundit say he wants tax revenues to be more "stable," he simply means "higher, all the time."

There are two problems with that.

First, some still consider it a problem when, in a public debate, one side resorts to what we used to call "lying." In no dictionary does "stable" mean "bigger but resultantly more volatile."

Second, schemes which merely seek to generate more taxes only guarantee that the swings between fat times and lean times will be wilder -- the opposite of "more stable."

At www.cbpp.org/9-8-08sfp.htm, the Center on Budget and Policy Priorities reports the states that face the worst fiscal shortfalls right now include California, Connecticut, Hawaii, Maryland, Virginia, and New York.

New York alone is $1.2 billion short of the money politicians need to fund their current state budget. Virginia Gov. Tim Kaine just discovered a new $900 million budget gap, promptly announcing 50 layoffs, suspension of 2 percent raises for state workers, and a hiring freeze.

But those are all high-tax states, that already impose virtually every type of new tax that's been proposed to "stabilize Nevada's tax base" -- along with "progressive" state personal income taxes, which fortunately are not available in Nevada's budget mix.

If higher taxes -- and lots of different kinds of taxes -- ensure economic "stability," why are California, Connecticut and New York in trouble?

Lawmakers in these states have been a lot more creative -- for a lot longer -- in dreaming up ways to squeeze more money out of the populace. Yet it is precisely the states with high taxes -- and a broad range of types of taxes -- that now face the most arduous cutbacks.

In fact, in a report on "The Nevada Tax System" ordered up by the Nevada Development Authority and released this month by the Theodore Roosevelt Institute, lead author UNLV Economics Professor Alan Schlottman says he and his staff concluded Nevada is actually one of the "more stable" states when it comes to income fluctuations (in part because the state's gaming tax shows "low volatility"), that there is no combination of taxes that allow a state to entirely "escape volatility," and that a state corporate income tax -- some variant of which is often proposed here -- is in fact "the most volatile" tax on which a state can rely ... as California is now discovering.

The lesson is simple, even if a bit dulled from repetition. The key to "stability" in government services is not to boost spending in the gravy days, any more than a private toy store would be wise to hire a lot more workers in mid-December, on the expectation that, "This wonderful sales boom we've seen all through the fall may last right through the winter!"

No it won't.

Ever hear of "natural business cycles"? Ever hear of "Christmas"?

Rather, the solution is to keep the spending belt tightened even when things look rosy -- expanding and fully funding the state "rainy day" fund and then rebating any excess collections to the taxpayers, instead of launching new offices and "programs" that will squeal with hunger when the lean months inevitably arrive.