A CCSD substitute teacher punched a student at Valley High School in Las Vegas after the student called him a racial slur, according to an arrest report.

The Golden Knights’ championship defense ended much sooner than many anticipated. Here are five reasons why their offseason is off to an early start.

A group of Las Vegas business owners who say they lost millions from last year’s Formula 1 launched an online petition hoping to get a public meeting on the 2024 race.

The Raiders have used their practice facility in Henderson as their training camp site since moving to Las Vegas in 2020, but that could change this summer.

Las Vegas police say two men have been arrested in connection with the fatal shooting of a man who was found in a vacant lot in the central valley.

Commercial real estate experts weighed in on how much the property co-owned by Donald Trump and Phil Ruffin might sell for if it were put on the market.

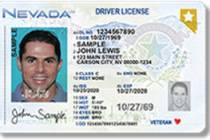

To meet federal requirements, Real IDs will be needed for anyone looking to use their driver’s license to get through security at airports for domestic flights nationwide.

An unrestricted free agent, Jonathan Marchessault’s status becomes a top storyline after the Golden Knights were eliminated in Game 7 against the Dallas Stars.

Impairment is suspected in a fatal crash that occurred early Monday morning in the south-central Las Vegas Valley.

The cease-fire agreement was announced hours after Israel ordered Palestinians to begin evacuating from Rafah, signaling an invasion was imminent.

The crowded Nevada Republican Senate field includes candidates who continue to promote unfounded claims of mass election fraud in the 2020 election.

Freeway interchanges with nicknames including “bowl” are a regular part of many Las Vegas Valley motorists daily commutes.

The fine marks the second sanction for the former president for inflammatory comments about witnesses since the start of the trial last month.

A new documentary shines a light on George Lee, who was hand-picked by George Balanchine for the choreographer’s first staging of “The Nutcracker” with the New York City Ballet.

Generosity: Any act of kindness or support given without expectation of exchange or return from the recipient(s). The game’s biggest stars remain active one month into the NFL offseason. They may not be running drills on the field, but they practice something more important: generosity. Hall of Fame quarterback Troy Aikman and 2022 NFL Man […]

The defending champion Golden Knights were eliminated from the Stanley Cup playoffs after a Game 7 loss to the Dallas Stars on Sunday.

Food and drink specials, prix fixe menus, bottomless boozing and more to celebrate the mother(s) in your life.

Don’t expect a repeat of “Barbenheimer,” last year’s $2.4 billion box-office phenomenon, but here’s a look at some of what’s in store.

Colin Czech appeared in court days after he told police he ate parts of his alleged murder victim in Las Vegas.