They’re only ‘temporary’

The current favorite scheme to curb taxpayer ire over the constant call from progressive and big government types to raise taxes? The "latest fashion in taxation," USA Today reported Tuesday, is "the temporary tax. Governments are raising taxes for a specific period of time and promising the hikes will go away when good times return."

Arizona voters approved this week a 1 point sales tax hike, supposedly to last only three years, with a promise that two-thirds of the new money would go to schools. Kansas will hike its sales tax by a similar 1 point as of July 1, supposedly for only three years, "to prevent cuts in education and social programs." Mobile, Ala., will try a similar 1 point sales tax hike, this one promised to endure only a mere 16 months, to "avoid laying off police and firefighters," reports USA Today.

Nevada's own 2009 Legislature laughed at Gov. Jim Gibbons' sensible proposed state spending cuts last year, instead fueling continued public employee pay and pension growth -- for all the world like a desperate steamship captain, pulling up his own ship's deck planking and feeding it to the boilers to keep full speed ahead -- by enacting $781 million in supposedly "temporary" tax increases, including taxes on motor vehicle registrations, on business licenses and payrolls (anyone wondering why there's no job growth?) and a "temporary" sales tax increase of 0.35 percent.

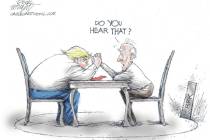

The problem with such "temporary" levies, of course, is that they tend to never go away. "Once politicians get their hands on revenue, they won't give it up," explains Curtis Dubay, a tax expert at the Heritage Foundation

Local voters saw that effect a few years back when tax hikes designed to pay off school bonds were set to expire. School district officials floated the idea of keeping taxes at the current, higher levels -- even though the bonds they were designed to pay off had indeed been paid off -- arguing, "It's not really a tax hike; we just want to keep the tax level right where it is."

Fortunately, that scheme failed.

Now, voters are about to see just how "temporary" some such recession tax hikes will prove to be. Early in the recession, Maryland, New Jersey, New York and North Carolina were among states "imposing temporary tax hikes on the wealthy," USA Today reports. Now, the deadline is nearing for some of those "temporary" tax hikes to expire (though few believe the relocations of "wealthy" taxpayers who left those states in droves for lower-tax havens as a result will prove to be "temporary.")

Will those taxes be allowed to expire?

"Their fate is uncertain," the national daily reports.

Yeah. And if you believe those state legislatures -- and the public employee unions who own them -- are now going to say, "Sure, we've got all we need, let those taxes expire," perhaps we could interest you in some charming elk-herd real estate on the shores of a sparkling alpine lake, in scenic downtown Beatty.