‘Tis the scam season, so seniors are playing ‘Fraud Prevention Bingo’

“Fraud!” shouted 66-year-old Beth Benoit, waving her hand in the air.

Moments later, cheering and laughter erupted from fellow players as Benoit collected her second prize of the afternoon for winning another round of Fraud Prevention Bingo — one of several informational sessions the locally based financial institution GBank and the Independent Community Bankers of America (ICBA) hosted at senior centers across the valley this holiday season.

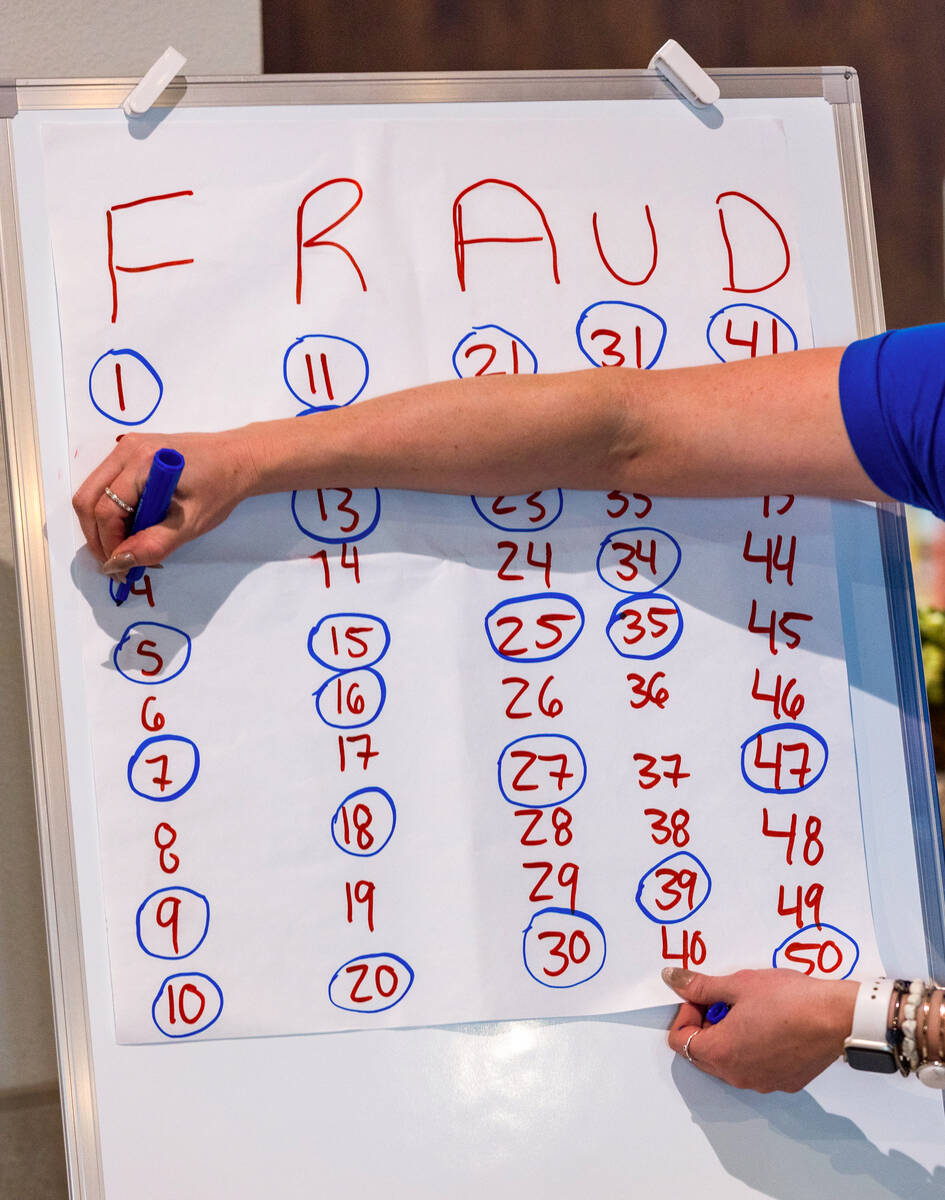

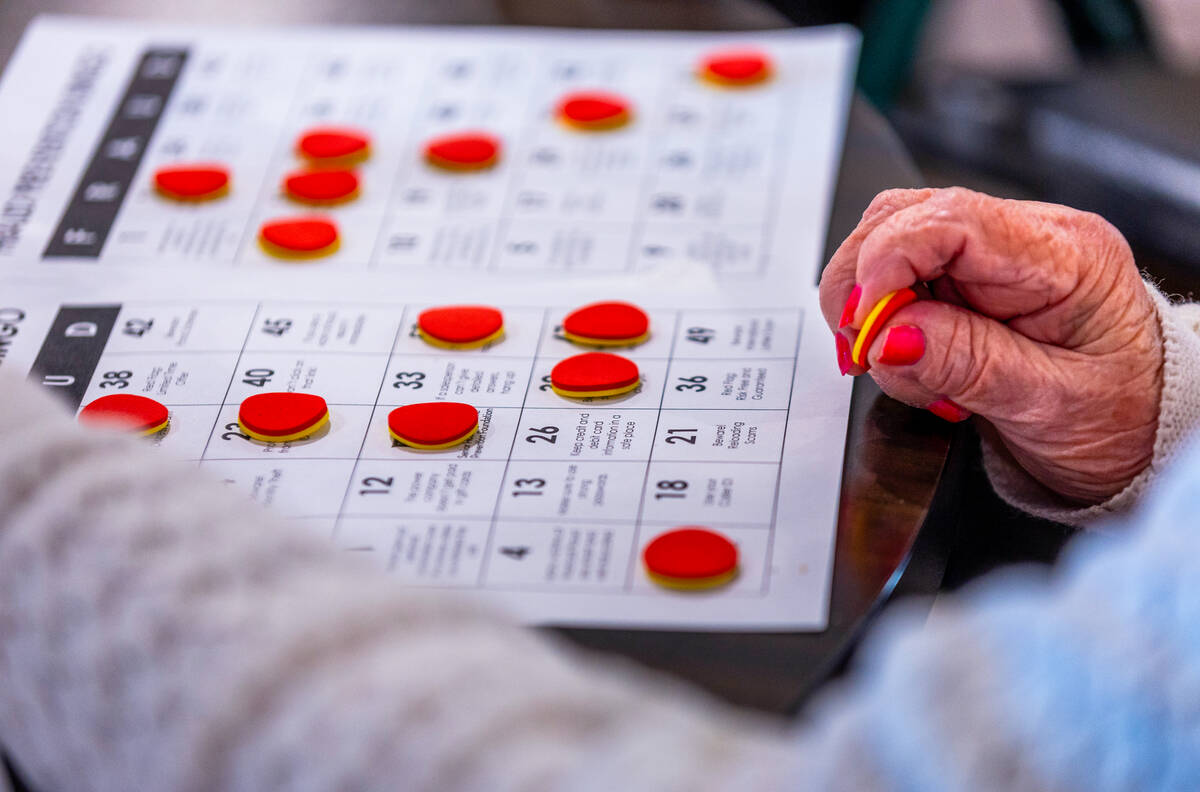

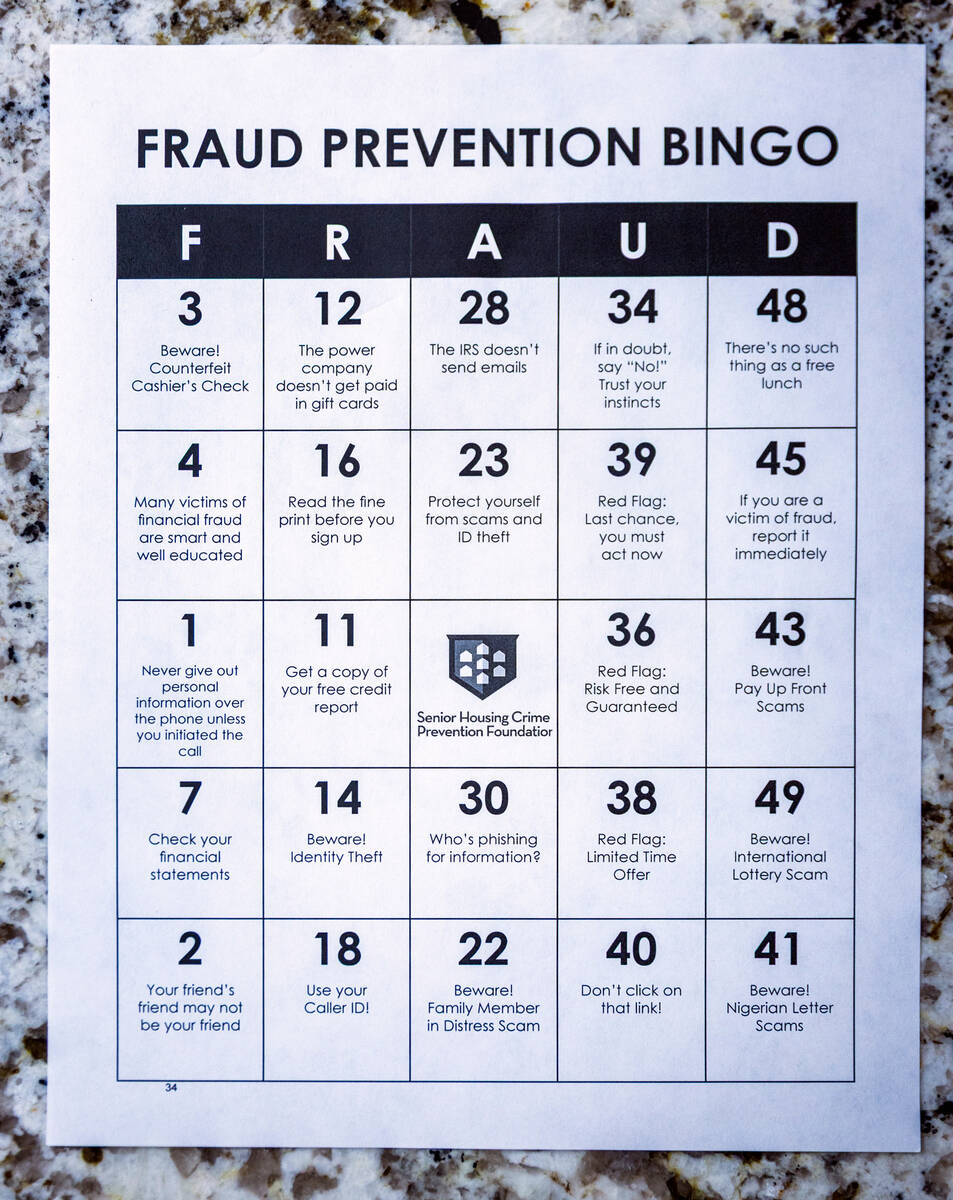

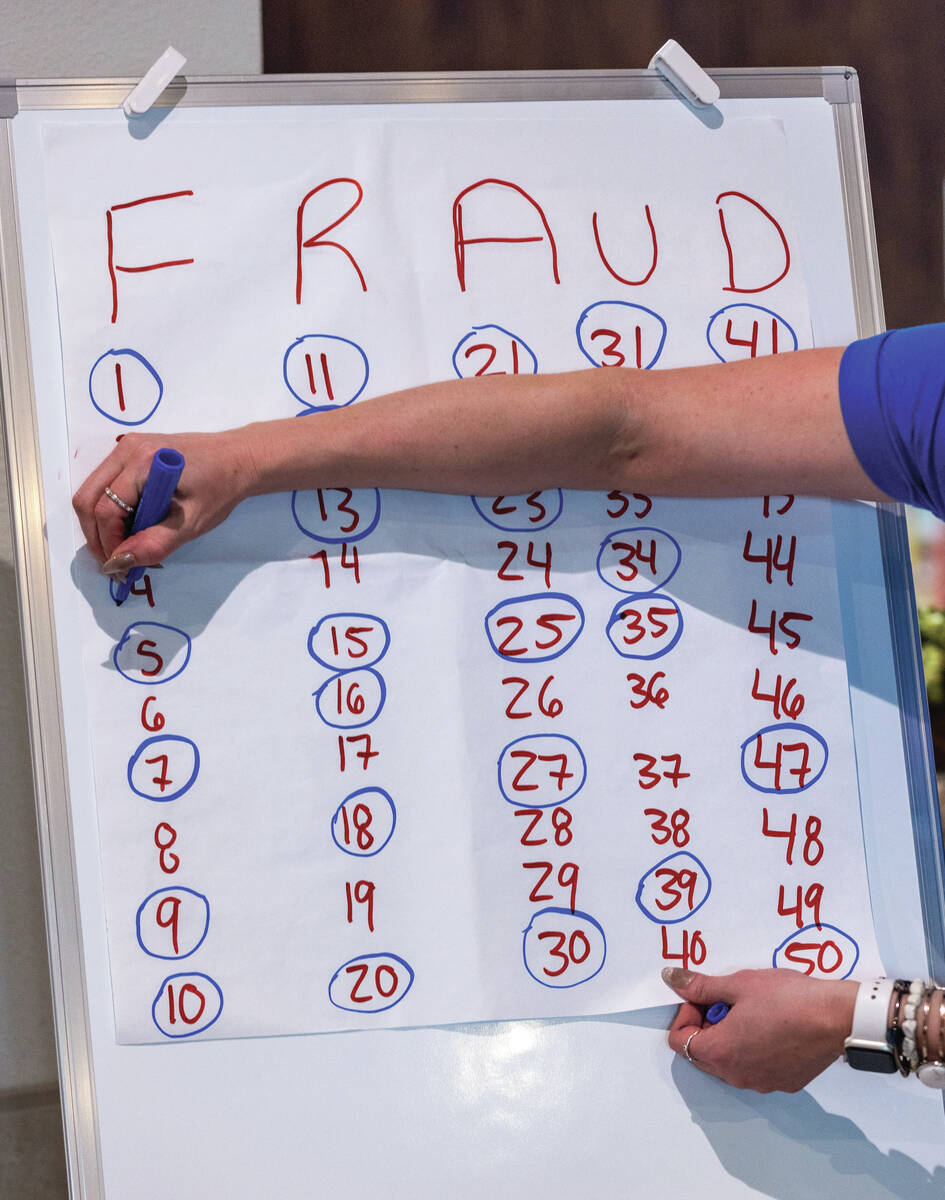

After lunch, about 50 senior residents — including Benoit — gathered in the common room of Madison Palms Senior Community in North Las Vegas. Each held a bingo card: a five-by-five grid of random numbers paired with “red flag” warnings like “Beware! Ponzi Schemes” and “Don’t click on that link.” Some squares also included questions and tips to help players navigate risky situations.

When someone lined up five squares — across, down, or diagonally — they yelled “Fraud!” replacing the familiar “Bingo!”

Event spokesperson Mindy Eras said the holiday season often doubles as “scam season” — especially for seniors.

The FBI reported that in 2023, more than 101,000 seniors throughout the U.S. were defrauded, losing an estimated $3.4 billion total. Kristine LaVigna of ICBA’s Senior CrimeStoppers team said seniors are a particularly “vulnerable population” when it comes to financial crimes, with one in 10 falling victim to various scams. She added that the actual number could be as much as three times higher, since many cases go unreported.

“We see a huge uptick in the number of reported incidents during the holiday season. I think it’s because there’s a spirit of giving and this generation tends to be more trusting,” LaVigna said. “So, we love to do these events during the holidays. Hopefully, these seniors will pick up some tips on what to do and what not to do.”

The tips included checking bank statements regularly, ignoring calls from unknown numbers, using strong passwords and reaching out to a trusted friend or family member when an offer seems “too good to be true.”

LaVigna also urged players to report any suspected fraud or financial crimes to law enforcement.

GBank representative Matthew Pedroza served as the interactive game’s bingo caller. When he called out, “A 25 — should we give out personal information over the phone?” a unified “No!” rang out across the room.

Benoit and her friend, Angela Galafante, 64, shook their heads and grabbed more felt chips to mark their boards. Galafante, who won one game, chose a chocolate bar as her prize, while Benoit picked a can of Pringles and new kitchen towels.

“Some of these scenarios that we’re talking about — like reading the fine print — I’ve struggled with,” Galafante said, smiling. “I don’t always take the time to slow down and understand, so I am learning a lot.”

Contact Akiya Dillon at adillon@reviewjournal.com.