Inside Gaming: Sunny days may be ahead for MGM Resorts

In a recent research note, J.P. Morgan gaming analyst Joe Greff said MGM Resorts International offers “fresh ideas” for stock investors exploring their options in the new year.

And that was before the casino company cleared several giant hurdles in December for building two potentially lucrative gaming complexes in the Northeast.

With almost $3 billion in developments looming in Macau and Las Vegas — coupled with a potential return to Atlantic City — MGM Resorts is already the most-watched casino company on Wall Street just five days into 2014.

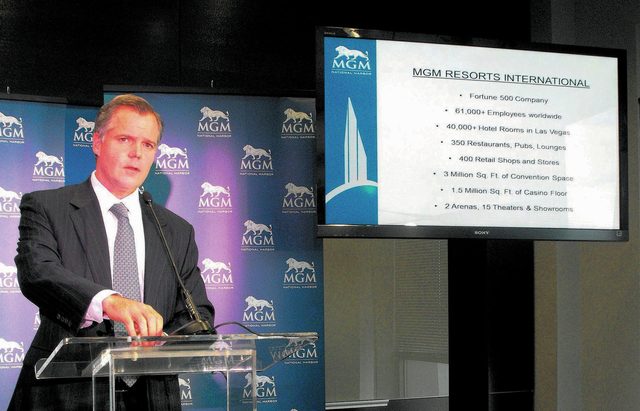

The likely prospects of MGM Resorts adding to its portfolio an $800 million hotel-casino in Springfield, Mass., and a $925 million resort just outside Washington, D.C., at National Harbor, Md., only enrich the story.

Greff said MGM Resorts offers “the top gaming investment idea” because the company’s stock price, which closed at $23.45 Friday, should be getting more respect from the market. The price is up 85 percent over the past 12 months and analyst consensus is the stock could be worth at least $26 per share.

Credit Suisse gaming analyst Joel Simkins wrote in his recently published 2014 gaming outlook that MGM Resorts “remains the best-positioned operator to capitalize on the continued recovery of Las Vegas as the U.S. economy recovers.”

The praise is a glimpse into the company’s future.

The Northeast developments require additional regulatory approvals and won’t welcome customers until 2017. MGM Resorts’ $2.6 billion hotel-casino development on Macau’s Cotai Strip is scheduled to open in early 2016.

On the Strip, the company is spending $100 million on an outdoor retail, dining and entertainment district under construction between New York-New York and Monte Carlo. The development will lead into a planned $350 million sports and entertainment arena. The district is expected to open this year; the arena in 2016.

Meanwhile, New Jersey gaming regulators are expected to rule in the next three months on whether MGM Resorts will regain a license for its 50 percent ownership stake in the Borgata. The company’s share of the Atlantic City resort’s profits — $110 million as of Sept. 30 — have been held in trust since 2010. MGM departed the market that year rather than sever ties to Macau casino partner Pansy Ho, whose father, Stanley Ho, reportedly has Asian organized crime connections. The company and the Ho family have denied the allegations.

If MGM Resorts regains the license, profits from the market’s top performing casino — including Borgata’s new online gaming business — could flow back to the company’s bottom line.

These are just some of the reasons MGM Resorts Chairman and CEO Jim Murren walks around with a big smile.

Las Vegas is seeing an economic recovery, and MGM Resorts, which owns 10 Strip properties including the MGM Grand, The Mirage, Bellagio and Mandalay Bay, figures to benefit. Convention bookings for the first six months are on the rise. MGM has already locked in 88 percent of its convention room nights.

“We believe 2014 has the potential to be a stronger year for Las Vegas, as any meaningful uplift in the economy will give retail gamblers and leisure travelers confidence to book their trips to the Strip,” Simkins said.

Murren — whose national profile will increase this year when he takes over chairmanship of the Washington-based American Gaming Association — is confident the company’s growth in Macau, Maryland and Massachusetts will benefit the company’s Las Vegas resorts.

Two gaming destinations in the populous Northeast will add customers to MGM Resorts’ ever-growing database.

In Macau, a second casino will give the company a stronger piece of the region’s gaming market, which generated $45.2 billion in revenue in 2013 and is expected to grow.

MGM Resorts, which opened the MGM Macau in 2007, listed shares of its Chinese subsidiary on the Hong Kong Stock Exchange more than two years ago. The move gave the company 51 percent ownership in the resort and allowed it to return profits and dividends from the Chinese casino operations to the U.S. corporate parent. In 2013, that figure was more than $300 million and counting.

After winning the licensing recommendation in Maryland, Murren said morale was boosted among company employees. A week later, MGM Resorts was found suitable in Massachusetts. He credited the development team with creating two properties that are designed somewhat outside the traditional casino box.

The sunny outlook within the company and from the investment community is a marked change from a few years ago.

Analysts thought MGM Resorts was overextended after opening the massive $8.5 billion CityCenter complex in 2009 during the grips of the recession. Since then, the company has reduced its long-term debt to a manageable $13 billion and has extended maturity dates late into the decade.

CityCenter has turned around its financial prospects. Revenue for the development, which includes the centerpiece Aria hotel-casino, grew in the more recent quarter. Murren said the company would be interested in acquiring the 50 percent interest in the development owned by Dubai World if the Persian Gulf emirate’s investment arm were willing to sell the stake.

Greff told investors any little bump in consumer spending over the next few months could translate into additional cash flow for MGM Resorts, which has implemented tight cost controls and brought about more efficient marketing efforts.

“We believe that MGM can grind higher from here given its exposure to Macau’s growth and its leverage to a modestly improving Las Vegas Strip market,” Greff said.

Howard Stutz’s Inside Gaming column appears Sundays. He can be reached at hstutz@reviewjournal.com or 702-477-3871. Follow @howardstutz on Twitter.