Demand for LV office space softens

The lack of available jobs, along with a sluggish economy, has softened demand for new office space in Las Vegas, a research analyst for Grubb & Ellis brokerage said.

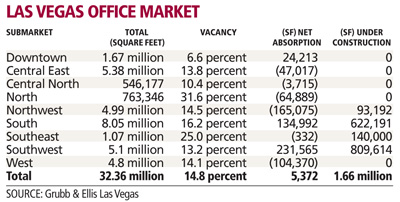

Office vacancy remained at 14.8 percent in the second quarter, same as the previous quarter and up from 11.4 percent in second quarter 2007, Grubb & Ellis reported.

The office market is expected to improve in 2009 with the completion of several large-scale projects on the Strip, which will add thousands of new jobs to the economy, analyst Dave Dworkin said.

"There's going to be so much more going on on the Strip, so many attractions at CityCenter and Echelon and somebody's got to be there," he said. "Hopefully all these new projects will bring more tourists. The heat used to keep people away. Now it's just getting here."

North Las Vegas showed the highest vacancy at 31.6 percent. Downtown Las Vegas dropped 100 basis points to record the lowest vacancy at 6.6 percent and had the highest lease rates for Class B, or middle-class office properties, at $30.78 a square foot on an annual basis.

In the next few years, the renovation of the downtown submarket will offer high-quality office product that will give business owners more options to relocate closer to the city's coming amenities and attractions, Dworkin said.

Average asking rent for Class A, or premium office space such as Hughes Center, was $35.53 a square foot per year, up from $33.11 a year ago. Class B rent dropped 26 cents to $25.71 over the same period.

Voit Commercial put the office vacancy even higher at 16.7 percent, compared with 12.4 percent in the year-ago quarter.

A number of projects coming onto the market today were designed a year or two ago when fundamentals were much more favorable, Voit Vice President Jerry Holdner said. They're going to have to offer competitive pricing and lease incentives during the next year to limit long-term downside risk.

The office market added 1.3 million square feet during the second quarter for a total of 47.3 million square feet, Voit reported. Net absorption, or the amount of office space taken, was negligible at 1,413 square feet.

"They're building too much," CB Richard Ellis office broker Jayne Cayton said. "It's definitely soft and it's a good time for tenants to be out looking for space. There is activity in the market. It's not completely dead. Deals are just taking longer to get done."

Cayton signed Whiting-Turner Construction to a six-year lease of 6,000 square feet at Marnell Corporate Center and said she's in negotiations with another office user for 20,000 square feet.

Major completions included office space at Town Square on the south Strip, Green Valley Corporate Center in Henderson and the first phase of Durango Business Park, which is occupied by Las Vegas-based Allegiant Air.

"I don't think it's all doom and gloom," Dworkin said. "Las Vegas is still one of the most resilient economies in the United States. The trends aren't always going down. Any of the numbers you look at, they're going to be up and down."

A lot of developers don't want to put money into a project and have it sit vacant, so they're taking a wait-and-see attitude, looking at 2009, Dworkin said.

Contact reporter Hubble Smith at hsmith@ reviewjournal.com or 702-383-0491.