Falling attendance forces new strategy

They have become known as "rooms around the block" even though they may only be down the hall.

When convention and conference planners send invitations to their events, the packages include a multinight room rate that may have been negotiated a couple of years ago. But delegates aware of the rampant discounting that has since taken over the leisure market will pay just the conference fee, then jump online to book the room separately at the same hotel for perhaps $69 a night instead of the official $109-a-night rate. Once they arrive, the delegates often criticize the meeting planners for cutting a lame deal.

To avoid being stung by rooms around the block, Brian Stevens, president of the convention booking firm ConferenceDirect in Los Angeles, has adopted a policy of renegotiating any contract he signed more than a year ago.

"We need to get the terms down to the current realities," he said.

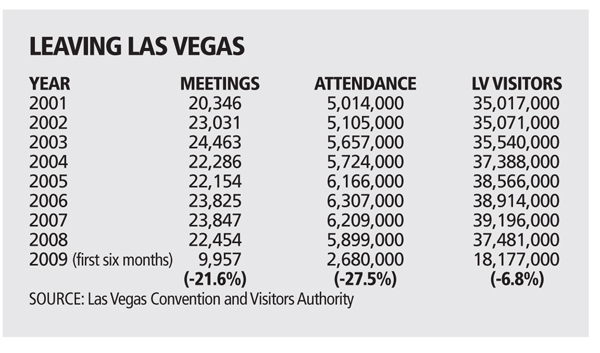

Traffic began to stall in 2007, even as tourists continued to arrive in record numbers, and has plunged this year. Through the first six months of this year, the 9,957 meetings held were 21.6 percent fewer than in 2008 and attendance was down 27.5 percent to 2.7 million, even as the overall visitor count was down only 6.8 percent.

Although President Barack Obama's now-infamous "taxpayer's dime" remark has received an outsized share of attention, the meeting business that the Las Vegas Convention and Visitors Authority said disappeared because of it accounts for only about 10 percent of the decline. The rest has come as companies and associations across the country have opted for more austere expense accounts when they travel or are just staying home, a collective retrenchment that has also stung airlines.

This shift has resulted in not only the wholesale discounting of rooms but also catering services, enhanced amenities, such as more comped suites, and waiving of previously standard terms such as cancellation penalties or minimum tabs.

"You bring out all the bells and whistles in this kind of environment," said one executive of Las Vegas Sands, which owns the city's second-largest exhibit hall.

The largest hall, the Las Vegas Convention Center, has rates that are set by the authority board and not discounted, spokesman Vince Alberta said.

Meanwhile, the fighting has sharpened to grab the business that is still available.

"We have had repeat customers more than willing to pay reasonable rates that have told us our competitors are willing to 'buy' their business with major discounts" and looser conditions, Don Voss, vice president of hotel sales and marketing at Treasure Island, said in an e-mailed statement. "While we know that this strategy works to get business on the books, we do not believe it is in the best interests of the hotel."

Of the meetings he has booked, Stevens said the average room rate has dropped 42 percent in the past year.

"An empty room can't gamble, so you fill it at any price," he said.

Mike Massari, vice president of the Las Vegas meetings division of Harrah's Entertainment, said, "It has always been a competitive market. Now it is a hypercompetitive market."

However, he added, "The decision to pick Property A over Property B is not one of price but one of execution."

Some industry insiders downplay the effect of discounting but worry about how to reverse it once the economy rebounds.

"The lesson we all learned in the past is that discounting doesn't necessarily stimulate demand," said Maureen O'Hanlon, a partner with the Boston consulting firm Prism Partnership.

After the last major business travel recession, following the Sept. 11, 2001, terrorist attacks, she said that properties that discounted took four or five years to return to price levels they wanted.

Outwardly, the industry's new mantra for dealing with tight spending has become flexibility.

"Before, a group might have had a $1 million catering budget, but it's now down to $750,000," said Chuck Bowling, executive vice president of sales and marketing for MGM Mirage. "All we can do is say 'thank you' and give them the best possible experience."

Some longstanding practices have started to shift. Lenise Fourcault, vice president of Meeting Planners Plus in Costa Mesa, Calif., said she has not booked a group into Las Vegas for more than five years because of an indifference to medium and small groups and an aversion to weekend bookings.

"It was difficult because they were really focused on the big conventions," she said. "Now, they welcome any piece of business."

Basic economics dictate that one large group can generate more profit than several smaller groups combined. Coupled with that, Las Vegas is skewed toward handling masses of people and exhibit hall paraphernalia with 141,000 hotel rooms and three of the nation's 11 largest convention halls.

Treasure Island, with 18,000 square feet of meeting space, has long pitched itself to conference crowds of 20 people to 100 people. Now, said Voss, "Our biggest challenge has been market conditions created by properties that are aggressively pursuing smaller groups that they previously treated with apathy." Later, he added, "Our responsibility ... is to ensure for our clients that the few extra dollars they spend at TI continue to offer excellent value."

Treasure Island has added a sales representative who will specialize in groups that want a banquet room and catering. Previously, the hotel required groups to book hotel rooms as well because of high demand.

Those in the industry cite the big-is-better mindset as a prime reason that the number of meetings has plateaued at about 23,000 for the past seven years, although the count would fall below 20,000 this year based on the current trend, convention authority reports show. This came as larger average meeting sizes boosted overall attendance by 24 percent from 2002 to the peak year of 2007, when attendance hit 6.3 million.

Before 2001, the authority accounted for the convention and meeting market differently, making comparisons difficult.

About 80 percent of the Las Vegas meetings have attendance of fewer than 500 people, authority spokesman Alberta said. This brings in half of the city's convention business. The relatively small lineup of conventions with more than 15,000 delegates each draws for one-fourth of total attendance, while the tier in between accounts for the other fourth.

But convention executives disagree which sector has been stung the most.

"One part that has held up fairly well are the big trade shows," Bowling said. "The groups for industries like homebuilding, banking and broadcasting have been down. It's a reflection of Corporate America."

For example, the MAGIC fashion trade show that ran Aug. 31 through Sept. 2 reportedly took more square footage and attracted more exhibitors and attendance than last year, although no numbers were disclosed.

But Voss has found the reverse, with large venues pursuing small groups precisely because the megaconventions have seen drop-offs.

Massari said the problems have been "pretty broad-based. I challenge somebody to find a bright spot I haven't seen."

The authority has moved on several fronts to try to bring back business travelers, including:

•1,000-call sales campaign that started in June and will close at the end of the month. The idea is to make in-person visits to a broad spectrum of convention and meeting planners and decision makers.

•"Blitz" combining target advertising with sales calls in key markets, including San Francisco, Southern California, Dallas and Houston.

•The fourth phase of a print advertising campaign that launched in February; spots started appearing in national magazines Monday.

•Continuing to use a contract marketing company to call people who have attended conventions in the past but have not registered for the same one this year. This program started last year and is made available free to different venues in town, whether or not they use the Las Vegas Convention Center.

"It is not the style of Las Vegas to sit back and wait for the economy to improve," Alberta said.

Convention executives do not expect a sustained recovery for at least another year and perhaps not until 2011. The initial 1,000-call campaign, in the fourth quarter of 2008, preceded this year's steep drop in attendance.

Apart from the immediate economy, other factors will influence the future of Las Vegas' position. The amount of convention space grew 38 percent to 88.5 million square feet in the decade through 2008, with another 5.8 million square feet under way, industry publication Tradeshow Week reports. Already, convention planners say they've received calls from facilities still under construction, which isn't unusual because major events are planned several years in advance.

At the same time, the U.S. meeting industry has reached a mature, slow-growth phase. The National Business Travel Association reports that business travel spending grew 1.9 percent a year through the decade ended in 2008 to $261.4 billion. That rate is projected to slow to 0.3 percent over the next four years.

Some smaller local venues have come on line in recent months or will open in the coming months, although some convention bookers have had to detour meetings scheduled for the now-stalled Fontainebleau.

Recession and improving technology have raised the profile of teleconferencing; some observers predict it will permanently replace some meetings. A similar line was pushed after Sept. 11, but the convention business rebounded after the economy improved and airline security settled into a routine.

Meeting planners maintain their faith in the need for face-to-face contacts instead of just monitor-to-monitor.

"There's a saying in our business that is you don't care what the answer is, send an e-mail," Massari said. "But if you need a 'yes,' go see somebody."

In the end, industry executives count on the city's renown as a good-time town to help fend off rivals. Tradeshow Week lists Las Vegas with a wide lead in multivenue conventions at 252, double that of second-place New York City.

"The boosters are right. 'It's Vegas' does mean something in the convention industry," said Laurie Mirman Rogers, president of the Site Services convention consulting firm in Irvine, Calif. "Vegas has an appeal that's one of a kind."

Contact reporter Tim O'Reiley at toreiley @lvbusinesspress.com or 702-387-5290.