Nevada taxable sales continue increase

Even as Nevada's taxable sales income rose for the fifth straight month, local retailers and economic analysts said Thursday that they're not ready to predict a banner sales year in 2011.

"We're supposed to have more foreclosures this year than we had last year. Until we see stable housing and stable employment, you're not going to see any big improvements," said Savvas Andrews, owner of the Bagel Cafe on North Buffalo Drive.

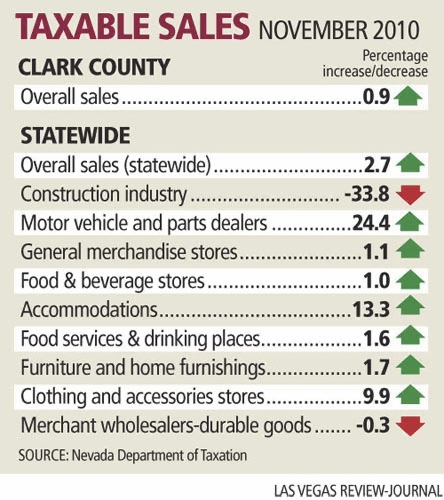

Sales at the Bagel Cafe rose slightly year over year in November, as did restaurant and bar sales statewide. Thursday numbers from the state Department of Taxation showed a 1.6 percent increase in sales in the food services and drinking establishments category.

Across all economic sectors, taxable sales increased 2.7 percent year over year statewide, to $3.1 billion. Taxable sales in Clark County grew at a slightly lower pace, rising 2.3 percent, to $2.3 billion.

Especially strong were retail sales inside hotels and motels, which improved 13.3 percent, and sales among dealers of cars and car parts, which jumped 24.4 percent. Clothing and accessories stores saw a 9.9 percent gain.

Also showing sales improvements were furniture retailers (1.7 percent) and general merchandisers, such as department stores (1.1 percent).

One local observer welcomed the streak of sales upticks, but he added that Nevada has far to go before it regains its prerecession footing

"The fact that we've seen taxable retail sales remain positive through the majority of the first half of the fiscal year is encouraging," said Brian Gordon, a principal in local research and consulting firm Applied Analysis. "But we haven't seen any material increases from where we were, and we remain 20 percent off our peak."

What's more, some crucial sales categories continued to show declines: The construction sector recorded a 33.8 percent drop in sales activity year over year. And there's not much relief on the horizon, after a predownturn building binge left the state with too many new homes and office parks. That supply overhang likely means that construction activity here will remain weak; that, in turn, could portend subpar taxable sales totals for the foreseeable future.

Numbers from Applied Analysis show that taxable construction spending in Clark County dipped to $1.6 billion in 2010, after peaking at $3.5 billion in 2005 and 2006. As long as the building trades remain so depressed, the state will have a tough time returning to its boom-era taxable sales figures, Gordon said.

Taxable sales are important because the revenue they generate helps fund prisons and schools, among other public services.

For fiscal 2011, which began on July 1, sales were up 3.4 percent compared with the same period in fiscal 2010.

Gross revenue collections from sales and use taxes totaled $244.7 million in November, a 4.1 percent boost from the same month in 2009.

In the first five months of the fiscal year, the general-fund share of sales and use taxes was 0.4 percent, or $1.3 million, above projections of the Economic Forum, a nonpartisan group that forecasts state income.

Excise taxes on cigarettes, liquor and live entertainment all ran above expectations in November.

Fifteen of Nevada's 17 counties saw gains in taxable sales in November. Only Lyon County, home to construction-reliant bedroom communities near Reno, and Esmeralda County, an area halfway between Reno and Las Vegas that houses fewer than 1,000 residents, saw year-over-year declines in taxable sales.

Despite the recent improvements, taxable sales should "bounce around" in coming months, with both periods of growth and contraction possible, Gordon said.

Gordon said he'll keep an especially close eye on December's taxable sales when they're reported in late February, because they'll indicate whether November's retail bump came from consumers getting their Christmas shopping done early, in the days around Thanksgiving, or if the season brought sustained sales that could presage a potentially more long-lived gain.

But back at the Bagel Cafe, Andrews said he sees few indications that his patrons plan to pick up their spending pace in 2011.

His sales of catered lunches to smaller companies dropped by 40 percent in the downturn, and that segment of sales has yet to revive. Plus, individual customers continue to show signs of thrift. Where they used to come in and buy a pound of food without even asking the price, today, they'll buy in quarter-pound increments, and "they question their bill constantly," Andrews said.

"They still worry about spending money," he said. "People are used to the fact that this (recovery) is going to take a long time, and they're just watching what they're spending."

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512.