Nonprofit groups shift strategy, cut costs to stay solvent

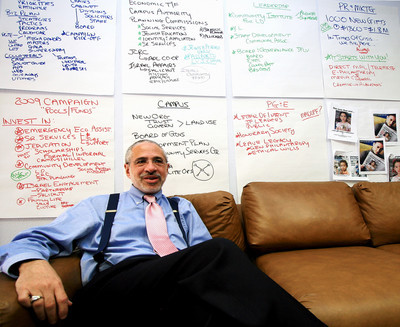

When preparing to call on a potential donor, the first thing Elliot Karp checks is not the person's asset profile or giving history but the stock market.

If it's one of those ugly days that has happened frequently in recent months, Karp, president and chief executive officer of the Jewish Federation of Las Vegas, knows he may as well stay in the office. Even on the good days, his approach is softer.

"It used to be that you could secure a gift in one meeting," Karp said. "Now, it takes two or three meetings before we even ask for a gift. The first thing I will tell (potential donors) is, 'I promise I'm not asking for money.'"

With many of the industries that dominate the Las Vegas economy wobbling, many nonprofit agencies have suffered. A broad spectrum of nonprofits has already resorted to layoffs, program cuts or, in the case of the Las Vegas Art Museum, closure.

But on the other side of the income statement, nonprofits have adopted a variety of tactics to brake or at least slow the declines in revenues, with varying degrees of success. Almost all of the nonprofits have stepped up face time with donors and reshaped their messages from generalized, feel-good messages about helping others in need to specific examples of how donors themselves or people they know might be affected.

At times, however, nonprofits have also gone in opposite directions. In February, the Keep Memory Alive Foundation put on a celebrity-laden benefit at Bellagio that raised $12 million for the Cleveland Clinic Lou Ruvo Center for Brain Health. But the Make-A-Wish Foundation of Southern Nevada canceled an annual fundraiser amid concerns that big donors might not show. Instead the foundation plans to invite backers to a free, less formal event at a restaurant.

Although hard numbers about last year are not yet available, some national indicators reveal how deep the problems have run. The Philanthropic Giving Index, a set of benchmarks compiled by the Indiana University's Center on Philanthropy, had by late last year fallen 10 percent below the previous nadir recorded in 2003. The number of gifts exceeding $1 million dropped by one-third in the second half of last year compared with the same period in 2007.

Despite the daunting economy, philanthropy experts stress that there is no alternative to pushing the envelope until someone puts a check in it.

"There seems to be a lot of hand-wringing among nonprofits, almost a self-fulfilling prophesy, that the world is going to hell in a handbasket," said James Yunker, president of the consulting firm Smith Beers Yunker & Co. in Cincinnati. "Now is the time to step up and keep going."

Jack Miller, CEO of the Fort Collins, Colo.-based consulting firm Miller Group Worldwide, added: "Let's not assume that everybody is going into a cocoon and not giving anything."

The Jewish Federation, which operates as an umbrella fundraiser for several groups, has spent more time cultivating small donors, even though Karp acknowledges that this will probably not fill the gap left by large donors who have pulled back as their investment portfolios have shriveled. For small and large donors alike, federation officials stress tangible results from money it distributes to groups such as the Jewish Family Service Agency's food pantry or to cover the rising demand for parochial-school scholarships.

How well this works is hard to tell. The annual drive brought in $3.3 million last year, a nearly one-third drop from 2007 partly due to a change in leadership.

Karp cannot yet predict where the current drive will finish. As a result, the federation is considering extending the traditional June 30 deadline by as many as three months, understanding that the move could cannibalize next year's efforts.

The United Way of Southern Nevada is on track to top last year's $12.2 million annual campaign by about 10 percent, President and CEO Dan Goulet said, even as normally large donors have retreated. This year, United Way does not even ask for money from companies widely reported to be in financial trouble, but requests to meet with employees.

When they meet with employee groups, United Way representatives hand out a small book on places to turn for assistance with such matters as paying mortgage or utility bills. At the same time, the agency has boosted efforts to enlist companies that came to the area or changed ownership in the past five years.

Although it has substantial reserves to cushion the blow of falling revenues, the Nevada Cancer Institute still launched initiatives on several fronts, spokeswoman Jennifer McDonnell said. The institute has resorted to social networking Web sites such as Facebook and blogs to get its message out, particularly news of a yearlong lecture series on health that started in March. Scientists have been pushed with greater urgency to find grant money to support their work. Small fundraisers, such as among a group of seniors at an assisted living center, have gained higher emphasis even as larger donors get more visits.

The institute has also initiated cancer survivor services and is bringing a pain physician aboard to draw more patients.

Many smaller nonprofits, however, lack the budgets to increase or even start formal fundraising, so they must turn in other directions.

Goodwill of Southern Nevada generates about 95 percent of its annual budget through its thrift shops, so it had to make changes when sales started slipping in 2007. As a result, sales in recent months have run about 5 percent ahead of the year-earlier period, President and CEO Steve Chartrand said.

"People are looking for ways to get more for their dollar," he said, but Goodwill was still losing ground two years ago.

To stimulate more merchandise donations, Goodwill boosted its satellite donation centers -- semi trailers permanently parked at retail centers -- by 50 percent to 27 to compete with the numerous other donation boxes that have cropped up for other groups. Goodwill touts that its centers are staffed by people who write receipts on the spot that donors can use for tax deductions. The advertising was recast around economy-oriented lines such as, "Thank you, Goodwill, for getting me a job."

Goodwill also reorganized the back-of-the-store operations, replaced some store managers and instituted e-mail notices of in-store promotions for customers who sign up.

In 2008, store sales rose 9.1 percent to $14.2 million, while operating losses dropped from $554,000 to $22,000. Chartrand said results are running ahead of this year's budget, which projects a $1.7 million operating gain on $15.6 million in sales.

Even with that, Goodwill created a new full-time position for pursuing grants.

Retailing has also helped the foundation for Habitat for Humanity Las Vegas to reorient its financial structure. With income from its ReStore outlet for used or donated building materials now covering more than half of the group's operating expenses, the group is now scouting for a second site that it hopes will help cover the entire budget. Already, it has a storage area full of supplies that don't fit in its store.

That, in turn, President and CEO Guy Amato said, would free the small donations now ticketed for operations to support the group's signature mission of building homes for low-income families.

"Right now, that corporation that donated $50,000 or $80,000 in the past is not around," Amato said. "The big sponsor has disappeared in the last six-to-eight months. The store does what we need to keep us afloat."

The store is fed by retailers like Lowe's, which donates discontinued merchandise, or developers like Pulte Homes, which recently demolished a pair of model homes that it has dropped in the current market and allowed Habitat to take whatever it wanted.

Still, Amato said that the number of homes built next year will likely drop from the 10 scheduled for 2009, especially if some local government grants don't come through.

Very small groups, such as Barry's Boxing Gym, may have no one to turn to but themselves. The gym, which works extensively with youths that have run into trouble, has been hit from two sides.

First, the gym last year had to move to a new location on South Highland Avenue and pay full rent after the previous landlord, who leased the gym space at a discounted rate, sold the property. Then, the gym saw the monthly memberships that form a critical component of its budget fall by about half. The budget ran $165,000 in 2007.

Dawn and Patrick Barry, who own the gym, say they sold a piece of rental property they owned and took a second mortgage on their house to raise money for the gym.

"It's about all we can do at this juncture," Dawn Barry said. "It's much harder now because people can't afford to come or don't want to come."

But having a large endowment has not made the financial situation any easier. The Nevada Community Foundation, which manages foundations created by individual benefactors, urged potential donation applicants to get their requests in early. The foundation predicts high need and less money available due to investment losses.

The downturn already started to show up during the year ended June 30 as approved grants dropped 21 percent to $6.8 million. Even then, the foundation had started to move its portfolio from equities to fixed-income securities. Nevertheless, the value of the total still declined 8 percent to $22.8 million.

President Gian Brosco could not provide specifics about where the endowment stands now after the carnage on Wall Street.

Contact reporter Tim O'Reiley at toreiley@lvbusinesspress.com or 702-387-5290.