Observers assess recovery since one-day 777-point drop of Dow Jones

A young professional at the National Bank of Detroit heard a speech in 1959 from the head of Germany's central bank and raised his hand to ask a question afterward.

Given all the financial system safeguards in place, did the banking chief think another Great Depression would ever occur again?

"Once large numbers of people act irrationally, anything can happen," the German official said.

The words still ring in the ears of David Ehlers, chairman of Las Vegas Investment Advisors and a gaming analyst. He wonders whether the comment isn't particularly appropriate in today's fragile economy.

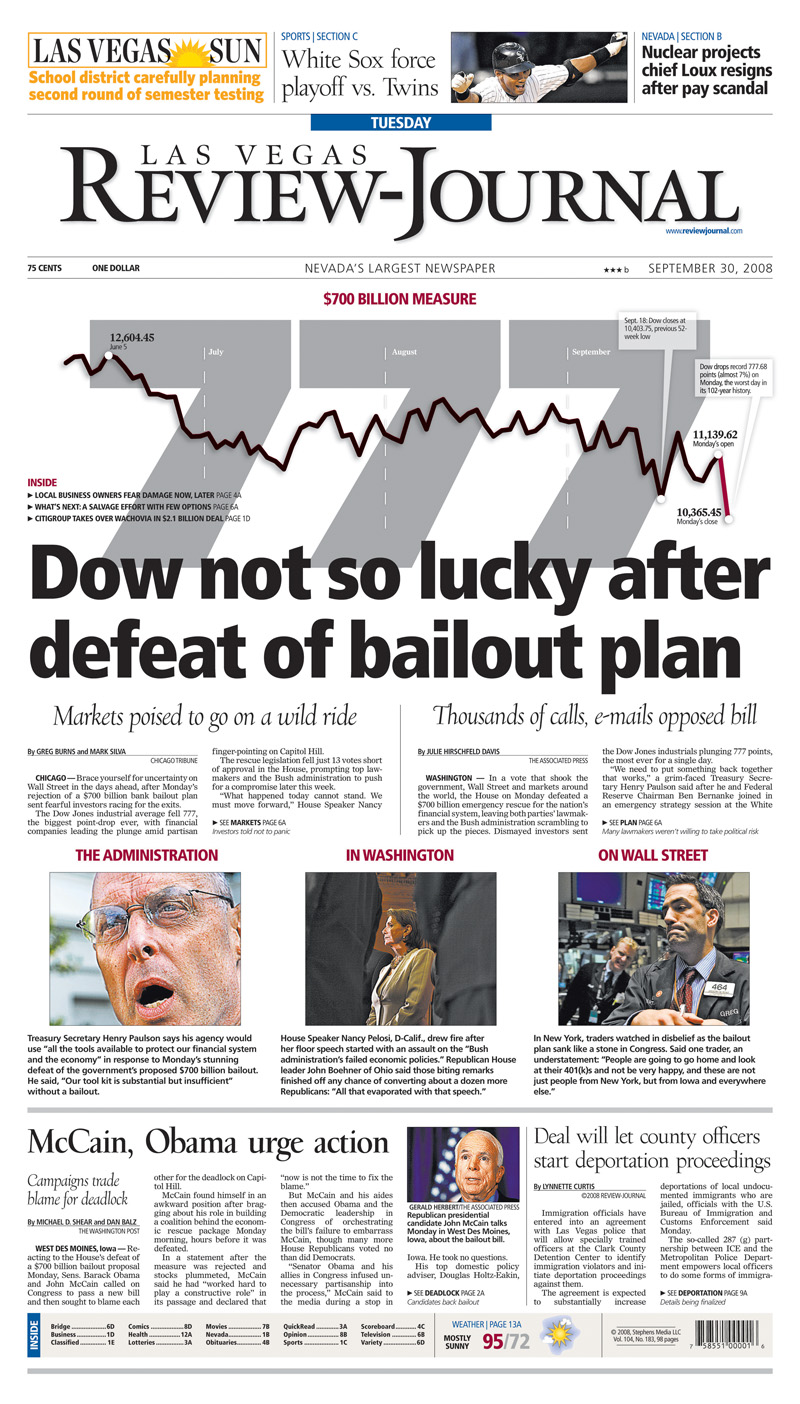

The stock market crashed a year ago; the Dow Jones industrial average shed 777 points on Sept. 29, 2008, the biggest one-day point decline ever. The drop came after the House of Representatives voted down a $700 billion bank bailout plan.

The bailout plan, which came to be known as the Troubled Asset Relief Program, or TARP, got Congressional approval in October 2008, and the stock market has surged since hitting lows in March.

Investment advisers are divided on the best course of action, given the stomach-turning drops and jumps in prices since then.

Some investors and advisers shun the market. Others are jumping on for the ride, and still others say properly constructed investment portfolios need no change.

The Standard & Poor's 500 index of the largest domestic public companies hit a high of 1,437 in May 2008, dropped 53 percent to 679 in March and closed at 1,044.38 on Friday. Someone who bought at the high still has a loss of 24.4 percent.

The stock market's rebound does not convince Ehlers that the country's economy is back on track. He questions what will happen with the ballooning federal deficit, massive quantities of toxic investments on Wall Street and "a radical liberal" in the White House.

"These are the darkest days that we've ever seen in the United States, and a lot of people are talking about leaving the country," he said.

"The fabric of our financial system is stretched to a degree that you and I cannot determine," he said. "We don't know what's in the back of these pieces of paper," such as stock certificates.

He sees little reason for optimism about Las Vegas.

"Las Vegas numbers, let's be honest, they're cratering," Ehlers said.

Ehlers is putting his and his investors' money mostly in bank certificates of deposit and Treasuries that are backed by the federal government.

John Futrell, president of Futrell Financial Management, an independent Las Vegas stock brokerage, takes the opposite position on the lessons of the last year.

"The primary lesson was, 'If you had stock in a good company, just hold onto it,'" Futrell said. "Those people who sold out at the lows obviously lost lots of money. The whole market went down to ridiculous levels. When everyone is scared and there is panic, these are opportunities."

Futrell said some of the stocks his firm has been buying for clients had been hit hard, including gaming and financial shares.

Ken Bott, managing director of Chicago Investment Group, a Las Vegas- investment brokerage, is cautiously optimistic.

Sept. 29, 2008, was a "black swan," a highly improbable event, Bott said in e-mail. "It can be compared to the Great Depression sell-off or October 1987 in its rarity and scope."

Since hitting recent lows on March 6, the Standard & Poor's 500 index of the largest publicly held companies is up 60 percent, Bott said.

He points out that the value of the U.S. dollar has gone in the opposite direction as the stock market, declining 14 percent against a basket of currencies.

"Currently we have a weak dollar and stocks and commodities should go higher," Bott said. "And the same should hold true if the situation is reversed."

Randy Garcia, chief executive officer of The Investment Counsel Co. in Las Vegas, takes a more bullish view.

Asked about the stock market's wild ride, Garcia said: "We really viewed this environment as a generational opportunity (to buy stocks at low prices)."

Investors could have hedged against the recessionary plunge last year by holding long-term bonds, he said, but bonds, like stocks, have been bouncing up and down across charts.

The longest-term Treasury bonds, which mature in 30 years, surged 36 percent last year but then collapsed 23.5 percent this year.

"If you held (these), you would have given most of (the gain) back," Garcia said.

Junk bonds fell 37 percent last year and rocketed up 32 percent this year, he said.

"These hedges that you could have had in place in 2008 have very sharp edges," he said.

Asked about his long-term outlook, Garcia said: "It has always cost investors money to be pessimistic in the long run."

Certified public accountant David Turner of Turner Loy & Co. in Reno is not an investment adviser, but he has been watching the varied reactions of clients to stock market volatility.

Some clients have the same investments they had two years ago, he said. That includes clients who hold stock purchased decades ago and who would pay large amounts of taxes on gains that remain despite the sell off. Others have been invested in bonds since about 2000 and did well in recent years.

Still others, he said, sold stock close to the bottom of the market in March and converted their money to cash and have not reinvested in stocks.

Many clients lost hundreds of thousands of dollars over the last year, Turner said. Many of them will not live long enough to deduct it all from "ordinary income" at the maximum rate $3,000 a year. Nor will they ever have enough gains that can be used to offset against the massive losses.

Jag Mehta, an adjunct professor of finance at the University of Nevada, Las Vegas, and a chartered financial analyst, takes an agnostic view of the stock and bond markets.

"Commentators don't know the future anymore than any of us do," Mehta said.

Mehta recommends that investors avoid trying to predict market trends. Instead, he recommends individuals determine the appropriate mix of stocks, bonds and cash. Then, he suggests investors stick with the portfolio allocations, making adjustments to keep stocks, bonds and cash in their appropriate percentages every one to three years.

Here are his key rules:

•Investors in or near retirement should keep enough cash and bonds to pay for living costs for five years to avoid having to sell stocks at depressed prices during a bear market.

•Hold a diversified mix of 30 to 40 stocks in large companies, small companies, different industries, foreign countries and the United States. Alternatively, get diversification through mutual funds and exchange-traded funds.

•Subtract your age from 110 to determine how much to invest in the market. A 60-year-old might hold up to 50 percent of his assets in stocks.

Although that may seem high, Mehta said returns from stocks are two to three times the returns on certificates of deposit over the long term.

"The cost of this return is the fluctuation (in prices)," he said. "If you take that stock-market risk, you get the stock-market return. If you follow my strategy, you're going to double your money every eight to nine years."

Contact reporter John G. Edwards at jedwards@reviewjournal.com or 702-383-0420.