Official sees deeper recession

Southern Nevada's economic recession is expected to worsen from mild to bad in the next couple of years, though most indicators are forecast to show growth relative to a weak 2008, UNLV economist Keith Schwer said Thursday.

A mild recession has an unemployment rate of 7.5 percent or less, while a bad recession is defined by unemployment of 7.5 percent to 15 percent. That's where Las Vegas is headed, topping 10 percent at some point, Schwer told about 200 businesspeople at his annual economic outlook.

"This is not going to be a mild recession," the executive director of the Center for Business and Economic Research at University of Nevada, Las Vegas said. "This is going to look like the bad recessions of the '70s and '80s in terms of unemployment."

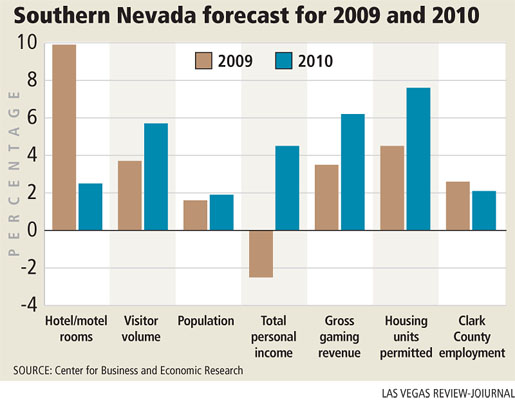

Schwer's forecast for Southern Nevada shows 9.9 percent growth in hotel and motel rooms in 2009, 4.5 percent growth in housing permits and 3.7 percent increase in visitor volume. Only one of the seven categories -- personal income -- is forecast to be negative, down 2.5 percent.

Population and job growth, the drivers of Las Vegas' economy in the 1990s and early 2000s, have slowed dramatically. They're projected to grow 1.6 percent and 2.6 percent, respectively in 2009.

The story line for Las Vegas is "decoupling the myth" that the local economy is somewhat immune to what's going on nationally, he said. That's not true.

Now that gaming is widely available throughout the country, people who get the gambling itch have high-quality casino choices closer to home. Gaming and tourism are discretionary spending, and although Las Vegas weathered down cycles in the past 25 years, the scene is changing, Schwer said.

The question is how will travel trends change.

"What happens here, stays here. That may not be what people are looking for," he said in reference to Las Vegas' advertising slogan. "They may want value. Maybe people are not looking for top shelf. We may have missed our brand here. Our brand used to be value."

Schwer presented charts and graphs on Southern Nevada's leading economic indicators, most of which generally showed steep downward trends from 2006 to 2008.

The construction, tourism and business activity indexes compiled by the UNLV economic research center have all declined from their peaks, though the construction index has turned back up from its low point in January 2008.

Consumer confidence is low and people aren't spending, Schwer said. Big-ticket items such as automobiles and furniture have seen double-digit sales declines. Stores such as Oak World Furniture and M&T Furniture have gone out of business.

Economic pessimism is widespread, according to a business outlook survey conducted by the research center. At the end of November 2007, 28.4 percent of responding companies expected to add employees within the next three months. That fell to 7.2 percent at the end of November this year.

Commercial real estate broker Perry Muscelli said he wasn't surprised by what he heard at the outlook.

"It's interesting to see actual concrete data that substantiates the actual experience in the business community," he said. "Most shocking was 50 percent of homes in Nevada have negative equity. That's a staggering statistic that puts the economy at great risk."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.