Rate cut may benefit some borrowers

The half-point cut in the short-term interest rates is squeezing rates for savers and lenders, but some borrowers may benefit, Southern Nevada financial executives said Wednesday.

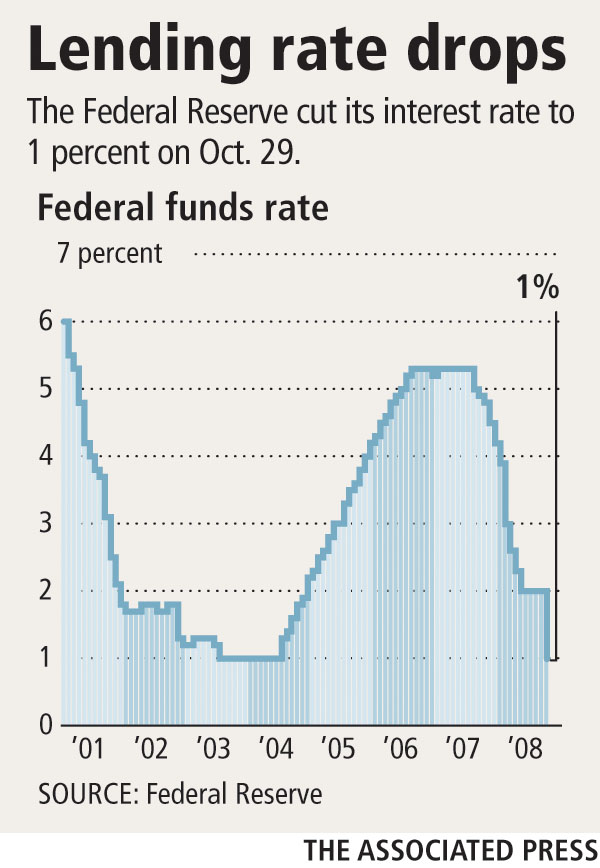

The Federal Reserve Board slashed the fed funds rate that banks charge each other for overnight loans by 0.5 percent to 1 percent, a low last seen in 2003-04. The funds rate has not been lower since 1958, when Dwight Eisenhower was president.

It was the second half-point reduction in the funds rate this month. The Fed slashed the rate by that amount in a coordinated move with foreign central banks on Oct. 8.

In a statement explaining Wednesday's action, the Fed said that the "intensification of financial market turmoil is likely to exert additional restraint on spending, partly by further reducing the ability of households and business to obtain credit."

Federal Reserve Chairman Ben Bernanke and his colleagues pledged that they would "monitor economic and financial developments carefully and will act as needed to promote sustainable economic growth and price stability."

David Jones, chief economist at DMJ Advisors, said the Fed's rate cut will be followed over the next week by similar action in other major countries as they grow more concerned that the recession that began in the United States is spreading to their regions.

As a result, financial executives say some variable-rate business loans will reset at lower rates. But they disagree on whether or how the Fed's action will affect consumer loans and savings.

Western Alliance Bancorporation, the holding company for Bank of Nevada, will cut its rates on home equity loans and credit cards by one-half percent, said Dale Gibbons, Western Alliance chief financial officer.

"It's going to put downward pressure on depository rates as well," Gibbons said. He doesn't expect deposit rates to fall as much as fed funds dropped, however.

Some financial executives disagreed.

"I think (credit card rates) are pretty much disconnected from fed funds rates," said Brad Beal, chief executive of Nevada Federal Credit Union.

Credit card rates are "driven by market risks right now," he said.

Rates on loans and certificates of deposit at the credit union may fall slightly, if at all, Beal said. It's unclear whether CD rates at Southern Nevada banks will decline as a result of the fed funds decrease, said Arvind Menon, chief executive of Meadows Bank.

Many depositors are reluctant to buy CDs because of fear about bank failures despite federal deposit insurance, he said.

"Depositors now are literally gun-shy," Menon said.

Menon believes banks must continue to offer attractive rates to overcome depositor fears of bank failures.

Many banks are offering more than 4 percent on one-year CDs, he said.

"Deposits are key to all of us to continue to lend in this market," he said.

Meadows, which opened earlier this year, and 1-year-old Bank of George, say they have strong loan demand because some of the older community bank have been slower to make new loans than during the boom years.

Local bankers said their banks will lower rates on some variable rate business loans, because of the rate decrease. Other business loans have floors, below which rates will not drop as a result of the Fed's action Wednesday.

While loan margins are getting compressed, "hopefully, that will be offset by the increase in confidence in the local economy and business community," said Diane Fearon, chief executive of Bank of George.

In a statement, Dallas Haun, chief executive of Nevada State Bank, said: "There is no immediate impact, due to the size and complexity of the United States economy. This type of short-term rate adjustment at times takes weeks to be reflected in other rates."

Fixed-rate, 30-year home mortgage loans already fell in expectation of a drop in the fed funds rate and then swung back, said Brock Davis, president of US Express Mortgage.

A typical 30-year, fixed-rate mortgage dropped from 6.5 percent on Oct. 17 to 5.88 percent on Oct. 20, Davis said.

"That's the single biggest (down) swing we've ever seen in 30 years," Davis said. "The rates didn't hold very long."

The fixed rate now has jumped back to the range of 6.75 percent to 6.88 percent, possibly because lenders were starting to fear a pick up in inflation, he said.

The Associated Press contributed to this report.