Report: Nevada No. 2 for default notices, auctions, bank repos

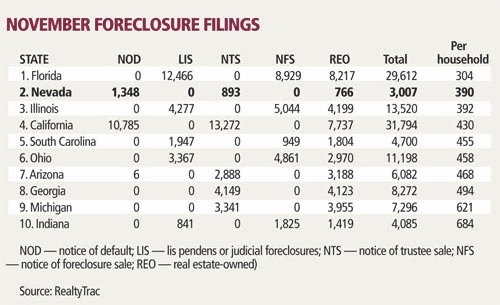

Nevada ranks No. 2 in the nation, behind Florida, for default notices, scheduled auctions and bank repossessions in November, RealtyTrac online listing service reported Thursday.

The firm reported one foreclosure filing per 390 households in Nevada, down 9.8 percent from the previous month and a 53.8 percent decrease from November 2011.

Florida posted the nation's highest foreclosure rate for the third month in a row, with one in every 304 housing units with a foreclosure filing in November.

Nevada saw 1,348 notice of default filings, which start the foreclosure process, and 893 notices of trustee sale in November. Real estate-owned properties, or homes taken back by the bank, totaled 766.

RealtyTrac's report showed 180,817 U.S. properties receiving foreclosure filings - default notices, scheduled auctions and bank repossessions - in November, a decrease of 3 percent from October and down 19 percent from a year ago.

It's the 26th consecutive month of year-over-year decreases in foreclosure activity.

"The drop in overall foreclosure activity in November was caused largely by a 71-month low in foreclosure starts for the month, more evidence that we are past the worst of the foreclosure problem brought about by the housing bubble bursting six years ago," said Daren Blomquist, vice president at Irvine, Calif.-based RealtyTrac.

"But foreclosures are continuing to hobble the U.S. housing market as lenders finally seize properties that started the process a year or two ago - and much longer in some cases. We're likely not completely out of the woods when it comes to foreclosure starts, either, as lenders are still adjusting to new foreclosure ground rules set forth in the National Mortgage Settlement along with various state laws and court rulings."

The full report can be found at www.realtytrac.com. Highlights include:

- Foreclosure starts were down 13 percent from the previous month and down 28 percent from a year ago to the lowest level since December 2006.

- Bank repossessions (real estate-owned) increased 11 percent from the previous month and were up 5 percent from November 2011, a nine-month high and the first year-over-year increase in REOs since October 2010.

- Despite the national decrease in foreclosure activity - driven largely by big year-over-year drops in California, Nevada, Georgia, Michigan, Texas and Arizona - foreclosure activity increased from a year ago in 23 states and the District of Columbia.

- Among the five lenders involved in the National Mortgage Settlement - Bank of America, Wells Fargo, JPMorgan Chase, Citi and Ally GMAC - nonjudicial foreclosure activity decreased 41 percent in November compared to a year ago, led by Bank of America with a 63 percent decrease and Citi with a 40 percent decrease.

- REO numbers decreased annually in 21 states, including Nevada (64 percent), Oregon (58 percent), Massachusetts (49 percent), Utah (47 percent), and Tennessee (22 percent).

In a separate report, Las Vegas-based Auction Control Systems counted 1,146 notices of defaults filed in Las Vegas in November, down 14 percent from 1,339 in October.

At trustee auction, 266 homes were purchased by third parties; 338 were sold back to the bank (REO); and 418 were canceled.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.