Report: Southern Nevada retail recovery seen first

Southern Nevada's commercial real estate market is showing signs of improvement, though a second-quarter report from brokerage Colliers International suggests a roller coaster ride into 2012.

Retail could be the first sector to benefit from an increase in gaming revenue and visitor volume, Colliers research director John Stater said Thursday. That would lead to more hiring, especially at retail shops on the Strip, though not necessarily in the suburbs, he said.

The U.S. economy is driven by consumer spending, and Las Vegas is even more dependent on it, Stater said.

"If people are spending more, there should be more employment in retail, but we haven't seen it yet," the Colliers analyst said. Any drop in the unemployment rate is probably because people stopped looking for work, he said.

Although employment figures and real estate values remain stagnant, economic improvement on the Strip is boosting companies in the southwest and west central sub-markets of the Las Vegas Valley that supply goods and services to the resort corridor.

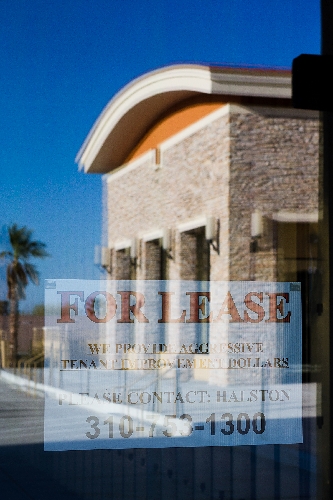

The retail market, which appeared to be heading toward recovery last year, has instead gone through two consecutive quarters of negative absorption and rising vacancy, which now stands at a record high of 12.1 percent.

"The problem with retail right now is a lot of empty anchor space and really nobody to fill it," Stater said. "That can only be solved by large national and regional chains moving in or returning to Southern Nevada."

Average retail asking rent is $1.48 a square foot per month, down 7 cents from the first quarter and a 17-cent decrease from a year ago, Colliers reported.

Southern Nevada's office vacancy rose to 24.5 percent in the second quarter, compared with 23.8 percent a year ago. The market has posted an absorption deficit of 382,000 square feet over the past eight quarters.

Office rents fell 5 cents from the previous quarter to $2 a square foot on a full-service gross basis.

"Office and retail rents still have a ways to go before hitting bottom," Stater said. "As you get more properties in default sold, they put downward pressure on rents."

While there were no new completions during the second quarter, the new 300,000-square-foot Las Vegas Metropolitan Police headquarters under construction at Martin Luther King Boulevard and Alta Drive is scheduled for completion in the coming quarter.

On the industrial side, vacancy climbed to 15.5 percent in the second quarter, up from 15.3 percent a year ago, and asking rent dropped 3 cents, to 53 cents a square foot. Industrial net absorption was 207,667 square feet, a reversal from negative absorption in the previous and year-ago quarters.

"The tide appears to have finally turned for Southern Nevada's industrial market," Stater said. "While we are not yet willing to declare a recovery trend, we are willing to declare that the downturn that started in 2008 is essentially over."

Although vacancy remains high, companies such as U.S. Micro are building facilities to suit their own needs, suggesting that a good portion of empty industrial space is not desirable for companies looking to establish operations in Las Vegas.

Multifamily vacancy fell to 8 percent in the quarter, down from 8.5 percent in the prior quarter.

The big news was the commercial auction in May that saw non-performing notes on nine apartment complexes change ownership. Investors may have purchased those notes with the intent of selling them at a profit in the near term, Stater said.

Generation X and baby boomers are both showing a predilection for renting, the first demographic being suspicious of home ownership after the housing crash and the latter group preferring a lifestyle unfettered by a mortgage, Stater said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.