Reverse mortgage leaves borrower stunned and stuck

His wife is deceased, he just underwent back surgery and now William Lancaster is told he owes $170,000 on a reverse mortgage for a home that's worth $130,000 tops.

So much for his plans to move back to New Jersey and live with his grandchildren.

Lancaster is stuck in Las Vegas with a financial disaster created when he took out a home equity conversion mortgage, also known as a reverse mortgage, on his east Las Vegas home in 2005.

San Francisco-based Financial Freedom Senior Funding Corp. paid off his $54,000 mortgage and gave him a $60,000 line of credit, which now has a balance of less than $1,000. The latest monthly statement from the lender shows a payoff of more than $170,000.

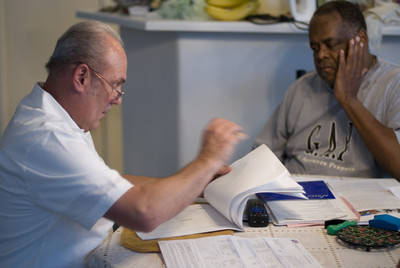

"I'm still a little baffled with what actually happened," Lancaster, 72, said as he sat at his living room table thumbing through paperwork. "I figured I had some equity, but I don't have any. They have it all. I owe them."

Dave Berard, broker and owner of Black Mountain Realty, said there's no way he can sell Lancaster's house for $170,000. A bank repossession down the street is listed at $157,000 and hasn't had an offer, he said.

The Realtor found "ridiculous" closing costs in documents from Financial Freedom, including $2,600 for mortgage insurance and $4,800 set aside for a service fee.

"So approximately $50,000 to $60,000 in interest in two years? That's insane," Berard said. "If mortgage companies are going to do these, why can't they set aside money for an attorney and let the attorney go over this (contract)?"

Older Americans who are considering taking out a reverse mortgage on their homes need to be careful to make sure they understand all of their contractual obligations, a local expert on the program said.

With today's rapidly rising cost of living, many seniors are looking at a number of options to supplement their income. Reverse mortgages have become a viable source, said Jeff Carter, director of reverse mortgages for Omni Home Financing in Las Vegas.

"I think there is still a lot of fear by seniors who are afraid that having a reverse mortgage means the lender can come and take away their home," Carter said. "That is not true. The homeowner always retains title of their property and can choose to sell the home at any time."

As for Lancaster's situation, Carter said he'll still be able to live in the home without making any payments and he's already taken out $60,000 in equity. Interest on the loan, at 5.5 percent, is about $7,000 a year. Lancaster could have made monthly interest payments to the lender to keep the balance at about $120,000, Carter said.

Reverse mortgages are increasing as aging Americans have come to depend on home equity to offset minimal Social Security payments and underfunded retirement plans.

Baby boomers are turning 60 years old at a rate of one every 7.5 seconds. Americans older than 65 will outnumber teenagers by more than 2-to-1 in 2025, The World Health Network predicts.

The number of reverse mortgages soared from 37,000 in 2004 to 107,000 in 2007, Carter noted. Borrowers must be at least 62 years old and live in the home to qualify. They can take the money in a lump sum, line of credit or regular monthly payments.

The state attorney general's Bureau of Consumer Protection issued a warning for seniors to get the facts before considering a reverse mortgage.

Unlike a regular mortgage, which is repaid in monthly installments, the reverse mortgage generally does not have to be paid back as long as the borrower remains in the home.

As with anything that sounds too good to be true, there is a catch, said Eric Witkoski, consumer advocate for the attorney general. While borrowers are generally not required to repay these loans as long as they are living and remain in their homes, once they die or permanently leave their homes, the property essentially belongs to the lender.

"Some are more regulated by HUD (the Department of Housing and Urban Development) and FHA (the Federal Housing Administration) and some aren't following all the rules," Witkoski said. "You have mortgage brokers who aren't making much money right now, so they're looking for other kinds of business."

Under a typical arrangement, the lender places a lien on the property in exchange for the cash given to the homeowner, which allows the lender to recoup the loan, fees and interest by selling the vacated home.

This will significantly reduce or even eliminate any inheritance that would otherwise go to the borrower's survivors. That's usually the biggest argument against taking a reverse mortgage.

Berard said he gets calls all the time from older people who had few alternatives and didn't ask a lot of questions when it came time to sign the papers.

"They trust you," he said. "Even in my business, people just sign, even people in their 40s and 30s. When they're 65, they're not going to read it. 'You can live in your house debt-free,' and then you get this (Lancaster's case). I'm a little negative on reverse mortgages.

"We may see in the future we may have another minor catastrophe going on, not subprime mortgages, but reverse mortgages."

Carter said the attorney general's warning is misleading because no lender wants to own the home. They want to be repaid as they sell the home. Typically, the bank only loans 65 percent to 70 percent of the home's value to anyone age 70 or older.

Also, it's a nonrecourse loan, which means the bank cannot go after surviving family members for payment. If the home doesn't sell for enough to cover accrued interest, the lender and FHA take the loss, the mortgage director said.

The FHA mandates a ceiling of 2 percent of the home's value for origination fees and charges 2 percent as an insurance policy, he said. The loans have a variable rate interest, usually tied to one-year U.S. Treasury bills.

"There are unscrupulous people who get people into a reverse mortgage and then suggest using the money in other investment vehicles," Carter said.

A lot of people think their home must be owned free and clear to get a reverse mortgage. That's also a fallacy, Carter said. Homeowners can use reverse mortgages to pay off their current mortgage and eliminate monthly payments.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.