SkyVue wheel plan grounded, but developer hopes to profit regardless

The SkyVue observation wheel never turned on the south Strip. But Las Vegas developer Howard Bulloch hopes to turn a profit nevertheless.

Signs at the site of the never-built wheel, across from Mandalay Bay, advertise the 38.5-acre land parcel for sale. Las Vegas Stripfront land is rare and a space that size could accommodate a casino project.

Although a published report suggests Bulloch is seeking $10 million per acre, gauging what the land will fetch is tricky. Local observers said recently that Strip land prices can vary widely and price estimating is difficult.

SkyVue, which had its groundbreaking in May 2011, had many fits and starts.

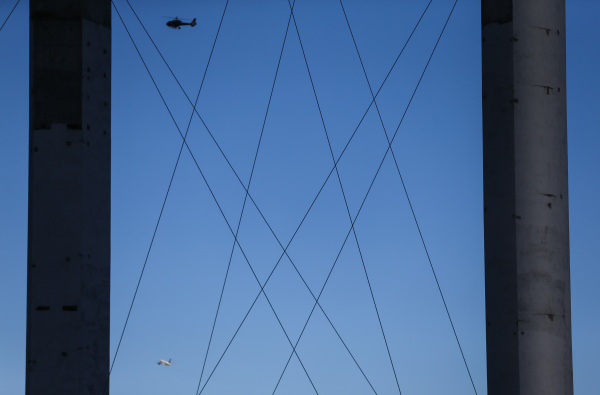

Bulloch envisioned spending $300 million to build a 500-foot-tall wheel with 140,000 square feet of retail, dining and entertainment. SkyVue's foundation was poured in March 2012 and two 247-foot-tall pillars were built soon after.

But progress stalled. Bulloch once forecast SkyVue would open July 4, 2013, but later pushed the opening date to Dec. 31, 2014, and then to mid-2015. Despite several cash infusions, including $64 million in loans and equity investments from Seattle businessman Wayne Perry, SkyVue died.

In a recent email, Bulloch said improvements to other properties near the parcel, including Mandalay Bay's convention center expansion, The Hotel at Mandalay Bay's transformation of into the Delano, MGM Resorts International's planned festival space and the MGM Resorts-Anschutz Entertainment Group arena encouraged him to field offers for the parcel.

He added that the wheel would have occupied only 3.5 acres.

"As the market improved and the other sales have taken place, we decided to consider offers on the entire property instead of putting a permanent structure on a fraction of the property, when someone master-planning this site may not want a wheel," he said.

Bulloch said he had no timeline for a sale and is open to market offers.

To complement his message, Bulloch forwarded a 64-page offering memorandum from Cushman & Wakefield, a real estate investment company, that included color pictures and statistics on the SkyVue land and Las Vegas' tourism and hotels.

Turning to Strip land prices, Brian Gordon, a principal in research company Applied Analysis, said CBRE listed the unfinished Fontainebleau site for $650 million, or about $29.5 million per acre. Corporate raider Carl Icahn bought Fontainebleau, once imagined as a $3 billion hotel-casino project, out of bankruptcy for $150 million in 2010.

Furthermore, Gordon said, the Las Vegas Convention and Visitors Authority bought the Riviera site earlier this year for about $7 million an acre.

Step back a year, and price gauging gets muddier. In August 2014, when Australian billionaire James Packer's Crown Resorts Ltd. paid $280 million for the 35-acre New Frontier site, across from Wynn Las Vegas. Alon Las Vegas, a hotel-casino project led by Packer and former Wynn Resorts Ltd. executive Andrew Pascal, is planned for that site.

Based on that deal, MGM Resorts International Chairman Jim Murren pegged the value of Strip land at $9 million per acre. Union Gaming Group, citing sources close to the transaction, pegged Strip land prices even higher, at $15.2 million per acre.

"Quantifying the value associated with (the SkyVue) location is something that the end user will ultimately determine," Gordon said. "It becomes a function of what can be developed on the site and what's feasible from a development perspective. Without knowing the specific plans, it would be difficult to determine what a buyer would ultimately be willing to pay."

Silver State Realty & Investments owner-broker Christopher Beavor said the SkyVue parcel's nearness to McCarran International Airport would probably require any project to get Federal Aviation Administration approval. Also, he said, the project's height could be restricted, although Cushman & Wakefield's offering memorandum cited an approved height allowance of up to 505 feet.

Beavor predicted the SkyVue land could fetch $1 million to $2 million an acre if a midlevel hotel developer bought it, or up to $4 million an acre if an experienced, high-profile casino developer pounced, think MGM Resorts or Wynn Resorts.

Colliers Gaming Group consultant Josh Smith said the timing could be favorable for a SkyVue land sale. First, he said, north Strip projects show the market is recovering. Alon Las Vegas is in progress, Genting Group is developing the $4 billion Resorts World project on the former Boyd Gaming Corp. Echelon Place site and lodging giant Starwood Resorts Worldwide agreed to rebrand a tower at SLS Las Vegas as a W-branded hotel.

Also, Smith said, more investors are showing interest in valley real estate.

"Today we're seeing a lot of people kicking the tires on whether it's the right time to build a resort," he said.

Furthermore, increasing visitor volume and improving market dynamics could benefit a SkyVue-site hotel, Smith said. Las Vegas now draws more than 41 million visitors annually, which will boost hotel room demand. Although Alon Las Vegas and Resorts World will add rooms to Las Vegas' market, the closures of the Riviera and Las Vegas Club this year and the Westgate's conversion of some rooms to time shares last year, subtracted them.

"Increasing demand for rooms plus the loss of room nights to the market might be the perfect scenario," Smith said.

Find Matthew Crowley on Twitter @copyjockey