Stocks sink again on fears virus will stunt economy

Stocks sank again Tuesday on Wall Street, piling on losses a day after the market’s biggest drop in two years as fears spread that the growing virus outbreak will put the brakes on the global economy.

The latest wave of selling came as U.S. health officials called on Americans to be prepared for the disease to spread in the United States.

“It’s not so much a question of if this will happen anymore, but rather more a question of exactly when this will happen and how many people in this country will have severe illness,” Dr. Nancy Messonnier of the Centers for Disease Control and Prevention said in a call with reporters.

The CDC’s call for Americans to be prepared added new urgency to response efforts that, until this week, focused on a disease largely confined to China, where it originated, and neighboring countries.

In other developments Tuesday:

■ The number of new cases in South Korea jumped again Wednesday, and the first U.S. military member tested positive, with his infection and many others connected to a southeastern city where the outbreak has clustered.

South Korea’s Centers for Disease Control and Prevention said 134 of the 169 new cases were confirmed in Daegu, where the government has been mobilizing public health tools to contain the virus. A further 19 cases were in neighboring North Gyeongsang province towns.

A U.S. military statement said the 23-year-old soldier who tested positive was in self-quarantine at his off-base residence. He had been based in Camp Caroll, in a town near Daegu, and visited Camp Walker in Daegu earlier this week.

The military said South Korean authorities and U.S. military health professionals are tracing his contacts to determine whether other people may have been exposed.

■ New clusters of the illness popped up far from China, causing increased concerns for officials in some of the wealthiest nations in Europe and Asia as well as in countries with far fewer resources. But many remained uncertain about how best to contain it.

The new outbreaks were reported in places as far-flung as Italy and Iran, France and Algeria and Spain’s Canary Islands. The tiny Persian Gulf nation of Bahrain said it had 17 cases, including a school bus driver who had transported students as recently as Sunday.

■ The virus’ toll continued to mount, even as Chinese officials reported a slowing in the number of new cases. As of Tuesday, the spread of the illness had sickened some 80,000 people worldwide and caused about 2,700 deaths.

Meanwhile, more U.S. companies, including United Airlines and Mastercard, warned that the outbreak will hurt their finances.

The worst-case scenario for investors, in which the virus spreads around the world and cripples supply chains and the global economy, hasn’t changed in the past few weeks. But the probability of it happening has risen, said Yung-Yu Ma, chief investment strategist at BMO Wealth Management.

“It’s the combination of South Korea, Japan, Italy and even Iran” reporting virus cases, Ma said. “That really woke up the market, that these four places in different places around the globe can go from low concern to high concern in a matter of days and that we could potentially wake up a week from now and it could be five to 10 additional places.”

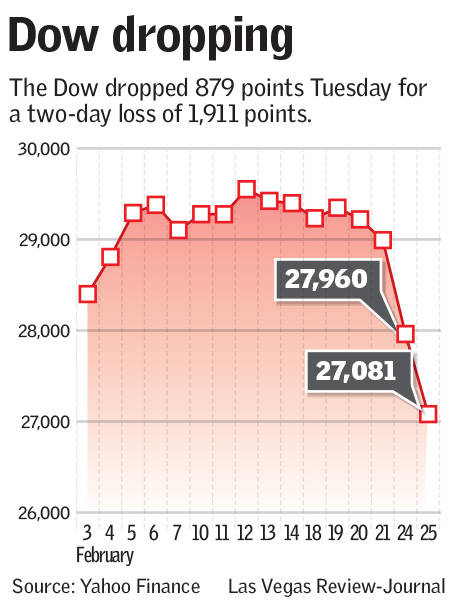

The Dow Jones Industrial Average fell 878 points, or 3.1 percent, to 27,081. The S&P 500 fell 97 points, or 3 percent, to 3,128. The Nasdaq lost 255 points, or 2.8 percent, to 8,965.

European markets also fell. The Euro Stoxx index lost 2.1 percent. Markets in Asia were mixed.

Monday’s sell-off sent the Dow more than 1,000 points lower and wiped out its gains for the year. The S&P 500 is now down 7.7 percent from its record high set last Wednesday and is also in the red for 2019.

Technology stocks, which rely heavily on China for both sales and supply chains, once again led the decline. Apple dropped 3.3 percent, and chipmaker Nvidia fell 4.7 percent.

Travel-related stocks also took another drubbing, bringing the two-day loss for American Airlines to 16.8 percent.

Bond prices continued rising. The yield on the 10-year Treasury fell as low as 1.31 percent, a record, according to TradeWeb, before recovering somewhat to 1.32 percent in the afternoon. That’s down from 1.37 percent late Monday and far below the 1.90 percent it traded at in early 2020.

The lower bond yields, which force interest rates lower on mortgages and other loans, weighed on banks. JPMorgan Chase slid 4.5 percent, and Bank of America fell 5.3 percent.

Energy companies fell as crude oil prices headed lower. Real estate companies and utilities also declined, though they held up better than the rest of the market as investors favored safe-play stocks.

United Airlines tumbled 6 percent after withdrawing its financial forecasts for the year because of the impact on demand for air travel. Mastercard dropped 6.6 percent after saying the impact on cross-border travel and business could cut into its revenue, depending on the duration and severity of the virus outbreak.

Moderna surged 31.4 percent after the company sent its potential virus vaccine to government researchers for additional testing. The biotechnology company is one of several drug developers racing to develop a vaccine.

The S&P 500 is on track for its first four-day losing streak since early August. One measure of fear in the market, which shows how much traders are paying to protect themselves from future swings for the S&P 500, touched its highest level since the start of 2019, when stocks were tumbling on worries about a possible recession.