Study shows foreclosures rising

The drumbeat of bad news on residential mortgages continued Thursday as the Mortgage Bankers Association reported that new foreclosures and past-due loan numbers increased in Nevada during the quarter ending June 30.

Nevada is faring better than many states in some ways and worse in others, the association reported.

The Silver State ranked 25th in delinquencies and 13th in foreclosure inventory on June 30, the association said.

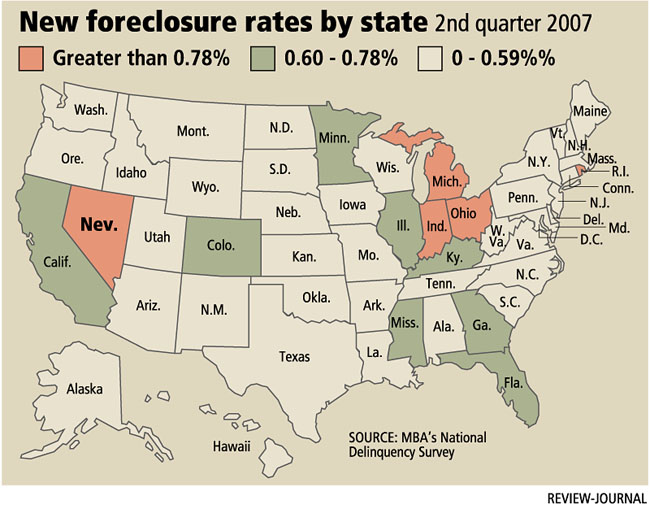

Yet Nevada is among five states with new foreclosures representing more than 0.78 percent of the total. In Nevada, 0.89 percent of all mortgage loans are going into foreclosure. Other states with large increases in new foreclosure starts were Ohio, Michigan, Indiana and Rhode Island.

Association chief economist Doug Duncan also lists Nevada among states with mortgage loan problems so onerous they are driving up numbers nationally.

"What continues to drive the national numbers," Duncan said, "is what is happening in the states of California, Florida, Nevada and Arizona. Were it not for the increases in foreclosure starts in those four states, we would have seen a nationwide drop in the rate of foreclosure filings."

Duncan counted 34 states with declining rates of foreclosure.

The same four states have more than 19 percent of the nation's subprime adjustable-rate mortgages. Subprime loans are those made to borrowers with below standard credit ratings. Adjustable-rate mortgages adjust their interest rates periodically to reflect changes in market rates, as contrasted to fixed-rate mortgages that remain unchanged for the life of the loan.

More than 2 million families are facing the prospect of seeing their adjustable mortgage payments rise sharply over the next two years, possibly to levels that many will be unable to pay.

Mark Zandi, chief economist at Moody's Economy.com, said defaults will not peak until next year, reflecting a wave of introductory mortgages that are just now resetting from low "teaser" rates. Those resets can in many cases mean an extra $250 to $300 in higher monthly payments on the typical $1,200 monthly mortgage.

Bill Ochs Jr., owner of Nevada Mortgage, blames a large portion of the problem loans on investors.

"Speculators and investors came from anywhere and everywhere just to see if they could make a fast buck (in Nevada)," Ochs said.

Now, speculators are defaulting on mortgage loans, he said, mentioning one investor who allowed 40 single-family homes to go into foreclosure.

As investor-owned mortgages are foreclosed, their houses are being dumped on the market, driving down the appraised value of other houses in the neighborhood and making it difficult for homeowners to refinance, Ochs said.

The association report showed the number of homeowners who got foreclosure notices in the April-June quarter hit an all-time high of 0.65 percent, up from 0.58 percent in the first three months of the year. It was the third consecutive quarter that a record has been set.

In Nevada, 4.41 percent of residential mortgages were past due as of June 30. That's an additional 0.82 of a percentage point more than at the end of March, according to association.

Delinquency rates usually decline in the first quarter and rise in the second quarter, because of seasonal factors, the association said.

The percentage of mortgages going into foreclosure during the second quarter rose 0.13 of a percentage point to 0.89 percent, according to the association. The number of loans in the foreclosure process at the end of the quarter climbed 0.41 of percentage point to 1.57, according to the association's survey.

Nationally, foreclosure was started on 0.65 percent of loans during the months ending June 30, the highest in the history of the association survey. That's up 0.07 of a percentage point from the first quarter The percentage of loans in the foreclosure process was 1.4 percent, up 0.12 of a percentage point.

The delinquency rate for mortgage loans nationally hit 5.12 percent after seasonal adjustments, up 0.28 of a percent from the first quarter.

The Associated Press contributed to this report.

NEVADA STATISTICS AT A GLANCE

Delinquency rate for mortgage loans: 4.41 percent, up 0.68 percent.

Percentage of loans being foreclosed: 0.89 percent, up 0.13 percent.

Percentage of loans in foreclosure: 1.57 percent, up 0.41 percent.