Taxable sales in Nevada, Clark County rise

Looks like this growth trend is real.

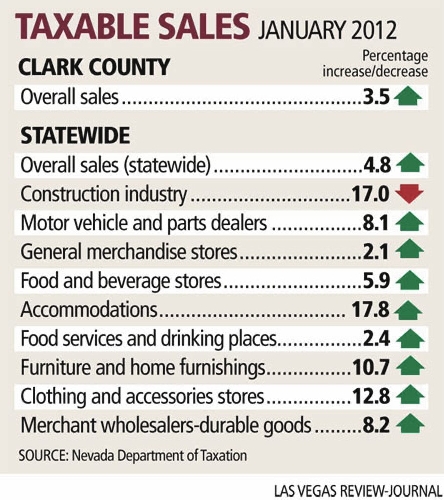

Taxable sales numbers released Thursday showed tidy gains in goods sold by merchants across Nevada and Clark County. Statewide taxable sales came in at $3.15 billion in January, up from $3 billion a year earlier, the state Department of Taxation reported. Sales in Clark County jumped to $2.33 billion, up from $2.25 billion in January 2011.

It was the ninth straight month of local gains, and, notably, the second consecutive January with growth. After cratering at $2.12 billion in January 2010, Clark County's sales spiked 6 percent in January 2011, and 3.5 percent a year later. No longer is the sales base increasing year-over-year merely because numbers are weighed against recession-era lows. Expansion is officially under way.

"These are respectable gains in any environment. They suggest the market is experiencing increased stability, and consumers are feeling much more comfortable than they did a couple of years ago," said Brian Gordon, a principal in local research firm Applied Analysis.

Virtually every major sales category in Clark County saw improvements.

Sales in bars and restaurants, which made up 28.4 percent of January's total, jumped 2.9 percent, to $663 million. Sales among dealers of cars and car parts, which accounted for 9.6 percent of all sales, rose 8 percent, to $224.3 million. Clothing and accessories stores, which rang up 10.2 percent of all sales, posted a 13.3 percent increase, to $236.9 million.

Other categories seeing bigger-than-average gains were merchant wholesalers of durable goods such as sporting equipment and factory machines, up 4.3 percent to $109.1 million; furniture stores, up 13.4 percent to $46.1 million; grocery stores, up 7.4 percent to $81.7 million; and retail sales inside hotels and motels, up 18.2 percent to $6.6 million.

Construction sales slid 31.4 percent, to $31.8 million. But the slump wasn't a huge drag because the sector was behind just 1.4 percent of sales.

Despite improvements, sales remain well off of their peak.

January sales hit a high of $3.7 billion statewide and $2.8 billion countywide in 2007. The most recent numbers were 15 percent below their statewide record for the month, and 16.4 percent below their apex in Clark County.

And for many businesses, improving sales don't mean a healthier bottom line.

At Silver Post in the Las Vegas Outlet Center on Las Vegas Boulevard South, foot traffic has gained 5 percent to 10 percent in the past six months, and sales are up around 10 percent to 12 percent year-over-year, said owner Aaron Sidranski. But profit hasn't budged for the store, which sells cowboy boots, moccasins and Native American-made jewelry. Blame discounts: Silver Post has slashed prices on its knives and belt buckles in half, and cut jewelry prices by as much as 25 percent. The story's the same at the store's sister company, De Trading Post in Boulder City.

Sidranski said he and his parents, who own De Trading Post, would never have discounted so heavily five years ago. Today, they have little choice. Years of discounting by major retailers and the rise of online coupon sites have conditioned U.S. shoppers to buy only on sale.

"We've educated the consumer to be looking for deals now," Sidranski said. "We have people asking us if we give a locals discount or a military discount. Even I'm doing it: I just bought a king-sized bed with a box spring and mattress, and I haggled the price down to $1,000."

For now, Canadians are saving Silver Post's bacon. They now make up about 30 percent of the store's sales, up from 10 percent two years ago. Canadians are spending bigger, as well, averaging $300 to $500 in purchases, compared with about $100 for U.S. shoppers. Sidranski said the surge in Canada's dollar against the U.S. dollar is behind the boost. U.S. consumers also remain too beleaguered to spend much.

"I think people are just way more cautious than they were five years ago, when they were just refinancing their houses and buying stuff," he said.

And that's not necessarily a bad thing, says Steve Brown, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas.

From 2002 to 2007, growth in consumer spending outstripped income gains as shoppers tapped home equity for buying binges. Mortgage-backed sales spikes couldn't last, Brown said. Nor are they possible for underwater homeowners now. Today's year-over-year sales increases of 3.5 percent may not dazzle as much as pre-recession jumps, but they're better for long-term economic health, he said.

"We're seeing a more conservative growth that's more sustainable," Brown said. "It's a growth rate we can be comfortable with."

Revenue from sales and use taxes helps fund prisons and schools. Gross revenue collections were up 6 percent in January, rising to $248.5 million.

Contact reporter Jennifer Robison at jrobison@review

journal.com or 702-380-4512. Follow @J_Robison1 on Twitter.