Unemployment numbers bring more bad news for Las Vegas recovery

Employers stopped adding jobs in August, an alarming setback for an economy that has struggled to grow and might be at risk of another recession.

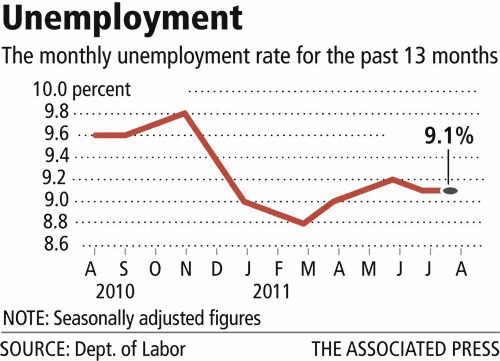

The government also reported that the unemployment rate remained at 9.1 percent. It was the weakest jobs report since September 2010, and it portends weak job growth in Southern Nevada.

"There is no silver lining in this one," said Steve Blitz, senior economist at ITG Investment Research. "It is difficult to walk away from these numbers without the conclusion that the economy is simply grinding to a halt."

The private sector, including the leisure and hospitality industry, added jobs nationwide, said Steve Brown, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas. But cuts in government jobs canceled out new hires elsewhere for a flat report overall. Brown said he expects state jobless numbers to look similar when released on Sept. 16.

Nevada's jobs base has continued to shrink year over year. The state Department of Employment, Training and Rehabilitation reported a 0.5 percent annual decline in jobs statewide in July.

"From the lows we saw during the recession, we have not seen any material gains overall, so we're continuing to climb out of a very big hole," said Brian Gordon, a principal with the Las Vegas consulting and research firm Applied Analysis. "The recovery cycle is elongated and will be measured in years and not months, so we have a lot of work to do in terms of the overall job market.''

In fact, it's not clear that Las Vegas ever emerged from recession.

Sure, there are positive signs in pockets of the local economy. Sectors including leisure and hospitality, business services, education and health care are posting job gains. Taxable sales, average daily room rates and visitor volumes have improved in recent months.

"But I'm not sure I'd say we have a recovery," Brown said. "I'd say we have the elements of a recovery. It's not something that seems to be extending to all areas of the economy, and the areas that are doing well aren't doing well enough, at least in terms of employment, to offset losses elsewhere."

Nor do local observers see a lifeline for Nevada's unemployment woes.

Recessions spurred by financial crises last longer than downturns from other causes, Brown said. The United States -- and Nevada -- could see two more years of flat job markets before hiring turns upward noticeably.

Total payrolls across the nation were unchanged in August, the first time since 1945 that the government has reported a net job change of zero.

Fears that the United States will slip back into recession have been rising since the government reported that the economy barely grew in the first half of the year. Consumer and business confidence has been sapped by the political standoff over the federal debt limit, a downgrade in the U.S. government's credit rating and a debt crisis in Europe.

Brown said he doesn't expect a double-dip recession. He predicted that the nation's economy would expand fairly quickly in the fourth quarter. That would be good news for Las Vegas, where the tourism sector has managed to expand throughout 2011 despite a stalled national economy, Brown said.

Stronger tourism will only help so much, as jobs in construction and the public sector keep sliding, Gordon said.

"Performance measures within the (leisure and hospitality) sector are up, and the sector is reporting job growth," he said. "The ripple effect of those investments will ultimately pay dividends for Southern Nevada. But diversification of the employment base, which is a much longer-term prospect, will be required to expand the economy in other areas."

National job growth was sputtering before it stalled last month. The economy produced an average 166,000 a month in the first quarter, 105,000 a month in the second quarter and 28,000 a month in the third quarter, said John Silvia, chief economist at Wells Fargo.

The job numbers for August will put more pressure on the Federal Reserve, President Barack Obama and Congress to find ways to stimulate the economy. Fed Chairman Ben Bernanke has been reluctant to try a third round of bond purchases to jolt the economy by further lowering long-term interest rates.

Obama next week will address a joint session of Congress to introduce a plan for creating jobs. But House Republicans have resisted more stimulus spending.

The economy needs to add roughly 250,000 jobs a month to rapidly bring down the unemployment rate, which has been above 9 percent in all but two months since May 2009.

In August, the private sector added 17,000 jobs, the fewest since February 2010. That compares with 156,000 in July and 75,000 in June.

"The stagnation in U.S. payroll employment is an ominous sign," said Paul Ashworth, an economist at Capital Economics. "The broad message is that even if the U.S. economy doesn't start to contract again, any expansion is going to be very, very modest and fall well short of what would be needed to drive the still elevated unemployment rate lower."

This report includes material from The Associated Press. Contact Jennifer Robison at jrobison@reviewjournal. com or 702-380-4512.