Public employees and the magic of compounding

I remember, when I started covering local governments nearly 40 years ago, being taken aside and politely "educated" to the fact that, yes, public employees did have excellent job security, attractive health insurance, cost of living and longevity raises and a decent pension plan, but that was to offset the low pay scale. Otherwise, no one would take a government job, I was informed.

There is no denying the inexorable law of compounding. You know the law of compounding, right?

It is illustrated by the tale of the farrier, who, when the farmer balked at his price for shoeing a horse, offered to accept pay per nail. The first would cost only a penny, the second would cost double that and the third double that and so on.

Sounds reasonable, until you calculate the 28th nail would cost more than $1 million.

Amid the turmoil in Wisconsin and other Midwestern states over public employee wages, benefits and collective bargaining rights, there have been a number of newspaper accounts of the ever-widening gap between what the private employee is paid and his public-sector "servant."

It started with a New York Times-sponsored study showing state government employment was more lucrative than private-sector work for comparable positions. Nevada's gap was the fourth-highest for jobs that do not require a college degree and third-highest for those that do.

Next, USA Today looked at the gap between state and local government workers and the private sector. The newspaper found that, on average, the Nevada government worker is paid 35 percent, or $17,815 more than those working for private businesses in the state, the widest gap in the nation. That doesn't even take into account the difference in pensions and benefits. (According to the Bureau of Labor Statistics, state and local government workers nationwide have a total benefits package nearly 70 percent higher than those in private industry.)

The Las Vegas Chamber of Commerce also published its third annual report on public employee pay. It found Nevada state and local government employees are the ninth highest-paid in the nation, with average pay in 2009 that was 13 percent higher than the national average for public workers.

Yet, in Wednesday's Review-Journal, Al Martinez, president of Service Employees International Union Local 1107, which represents 9,500 Clark County workers, was quoted as saying in response to calls for further budget cuts due to declining tax revenue, "We need to hold the line and maintain what we have." The county is expected to ask its unionized workers for slight reductions in salaries in order to avoid further layoffs.

In a Review-Journal editorial board meeting earlier in the week, state Senate Majority Leader Steven Horsford, D-Las Vegas, had a different take on the situation than Martinez.

"On the issue of local pay," Horsford said, "and I think that this has to be talked about, why is it OK that teachers are going to be asked to take a 5 percent pay cut? What are we asking local government to take? How come we're singling out teachers.

"I think local government needs to be asked how it spends $16 billion of our money, and I think they need to justify why their pay is 25 percent more than the national average."

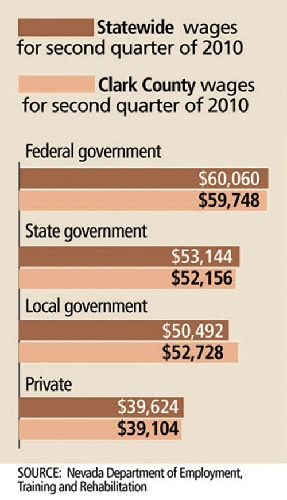

According to state Department of Employment, Training and Rehabilitation data from the second quarter of 2010, the latest available, the average local government worker in Clark County is paid 35 percent more than those in private employment, while the state government worker here is paid 33 percent more. The average federal government employee is paid 53 percent more. Don't forget those benefits.

They got there one nail at a time.

Thomas Mitchell is senior opinion editor of the Review-Journal. He may be contacted at (702) 383-0261 or via e-mail at tmitchell@ reviewjournal.com.