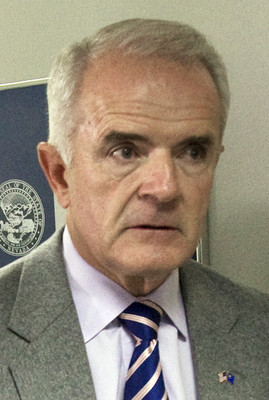

Gibbons: Tax hikes spur joblessness

CARSON CITY -- Gov. Jim Gibbons blamed Nevada's unemployment growth in July on legislators who backed $780 million in tax increases over his vetoes.

"I warned them against raising taxes," Gibbons said Tuesday after a state Board of Examiners meeting.

Gibbons said it made no sense to hit business owners with higher taxes at a time when they are struggling because of the nationwide recession.

He offered no evidence proving that the June-to-July unemployment rate increase was because of increased taxes rather than the deepening recession.

However, one Democratic legislative leader said Gibbons was wrong to place blame on lawmakers, noting that they slightly reduced the state's payroll tax rate to help 74 percent of businesses.

Nevada unemployment in July reached a record 12.5 percent, including a 13.1 percent rate in Clark County. Unemployment in the state now is third highest in the nation behind Michigan and Rhode Island.

The unemployment rate climbed 0.5 percentage points from June, the last month before the tax increases went into effect July 1. And the July rate is almost twice as high as the 6.7 percent unemployment rate in July 2008.

The 2009 Legislature nearly doubled the payroll tax paid by employers on workers' wages, increased the sales tax rate by 0.35 percentage points and doubled the business license tax to $200 a year.

Another tax increase, a 10 percent boost in car registration fees, was implemented Sept. 1.

Taxes actually increased by $1 billion, but $220 million of the increase came from hiking room tax rates in Clark and Washoe counties by 3 percentage points.

Gibbons, however, let that increase go into effect by not signing or vetoing the bill.

Gibbons vetoed the other tax increases, but legislators secured the necessary two-thirds votes to override his veto.

Reached in Las Vegas, Assembly Majority Leader John Oceguera said Gibbons is forgetting that the payroll tax rate was reduced slightly for 74 percent of businesses, those with payrolls of less than $250,000.

"I don't know where his basis is (to blame legislators) when we lowered taxes on business," said Oceguera, D-Las Vegas, referring to the payroll tax. "It is a baseless remark."

Oceguera, who is in line to become the next speaker of the Assembly, said legislative analysts predicted the current quarter would be bad economically before starting to turn around.

State Budget Director Andrew Clinger said that because of the continuing recession, state tax receipts now are $31.6 million short of the estimates made by the Economic Forum in May.

The estimates by the forum, a group of five business leaders, were binding on the Legislature and governor in creating a $6.9 billion two-year general fund budget.

Gibbons said he won't know before November whether he will have to call a special legislative session to deal with the shortfall. By then, taxes paid on a quarterly basis will have been received, and he will know if the shortfall has gotten any worse.

Last year he called legislators into two special sessions to make budget cuts when tax revenues fell more than $1 billion short of expectations.

"It is premature to talk about special sessions," Oceguera said, because there's still uncertainty about how soon the economy will recover.

Because of the high unemployment, Gibbons said the Division of Employment Security now pays out $40 million a week in benefits and soon will be asking the federal government for a loan to keep making those payments.

Cindy Jones, administrator of the division, said last month that her agency will seek a $1 billion loan by the end of the year because the state's unemployment trust fund will be exhausted.

Gibbons said he hopes to secure an interest-free loan, but noted that any loan must be paid back through taxes collected on Nevada employers.

The governor does not favor increasing the current unemployment tax rate but said that decision will be made by Jones.

Contact Capital Bureau Chief Ed Vogel at evogel@reviewjournal.com or 775-687-3901.